1857 Shady Ct Columbus, OH 43229

Forest Park East NeighborhoodEstimated Value: $367,000 - $395,000

3

Beds

2

Baths

1,582

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 1857 Shady Ct, Columbus, OH 43229 and is currently estimated at $376,895, approximately $238 per square foot. 1857 Shady Ct is a home located in Franklin County with nearby schools including Northtowne Elementary School, Woodward Park Middle School, and Northland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 11, 2021

Sold by

Radca Ashley R

Bought by

Collins Anne and Collins Ryan M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,350

Outstanding Balance

$214,362

Interest Rate

2.67%

Mortgage Type

New Conventional

Estimated Equity

$162,533

Purchase Details

Closed on

May 9, 2012

Sold by

Lopez Gretchen K and Margraf Gretchen K

Bought by

Radea Ashley R

Purchase Details

Closed on

Jul 3, 1991

Purchase Details

Closed on

Nov 15, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Collins Anne | $253,000 | Title Connect Agency | |

| Radea Ashley R | $148,800 | None Available | |

| -- | -- | -- | |

| -- | $93,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Collins Anne | $240,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,917 | $112,670 | $32,690 | $79,980 |

| 2023 | $6,615 | $112,665 | $32,690 | $79,975 |

| 2022 | $5,685 | $76,830 | $18,450 | $58,380 |

| 2021 | $5,247 | $76,830 | $18,450 | $58,380 |

| 2020 | $5,185 | $76,830 | $18,450 | $58,380 |

| 2019 | $4,652 | $63,850 | $15,370 | $48,480 |

| 2018 | $4,231 | $63,850 | $15,370 | $48,480 |

| 2017 | $4,169 | $63,850 | $15,370 | $48,480 |

| 2016 | $3,954 | $55,690 | $13,200 | $42,490 |

| 2015 | $3,955 | $55,690 | $13,200 | $42,490 |

| 2014 | $3,953 | $55,690 | $13,200 | $42,490 |

| 2013 | $1,967 | $55,685 | $13,195 | $42,490 |

Source: Public Records

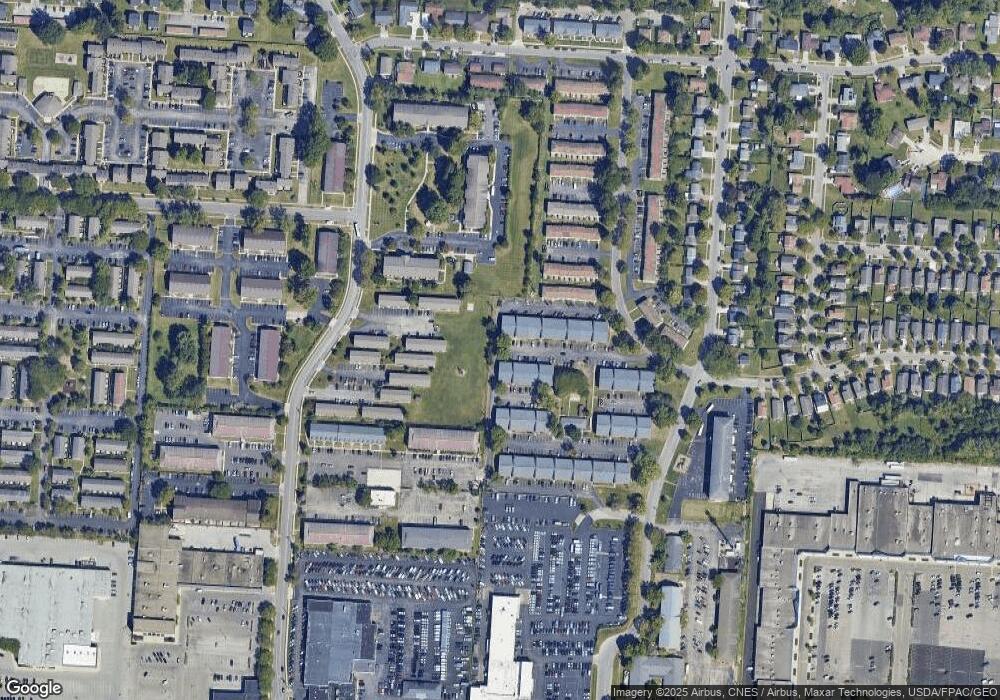

Map

Nearby Homes

- 4714 Ascot Dr

- 2033 Brittany Rd

- 4849 Heatherton Dr

- 2134 Trent Rd

- 4885 Northtowne Blvd

- 2244 Balmoral Rd

- 4852 Colonel Perry Dr

- 4923 Karl Rd Unit 4925

- 4761 Colonel Perry Dr

- 5022 Sienna Ln

- 4800 Bourke Rd

- 4816 Bourke Rd

- 4309 Walford St

- 2158 Kilbourne Ave

- 1704 Riverbirch Dr

- 4815 Bourke Rd

- 5124 Northcliff Loop W

- 1485 Norma Rd

- 2058 Northcliff Dr

- 5056 Northtowne Blvd Unit 5054