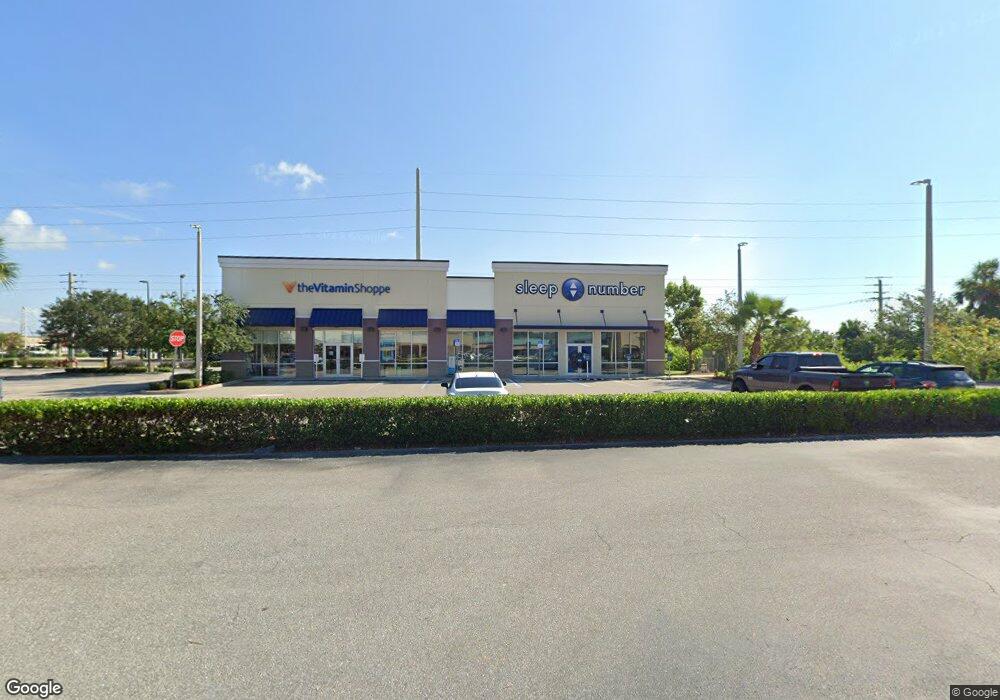

1851 Tamiami Trail Port Charlotte, FL 33948

Estimated Value: $2,597,280

--

Bed

4

Baths

5,225

Sq Ft

$497/Sq Ft

Est. Value

About This Home

This home is located at 1851 Tamiami Trail, Port Charlotte, FL 33948 and is currently estimated at $2,597,280, approximately $497 per square foot. 1851 Tamiami Trail is a home located in Charlotte County with nearby schools including Liberty Elementary School, Murdock Middle School, and Port Charlotte High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 26, 2023

Sold by

Teramore Development Llc

Bought by

Florida Investments 9 Llc

Current Estimated Value

Purchase Details

Closed on

Sep 25, 2015

Sold by

Holt William A and Holt Anita S

Bought by

Teramore Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$640,000

Interest Rate

3.97%

Mortgage Type

Commercial

Purchase Details

Closed on

Oct 3, 2000

Sold by

Holt Anita S and Holt William A

Bought by

Holt William A and Holt Anita S

Purchase Details

Closed on

Oct 22, 1997

Sold by

1St Union Natl Bk

Bought by

Holt Anita S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,500

Interest Rate

7.39%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Florida Investments 9 Llc | $3,000,000 | None Listed On Document | |

| Teramore Development Llc | $800,000 | Attorney | |

| Holt William A | $203,700 | -- | |

| Holt Anita S | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Teramore Development Llc | $640,000 | |

| Previous Owner | Holt Anita S | $187,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $20,117 | $1,291,340 | $450,782 | $840,558 |

| 2024 | $17,799 | $1,201,746 | $409,802 | $791,944 |

| 2023 | $17,799 | $1,019,450 | $368,822 | $650,628 |

| 2022 | $16,455 | $942,267 | $368,822 | $573,445 |

| 2021 | $15,907 | $872,154 | $368,822 | $503,332 |

| 2020 | $15,617 | $854,013 | $368,822 | $485,191 |

| 2019 | $15,148 | $818,955 | $368,822 | $450,133 |

| 2018 | $13,788 | $777,048 | $353,455 | $423,593 |

| 2017 | $13,982 | $778,965 | $409,802 | $369,163 |

| 2016 | $12,407 | $680,077 | $0 | $0 |

| 2015 | $11,426 | $610,347 | $0 | $0 |

| 2014 | $11,332 | $610,202 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1181 Seacrest Dr NW

- 1190 Seacrest Dr NW

- 1035 Red Bay Terrace NW

- 1073 Arden Terrace NW

- 19077 Cochran Blvd

- 19505 Quesada Ave Unit C201

- 19505 Quesada Ave Unit OO206

- 19505 Quesada Ave Unit A204

- 19505 Quesada Ave Unit EE103

- 19505 Quesada Ave Unit VV201

- 19505 Quesada Ave Unit EE201

- 19505 Quesada Ave Unit SS201

- 19505 Quesada Ave Unit C103

- 19505 Quesada Ave Unit EE204

- 19505 Quesada Ave Unit BB102

- 19505 Quesada Ave Unit CC103

- 2120 Broad Ranch Dr

- 1237 Pike Ave NW

- 2201 Hyatt Dr

- 906 Bayard Terrace

- 1811 Tamiami Trail

- 0 Tamiami Trail Unit C690197

- 0 Tamiami Trail Unit A377323

- 0 Tamiami Trail Unit C7015144

- 1931 Tamiami Trail Unit 8&9B

- 1931 Tamiami Trail Unit 10

- 1931 Tamiami Trail

- 1931 Tamiami Trail Unit 7

- 1931 Tamiami Trail Unit 1

- 1931 Tamiami Trail Unit 8

- 19239 Baoy Ave

- 19223 Baoy Ave

- 1900 Tamiami Trail

- 1000 Vega Ave NW

- 1016 Vega Ave NW

- 1032 Vega Ave NW

- 1295 Sheridan Dr NW

- 1048 Vega Ave NW

- 19125 Baoy Ave