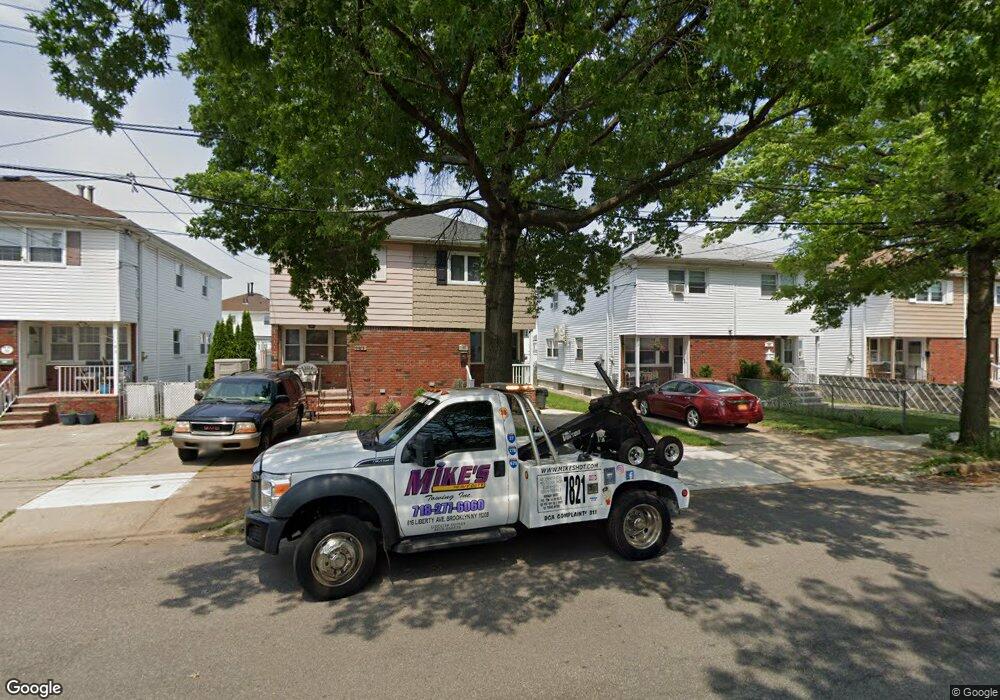

187 Benton Ave Unit HOUSE Staten Island, NY 10305

Dongan Hills NeighborhoodEstimated Value: $659,000 - $717,000

3

Beds

3

Baths

1,108

Sq Ft

$622/Sq Ft

Est. Value

About This Home

This home is located at 187 Benton Ave Unit HOUSE, Staten Island, NY 10305 and is currently estimated at $689,169, approximately $621 per square foot. 187 Benton Ave Unit HOUSE is a home located in Richmond County with nearby schools including P.S. 052 John C. Thompson, Is 2 George L Egbert, and New Dorp High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 16, 2017

Sold by

Capodanno Vincent and Scianna Danielle

Bought by

Li Mingyin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$82,676

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$606,493

Purchase Details

Closed on

Dec 6, 2007

Sold by

Guissarri Marie

Bought by

Capodanno Vincent and Scianna Danielle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,650

Interest Rate

6.02%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Li Mingyin | $525,000 | Professional Title Services | |

| Capodanno Vincent | $365,650 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Li Mingyin | $150,000 | |

| Previous Owner | Capodanno Vincent | $365,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,668 | $35,520 | $4,515 | $31,005 |

| 2024 | $4,668 | $34,980 | $4,585 | $30,395 |

| 2023 | $4,684 | $23,066 | $4,265 | $18,801 |

| 2022 | $4,344 | $33,180 | $6,900 | $26,280 |

| 2021 | $4,321 | $31,260 | $6,900 | $24,360 |

| 2020 | $4,100 | $31,500 | $6,900 | $24,600 |

| 2019 | $4,052 | $30,120 | $6,900 | $23,220 |

| 2018 | $3,918 | $19,222 | $5,201 | $14,021 |

| 2017 | $3,397 | $18,134 | $5,389 | $12,745 |

| 2016 | $3,110 | $17,108 | $6,346 | $10,762 |

| 2015 | $2,792 | $16,140 | $5,760 | $10,380 |

| 2014 | $2,792 | $16,140 | $5,760 | $10,380 |

Source: Public Records

Map

Nearby Homes

- 206 Benton Ave

- 12 Mcdermott Ave

- 275 Hurlbert St

- 125 Laconia Ave

- 381 Burgher Ave

- 139 Hurlbert St

- 71 Cameron Ave

- 74 Appleby Ave

- 57 Jerome Rd

- 141 Evergreen Ave Unit 2a

- 115 W Broadway Unit 4

- 44 Quintard St

- 12 Reid Ave

- 220 Norway Ave

- 4 Mccormick Place

- 200 Mallory Ave

- 286 Raritan Ave

- 418 Alter Ave

- 416 Alter Ave

- 236 Mallory Ave