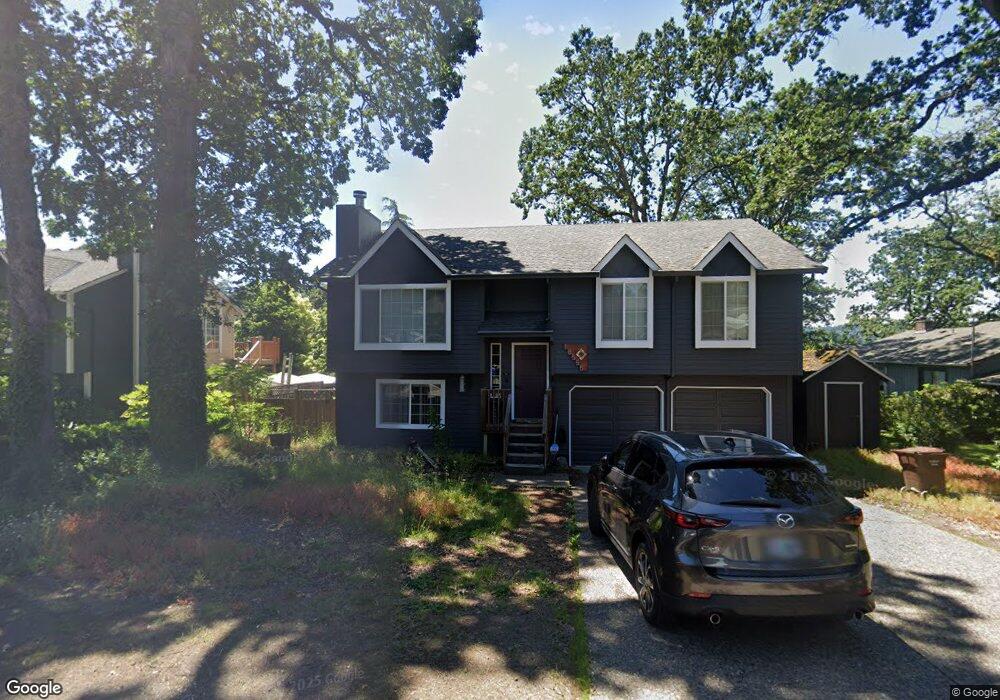

18555 Echo Way Gladstone, OR 97027

Estimated Value: $502,000 - $524,841

3

Beds

2

Baths

1,532

Sq Ft

$336/Sq Ft

Est. Value

About This Home

This home is located at 18555 Echo Way, Gladstone, OR 97027 and is currently estimated at $514,210, approximately $335 per square foot. 18555 Echo Way is a home located in Clackamas County with nearby schools including John Wetten Elementary School, Walter L Kraxberger Middle School, and Gladstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 25, 2006

Sold by

Miller Keith W

Bought by

Wood Stephannie Renee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,450

Outstanding Balance

$36,039

Interest Rate

6.28%

Mortgage Type

Stand Alone Second

Estimated Equity

$478,171

Purchase Details

Closed on

Feb 22, 2001

Sold by

Miller William R

Bought by

Miller Keith W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,896

Interest Rate

6.98%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 29, 2000

Sold by

Hirota Mark E and Hirota Kimberly A

Bought by

Miller Keith W and Miller William R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,609

Interest Rate

8.26%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wood Stephannie Renee | $257,900 | Chicago Title Insurance Comp | |

| Miller Keith W | -- | Fidelity National Title Co | |

| Miller Keith W | $157,900 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wood Stephannie Renee | $64,450 | |

| Open | Wood Stephannie Renee | $193,400 | |

| Previous Owner | Miller Keith W | $159,896 | |

| Previous Owner | Miller Keith W | $156,609 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,265 | $261,308 | -- | -- |

| 2024 | $5,119 | $253,698 | -- | -- |

| 2023 | $5,119 | $246,309 | $0 | $0 |

| 2022 | $4,761 | $239,135 | $0 | $0 |

| 2021 | $4,586 | $232,170 | $0 | $0 |

| 2020 | $4,476 | $225,408 | $0 | $0 |

| 2019 | $4,424 | $218,843 | $0 | $0 |

| 2018 | $4,264 | $212,469 | $0 | $0 |

| 2017 | $4,136 | $206,281 | $0 | $0 |

| 2016 | $4,000 | $200,273 | $0 | $0 |

| 2015 | $3,868 | $194,440 | $0 | $0 |

| 2014 | $3,764 | $188,777 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 18345 Petite Ct

- 575 Collins Crest St

- 1460 Cornell Ave

- 18300 Scott Ct

- 6625 Larissa Ln

- 330 Patricia Dr

- 5905 SE Angel Ln

- 6571 Oakridge Dr

- 17900 Monticello Dr

- 1065 Columbia Ave

- 19145 Addie St

- 119 E Jersey St

- 117 E Jersey St

- 115 E Jersey St

- 17511 SE Scrutton Ln

- 5622 SE Jennings Ave

- 17485 Monticello Dr

- 5625 SE Jennings Ave

- 810 Yale Ave

- 515 E Hereford St

- 18565 Echo Way

- 18550 Goetz Rd

- 6510 Glen Echo Ave

- 18510 Goetz Rd

- 18575 Echo Way

- 18560 Goetz Rd

- 18560 Echo Way

- 18590 Echo Way

- 18550 Echo Way

- 18570 Goetz Rd

- 18500 Goetz Rd

- 18570 Echo Way

- 18585 Echo Way

- 6520 Glen Echo Ave

- 18580 Goetz Rd

- 18580 Echo Way

- 18555 Goetz Rd

- 18565 Goetz Rd

- 18380 Franklin Way

- 6517 Glen Echo Ave