18582 Coshocton Rd Mount Vernon, OH 43050

Estimated Value: $295,000 - $521,195

3

Beds

4

Baths

1,722

Sq Ft

$237/Sq Ft

Est. Value

About This Home

This home is located at 18582 Coshocton Rd, Mount Vernon, OH 43050 and is currently estimated at $407,549, approximately $236 per square foot. 18582 Coshocton Rd is a home located in Knox County with nearby schools including Mount Vernon High School, St. Vincent de Paul School, and Christian Star Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 9, 2016

Sold by

Treen Bryan Lee and Treen Daleen Marie Kleiner

Bought by

Treen Bryan Lee and Treen Daleen Marie Kleiner

Current Estimated Value

Purchase Details

Closed on

Jan 19, 2006

Sold by

Treen Anissa A

Bought by

Treen Bryan L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,000

Outstanding Balance

$109,128

Interest Rate

6.46%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$298,421

Purchase Details

Closed on

Dec 20, 2004

Sold by

Brown Brown E E and Brown Linda M

Bought by

Treen Bryan L and Treen Anissa A

Purchase Details

Closed on

Nov 1, 1991

Sold by

Hull Shirley K

Bought by

Brown Brown E and Brown Linda M

Purchase Details

Closed on

Mar 21, 1991

Sold by

Hull Shirley K and Hull Harry

Bought by

Hull Shirley K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Treen Bryan Lee | -- | None Available | |

| Treen Bryan L | -- | None Available | |

| Treen Bryan L | $205,000 | -- | |

| Brown Brown E | $92,000 | -- | |

| Hull Shirley K | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Treen Bryan L | $192,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,723 | $133,380 | $45,730 | $87,650 |

| 2023 | $5,723 | $133,380 | $45,730 | $87,650 |

| 2022 | $3,508 | $91,990 | $31,540 | $60,450 |

| 2021 | $3,508 | $75,590 | $31,540 | $44,050 |

| 2020 | $3,423 | $75,590 | $31,540 | $44,050 |

| 2019 | $3,028 | $62,070 | $26,550 | $35,520 |

| 2018 | $3,029 | $62,070 | $26,550 | $35,520 |

| 2017 | $2,981 | $62,070 | $26,550 | $35,520 |

| 2016 | $2,822 | $57,310 | $24,580 | $32,730 |

| 2015 | $2,793 | $56,510 | $24,580 | $31,930 |

| 2014 | $2,806 | $56,510 | $24,580 | $31,930 |

| 2013 | $2,887 | $56,420 | $22,740 | $33,680 |

Source: Public Records

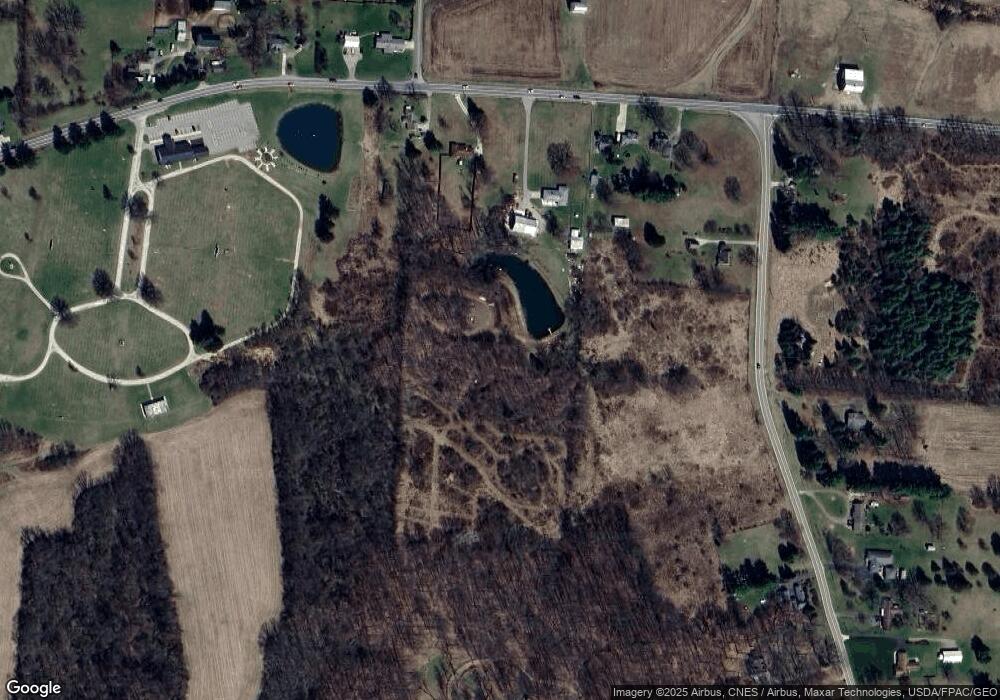

Map

Nearby Homes

- 11791 McManis Rd

- 12627 Upper Gilchrist Rd

- 104 Colonial Woods Dr Unit 4

- 117 Colonial Woods Dr

- 188 Plymouth Rd

- 17421 Coshocton Rd

- 13618 Gilchrist Rd

- 0 Venture Dr Unit 20240369

- 84 Woodlake Trail

- 42 Wildwood Ln

- 0 Wildwood Ln

- 14021 Gilchrist Rd

- 20561 Canada Rd

- 55 Wildwood Ln

- 60 Wildwood Ln

- 17375 Gambier Rd

- 2 Coventry Ct W

- 2 Coventry Ct

- 17 Upland Terrace

- 20090 New Gambier Rd

- 18618 Coshocton Rd

- 18628 Coshocton Rd

- 18542 Coshocton Rd

- 18640 Coshocton Rd

- 12141 Kenyon Rd

- 18512 Coshocton Rd

- 18509 Coshocton Rd

- 12251 Gilchrist Rd

- 18720 Coshocton Ave

- 12263 Gilchrist Rd

- 18745 Coshocton Rd

- 18441 Coshocton Rd

- 18413 Coshocton Rd

- 12040 Kenyon Rd

- 18359 Coshocton Rd

- 11988 Kenyon Rd

- 11957 Kenyon Rd

- 11968 Kenyon Rd

- 11925 Kenyon Rd

- 18873 Coshocton Rd