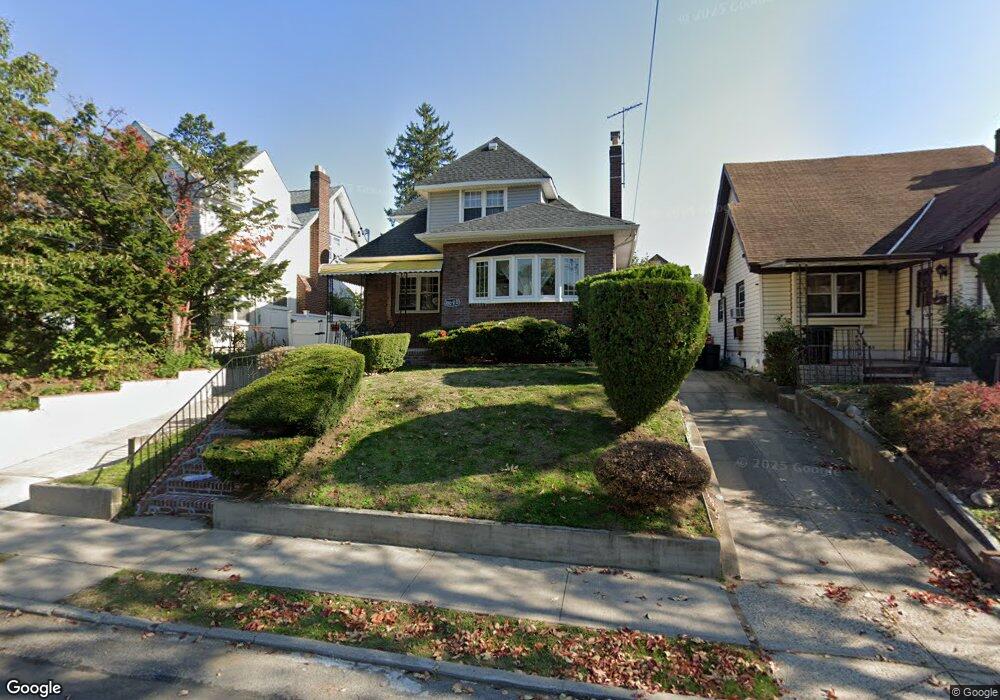

18620 Jordan Ave Saint Albans, NY 11412

Hollis NeighborhoodEstimated Value: $696,000 - $776,000

--

Bed

--

Bath

1,462

Sq Ft

$503/Sq Ft

Est. Value

About This Home

This home is located at 18620 Jordan Ave, Saint Albans, NY 11412 and is currently estimated at $735,083, approximately $502 per square foot. 18620 Jordan Ave is a home located in Queens County with nearby schools including P.S. 118 Lorraine Hansberry, I.S. 192 The Linden, and Riverton Street Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 23, 2019

Sold by

U S Bank Trust N A As Trustee and % : Hudson Homes Management Llc

Bought by

Callender Geneva

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$598,157

Outstanding Balance

$526,224

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$208,859

Purchase Details

Closed on

Sep 7, 2018

Sold by

Villoni Dominic A

Bought by

U S Bank Trust N A As Trustee For Ls

Purchase Details

Closed on

Jun 23, 2004

Sold by

Richards Sandra

Bought by

Beaubrun Carline and Beaubrun Jean Phalec

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,525

Interest Rate

6.32%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 23, 1999

Sold by

Bell Marie and The Marie Bell Revocable Trust

Bought by

Richards Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,000

Interest Rate

7.98%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Callender Geneva | $450,000 | -- | |

| U S Bank Trust N A As Trustee For Ls | $451,408 | -- | |

| Beaubrun Carline | $345,000 | -- | |

| Beaubrun Carline | $345,000 | -- | |

| Richards Sandra | $119,000 | First American Title Ins Co | |

| Richards Sandra | $119,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Callender Geneva | $598,157 | |

| Previous Owner | Beaubrun Carline | $51,750 | |

| Previous Owner | Beaubrun Carline | $275,525 | |

| Previous Owner | Richards Sandra | $146,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,218 | $32,818 | $11,980 | $20,838 |

| 2024 | $6,218 | $30,960 | $10,623 | $20,337 |

| 2023 | $6,218 | $30,960 | $11,465 | $19,495 |

| 2022 | $6,134 | $34,680 | $15,420 | $19,260 |

| 2021 | $6,101 | $35,040 | $15,420 | $19,620 |

| 2020 | $5,789 | $30,120 | $15,420 | $14,700 |

| 2019 | $5,397 | $25,800 | $15,420 | $10,380 |

| 2018 | $5,410 | $26,541 | $13,561 | $12,980 |

| 2017 | $5,369 | $26,339 | $13,758 | $12,581 |

| 2016 | $4,968 | $26,339 | $13,758 | $12,581 |

| 2015 | $2,777 | $23,444 | $16,804 | $6,640 |

| 2014 | $2,777 | $22,118 | $15,854 | $6,264 |

Source: Public Records

Map

Nearby Homes

- 188-07 Mangin Ave

- 18823 Mangin Ave

- 186-16 Hilburn Ave

- 188-25 Mangin Ave

- 187-44 Jordan Ave

- 18833 Keeseville Ave

- 183-34 Fonda Ave

- 188-31 Jordan Ave

- 183-29 Brinkerhoff Ave

- 11176 180th St

- 111-06 Farmers Blvd

- 183-12 Elmira Ave

- 179-07 Murdock Ave

- 18908 114th Rd

- 19022 111th Rd

- 188-45 Quencer Rd

- 187-23 Brinkerhoff Ave

- 112- 2 178th St

- 111-54 178th Place

- 183-09 Dunlop Ave

- 186-20 Jordan Ave

- 18616 Jordan Ave

- 18624 Jordan Ave

- 18612 Jordan Ave

- 18630 Jordan Ave

- 18719 Mangin Ave

- 18723 Mangin Ave

- 18717 Mangin Ave

- 187-17 Mangin Ave

- 18725 Mangin Ave

- 18713 Mangin Ave

- 18608 Jordan Ave

- 18729 Mangin Ave

- 18711 Mangin Ave

- 18636 Jordan Ave

- 18731 Mangin Ave

- 18617 Jordan Ave

- 18621 Jordan Ave

- 187-07 Mangin Ave

- 186-13 Jordan Ave