18590 Saint Andrews Ln Unit B Brookfield, WI 53045

Estimated Value: $466,775 - $507,000

3

Beds

3

Baths

2,325

Sq Ft

$208/Sq Ft

Est. Value

About This Home

This home is located at 18590 Saint Andrews Ln Unit B, Brookfield, WI 53045 and is currently estimated at $482,444, approximately $207 per square foot. 18590 Saint Andrews Ln Unit B is a home located in Waukesha County with nearby schools including Burleigh Elementary School, Pilgrim Park Middle School, and Brookfield East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 20, 2016

Sold by

Dewees Gregory D and Dewees Jane S

Bought by

Jordan Cheryl Greer and Jordan Theodore P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,500

Outstanding Balance

$202,399

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$280,045

Purchase Details

Closed on

Aug 31, 2009

Sold by

Block Neil D

Bought by

Dewees Gregory D and Dewees Jane S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,500

Interest Rate

5.28%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 28, 2008

Sold by

Block Dorothy L

Bought by

Block Neil D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 27, 2006

Sold by

Clark Patrick and Clark Patrick D

Bought by

Block Neil D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Interest Rate

6%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 27, 2006

Sold by

Clark Jeanne C

Bought by

Clark Patrick

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jordan Cheryl Greer | $275,000 | Priority Title Corp | |

| Dewees Gregory D | $250,000 | None Available | |

| Block Neil D | -- | None Available | |

| Block Neil D | $140,000 | None Available | |

| Block Neil D | $140,000 | None Available | |

| Clark Patrick | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jordan Cheryl Greer | $247,500 | |

| Previous Owner | Dewees Gregory D | $237,500 | |

| Previous Owner | Block Neil D | $224,000 | |

| Previous Owner | Block Neil D | $224,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,227 | $383,500 | $75,000 | $308,500 |

| 2023 | $4,223 | $383,500 | $75,000 | $308,500 |

| 2022 | $4,034 | $287,500 | $70,000 | $217,500 |

| 2021 | $4,267 | $287,500 | $70,000 | $217,500 |

| 2020 | $4,472 | $287,500 | $70,000 | $217,500 |

| 2019 | $4,480 | $287,500 | $70,000 | $217,500 |

| 2018 | $4,611 | $288,600 | $80,000 | $208,600 |

| 2017 | $4,576 | $288,600 | $80,000 | $208,600 |

| 2016 | $4,521 | $288,600 | $80,000 | $208,600 |

| 2015 | $4,499 | $288,600 | $80,000 | $208,600 |

| 2014 | $4,505 | $288,600 | $80,000 | $208,600 |

| 2013 | $4,667 | $288,600 | $80,000 | $208,600 |

Source: Public Records

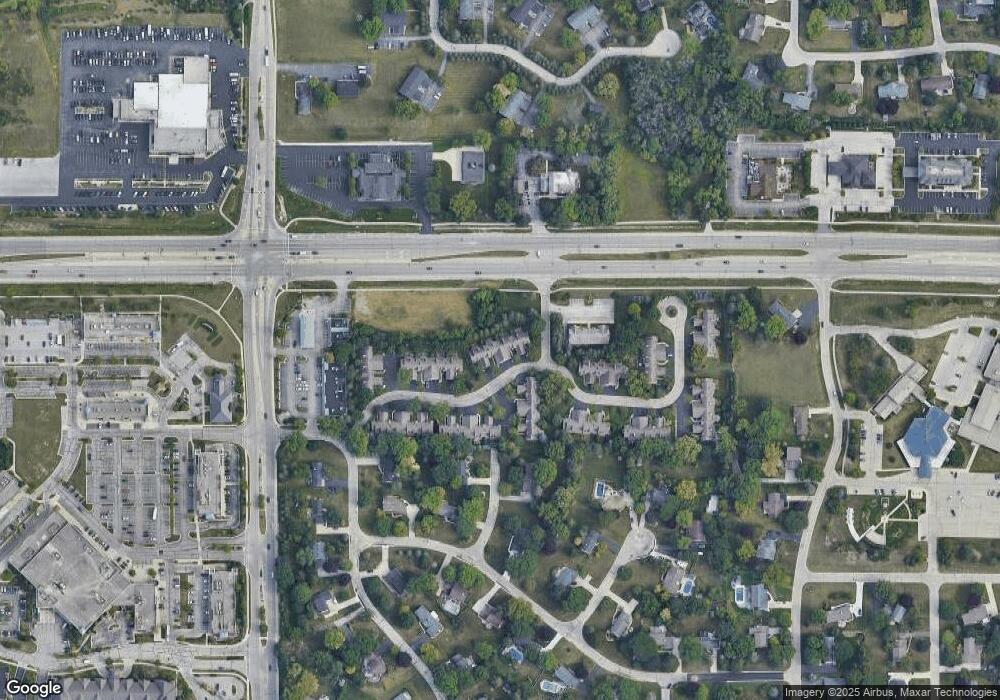

Map

Nearby Homes

- 18675 Saint Andrew Ln Unit B

- 18570 Kamala Ct Unit 18550

- 19075 Thomson Dr Unit 304

- 4265 Williams Ct

- 3465 Wilshire Rd

- 18045 Continental Dr

- 4355 Continental Ct

- 19475 Summerhill Ln

- 18205 Redvere Dr

- 18400 Beverly Hills Dr

- 17615 Continental Dr

- 3080 N Brookfield Rd

- 3040 N 186th St Unit 1

- 3030 N 186th St Unit 2

- 3000 N 186th St Unit 6

- 4690 Bradon Trail E

- 3020 N 186th St Unit 4

- 3010 N 186th St Unit 3

- 2990 N 186th St Unit 5

- 2960 N 186th St Unit 10

- 18590 Saint Andrews Ln Unit C

- 18590 Saint Andrews Ln Unit D

- 18590 Saint Andrews Ln Unit A

- 18710 Saint Andrew Ln Unit B

- 18710 Saint Andrew Ln Unit C

- 18710 Saint Andrew Ln

- 18710 Saint Andrew Ln Unit B

- 18625 Saint Andrew Ln Unit A

- 18625 Saint Andrew Ln Unit D

- 18710 Saint Andrew Ln Unit A

- 18710 Saint Andrew Ln Unit 18710

- 18710 Saint Andrew Ln Unit 18710

- 18625 Saint Andrew Ln Unit D

- 18675 Saint Andrew Ln

- 18675 Saint Andrew Ln Unit D

- 18675 Saint Andrew Ln Unit C

- 18675 Saint Andrew Ln Unit A

- 18675 Saint Andrew Ln Unit 18675

- 18650 Saint Andrew Ln Unit B

- 18650 Saint Andrews Ln Unit D