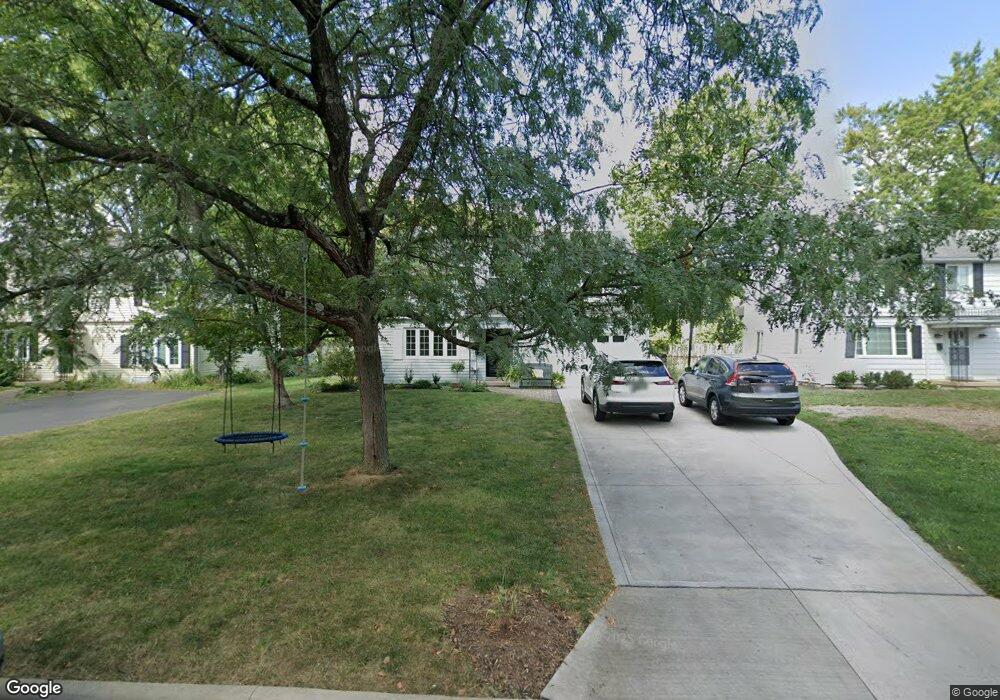

1861 Ashland Ave Columbus, OH 43212

Estimated Value: $559,000 - $651,646

3

Beds

2

Baths

1,900

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 1861 Ashland Ave, Columbus, OH 43212 and is currently estimated at $617,412, approximately $324 per square foot. 1861 Ashland Ave is a home located in Franklin County with nearby schools including Barrington Road Elementary School, Jones Middle School, and Upper Arlington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 13, 2019

Sold by

Betts Nicola R and Domijan Ronald A

Bought by

Betts Nicola R and Domijan Ronald A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$261,700

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 6, 2011

Sold by

Tilton Leslie A and The Trust Agreement Of David E

Bought by

Betts Nicola R and Betts Molly E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Interest Rate

4.52%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 4, 2009

Sold by

Estate Of David E Tilton

Bought by

Tilton Leslie A

Purchase Details

Closed on

Aug 5, 1986

Bought by

Tilton David E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Betts Nicola R | $100,000 | Peak Title | |

| Betts Nicola R | $200,000 | Real Living | |

| Tilton Leslie A | -- | None Available | |

| Tilton David E | $87,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Betts Nicola R | $261,700 | |

| Previous Owner | Betts Nicola R | $190,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,379 | $213,820 | $114,840 | $98,980 |

| 2023 | $12,225 | $213,815 | $114,835 | $98,980 |

| 2022 | $8,925 | $127,720 | $42,280 | $85,440 |

| 2021 | $7,900 | $127,720 | $42,280 | $85,440 |

| 2020 | $7,830 | $127,720 | $42,280 | $85,440 |

| 2019 | $7,847 | $113,160 | $42,280 | $70,880 |

| 2018 | $6,876 | $113,160 | $42,280 | $70,880 |

| 2017 | $6,871 | $113,160 | $42,280 | $70,880 |

| 2016 | $5,955 | $90,060 | $34,160 | $55,900 |

| 2015 | $5,949 | $90,060 | $34,160 | $55,900 |

| 2014 | $5,956 | $90,060 | $34,160 | $55,900 |

| 2013 | $2,844 | $81,865 | $31,045 | $50,820 |

Source: Public Records

Map

Nearby Homes

- 1825 Northwest Ct Unit D

- 1733 Elmwood Ave

- 1398 Lower Green Cir Unit 1398

- 1661 Ashland Ave Unit 663

- 1655-1657 Ashland Ave

- 2110 Northwest Blvd

- 1364 W 7th Ave

- 1561 Glenn Ave

- 00 W 7th Ave

- 1535 Doone Rd

- 1459 Elmwood Ave Unit 1459

- 1565 Berkshire Rd

- 2015 W 5th Ave Unit 211

- 2015 W 5th Ave Unit 102

- 2015 W 5th Ave Unit 108

- 1126 King Ave Unit 128

- 1475 W 3rd Ave Unit 204

- 1631 Roxbury Rd Unit A1

- 1631 Roxbury Rd Unit F3

- 1631 Roxbury Rd Unit B6

- 1869 Ashland Ave

- 1853 Ashland Ave

- 1868 Elmwood Ave

- 1868 Elmwood Ave

- 1845 Ashland Ave

- 1860 Elmwood Ave

- 1601 Stanford Rd

- 1589 Stanford Rd

- 1850 Elmwood Ave

- 1837 Ashland Ave

- 1850 Ashland Ave Unit 852

- 1842 Elmwood Ave

- 1842 Ashland Ave

- 1829 Ashland Ave

- 1834 Elmwood Ave

- 1834 Ashland Ave

- 1875 Elmwood Ave

- 1900 Elmwood Ave

- 1865 Elmwood Ave

- 1821 Ashland Ave