1848 Monte Carlo Way Unit 10 Coral Springs, FL 33071

Eagle Trace NeighborhoodEstimated Value: $559,000 - $654,000

4

Beds

3

Baths

2,410

Sq Ft

$251/Sq Ft

Est. Value

About This Home

This home is located at 1848 Monte Carlo Way Unit 10, Coral Springs, FL 33071 and is currently estimated at $604,002, approximately $250 per square foot. 1848 Monte Carlo Way Unit 10 is a home located in Broward County with nearby schools including Westchester Elementary School, Sawgrass Springs Middle School, and Coral Glades High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 7, 2005

Sold by

Roberts Julian G and Roberts Ina

Bought by

Lubart Leonard and Lubart Alison C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,001

Outstanding Balance

$103,592

Interest Rate

5.54%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$500,410

Purchase Details

Closed on

Jan 30, 2002

Sold by

Attias Yosef

Bought by

Roberts Julian G and Roberts Ina

Purchase Details

Closed on

Jul 26, 2001

Sold by

Available Not

Bought by

Available Not

Purchase Details

Closed on

Apr 1, 1996

Sold by

Robert W And Mary E Potochnik Tr

Bought by

Fisher Richard and Fisher Joyce

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

6.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 1, 1987

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lubart Leonard | $599,000 | Equity Land Title Inc | |

| Roberts Julian G | $285,000 | -- | |

| Available Not | $270,000 | -- | |

| Fisher Richard | $245,000 | -- | |

| Available Not | $285,450 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lubart Leonard | $200,001 | |

| Previous Owner | Fisher Richard | $185,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,388 | $367,200 | -- | -- |

| 2024 | $7,161 | $356,860 | -- | -- |

| 2023 | $7,161 | $346,470 | $0 | $0 |

| 2022 | $6,806 | $336,380 | $0 | $0 |

| 2021 | $6,596 | $326,590 | $0 | $0 |

| 2020 | $6,420 | $322,090 | $0 | $0 |

| 2019 | $6,303 | $314,850 | $0 | $0 |

| 2018 | $5,955 | $308,980 | $0 | $0 |

| 2017 | $5,921 | $302,630 | $0 | $0 |

| 2016 | $5,654 | $296,410 | $0 | $0 |

| 2015 | $5,741 | $294,350 | $0 | $0 |

| 2014 | $5,696 | $292,020 | $0 | $0 |

| 2013 | -- | $338,210 | $33,820 | $304,390 |

Source: Public Records

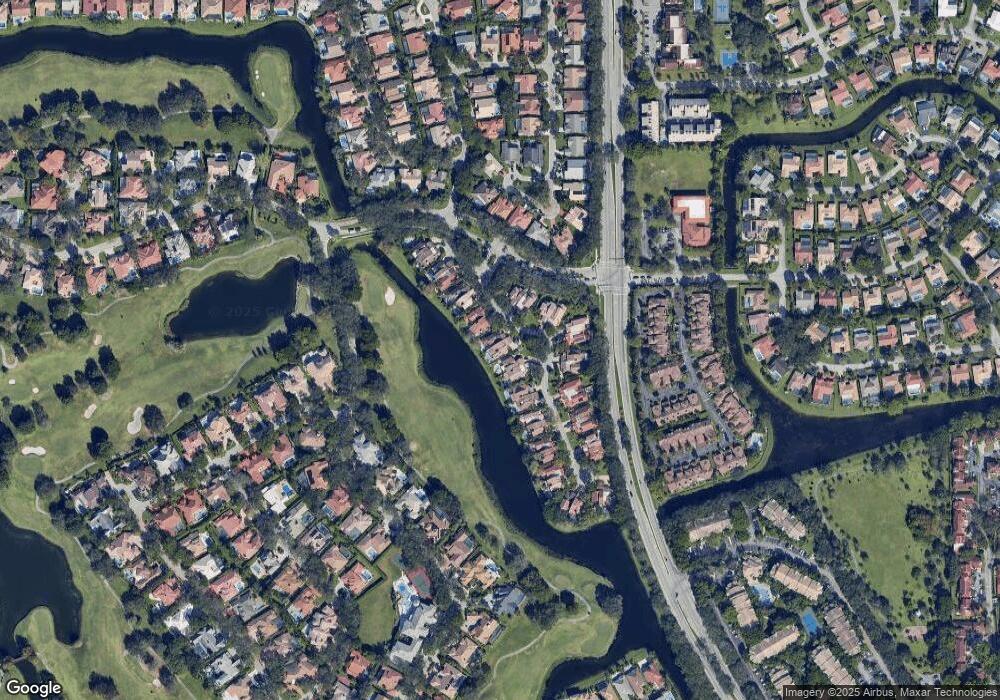

Map

Nearby Homes

- 11696 NW 19th Dr Unit 11696

- 11652 NW 19th Dr

- 11648 NW 19th Dr

- 11694 NW 20th Dr Unit 11694

- 11709 Highland Place

- 11668 NW 20th Dr Unit 11668

- 1860 Merion Ln

- 11311 Lakeview Dr Unit 7n

- 2059 Coral Ridge Dr Unit N106

- 2091 Coral Ridge Dr Unit N306

- 11461 Lakeview Dr

- 1935 Las Colinas Way

- 11622 Royal Palm Blvd Unit 11622

- 11562 Royal Palm Blvd Unit 11562

- 11651 Royal Palm Blvd Unit 306

- 12055 Classic Dr

- 11484 Royal Palm Blvd Unit 11484

- 1988 NW 112th Ave

- 11392 Royal Palm Blvd Unit 11392

- 12200 Classic Dr

- 1852 Monte Carlo Way Unit 9

- 1844 Monte Carlo Way Unit 11

- 1800 Monte Carlo Way Unit 22

- 1840 Monte Carlo Way Unit 12

- 1856 Monte Carlo Way Unit 8

- 1853 Monte Carlo Way Unit 36

- 1860 Monte Carlo Way Unit 7

- 1857 Monte Carlo Way Unit 37

- 1836 Monte Carlo Way Unit 13

- 1845 Monte Carlo Way Unit 34

- 1832 Monte Carlo Way

- 1832 Monte Carlo Way Unit 14

- 1861 Monte Carlo Way Unit 38

- 1864 Monte Carlo Way

- 1849 Monte Carlo Way Unit 35

- 1837 Monte Carlo Way Unit 32

- 1833 Monte Carlo Way Unit 31

- 1841 Monte Carlo Way Unit 33

- 1868 Monte Carlo Way

- 1828 Monte Carlo Way Unit 15