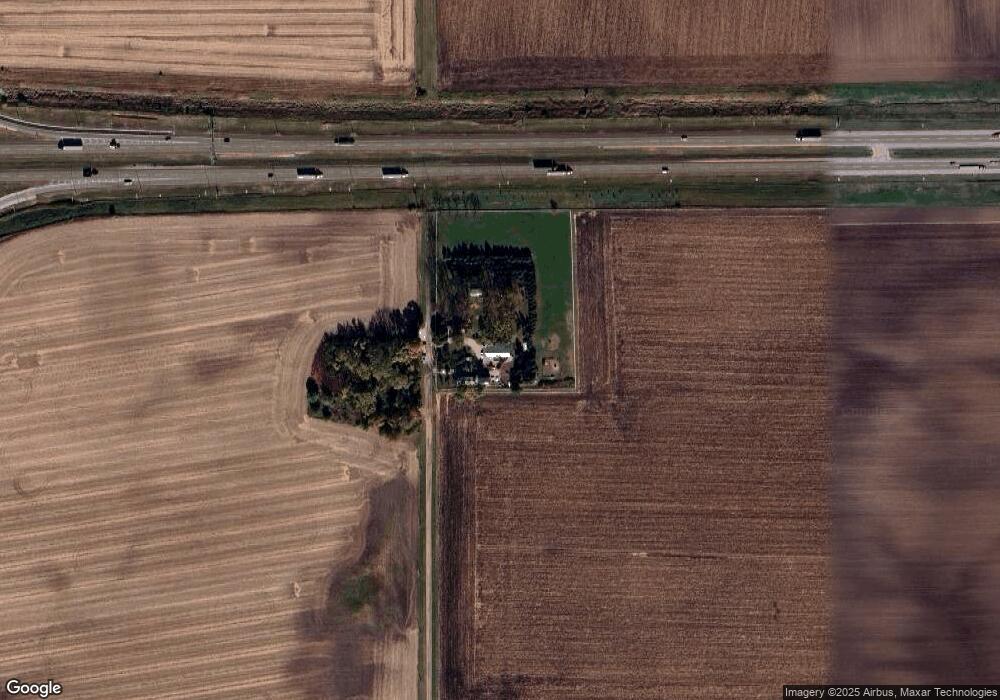

18440 Webster Rd Dekalb, IL 60115

Estimated Value: $393,000 - $652,295

4

Beds

2

Baths

1,792

Sq Ft

$263/Sq Ft

Est. Value

About This Home

This home is located at 18440 Webster Rd, Dekalb, IL 60115 and is currently estimated at $471,074, approximately $262 per square foot. 18440 Webster Rd is a home located in DeKalb County with nearby schools including Cortland Elementary School, Huntley Middle School, and De Kalb High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2022

Sold by

Carroll Jennifer L

Bought by

Delgados Farm Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$262,500

Outstanding Balance

$251,166

Interest Rate

5.78%

Mortgage Type

Credit Line Revolving

Estimated Equity

$219,908

Purchase Details

Closed on

Aug 22, 2011

Sold by

Hasche Stephen A

Bought by

Hasche Stephen A and Nesbit Shelly Ann

Purchase Details

Closed on

May 24, 2010

Sold by

Gengler Richard L

Bought by

Hasche Stephen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$246,678

Interest Rate

5.25%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 17, 2007

Sold by

Schaeffer Ronald M

Bought by

Gengler Richard L and Gengler Renee G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,000

Interest Rate

6.21%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Delgados Farm Llc | $350,000 | Doherty Law Firm Llc | |

| Hasche Stephen A | -- | -- | |

| Hasche Stephen A | $250,000 | -- | |

| Gengler Richard L | $424,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Delgados Farm Llc | $262,500 | |

| Previous Owner | Hasche Stephen A | $246,678 | |

| Previous Owner | Gengler Richard L | $265,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,541 | $124,132 | $48,750 | $75,382 |

| 2023 | $7,486 | $116,131 | $45,608 | $70,523 |

| 2022 | $7,486 | $91,448 | $43,527 | $47,921 |

| 2021 | $7,584 | $87,068 | $41,442 | $45,626 |

| 2020 | $7,591 | $84,352 | $40,149 | $44,203 |

| 2019 | $7,363 | $80,812 | $38,464 | $42,348 |

| 2018 | $6,338 | $68,599 | $28,550 | $40,049 |

| 2017 | $6,242 | $65,307 | $27,180 | $38,127 |

| 2016 | $5,943 | $61,379 | $25,545 | $35,834 |

| 2015 | -- | $57,638 | $23,988 | $33,650 |

| 2014 | -- | $55,475 | $23,088 | $32,387 |

| 2013 | -- | $57,487 | $23,925 | $33,562 |

Source: Public Records

Map

Nearby Homes

- 12539 Fairview Dr

- 532 - 534 College Ave

- TBD Peace Rd

- 18.6 Acre Lot Fairview Dr

- TBD Fairview Dr

- 192 S Joslyn St

- TBD 8.67 Acres Fairview Dr

- 231 S Walnut St

- 507 Preston St

- 505 Preston St

- 538 Preston St

- 467 Preston St

- 154 Llanos St

- 469 S Preston St

- 154 S Llanos St

- 152 S Llanos St

- 152 Llanos St

- Lot A16 Llanos St

- Lot B16 Llanos St

- 446 Preston St

Your Personal Tour Guide

Ask me questions while you tour the home.