18722 Wren Cir Unit 2 Mokena, IL 60448

Estimated Value: $380,083 - $407,000

2

Beds

4

Baths

1,957

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 18722 Wren Cir Unit 2, Mokena, IL 60448 and is currently estimated at $394,771, approximately $201 per square foot. 18722 Wren Cir Unit 2 is a home located in Will County with nearby schools including Mokena Elementary School, Mokena Intermediate School, and Mokena Jr High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 16, 2023

Sold by

Markham Robyn

Bought by

Trust Number 31108

Current Estimated Value

Purchase Details

Closed on

Jun 8, 2017

Sold by

Markham Robyn and Markham Patrick E

Bought by

Markham Robyn and Markham Patrick E

Purchase Details

Closed on

Jul 7, 2015

Sold by

Markham Robyn and Markham Patrick

Bought by

Markham Patrick and Markham Robyn

Purchase Details

Closed on

Jul 13, 2009

Sold by

Markham Patrick E

Bought by

Markham Robyn

Purchase Details

Closed on

Feb 15, 2005

Sold by

Nlsb

Bought by

Markham Patrick E and Markham Robyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,624

Interest Rate

5.8%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trust Number 31108 | -- | None Listed On Document | |

| Markham Robyn | -- | None Available | |

| Markham Patrick | -- | Attorney | |

| Markham Robyn | -- | Chicago Title Insurance Co | |

| Markham Patrick E | $238,500 | Atg |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Markham Patrick E | $186,624 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $121,153 | $780 | $120,373 |

| 2023 | -- | $108,202 | $697 | $107,505 |

| 2022 | $0 | $98,554 | $635 | $97,919 |

| 2021 | $0 | $92,201 | $594 | $91,607 |

| 2020 | $6,321 | $89,602 | $577 | $89,025 |

| 2019 | $6,321 | $87,204 | $562 | $86,642 |

| 2018 | $6,321 | $87,656 | $546 | $87,110 |

| 2017 | $6,194 | $85,610 | $533 | $85,077 |

| 2016 | $6,424 | $82,675 | $515 | $82,160 |

| 2015 | -- | $79,764 | $497 | $79,267 |

| 2014 | -- | $79,210 | $494 | $78,716 |

| 2013 | -- | $81,642 | $1,986 | $79,656 |

Source: Public Records

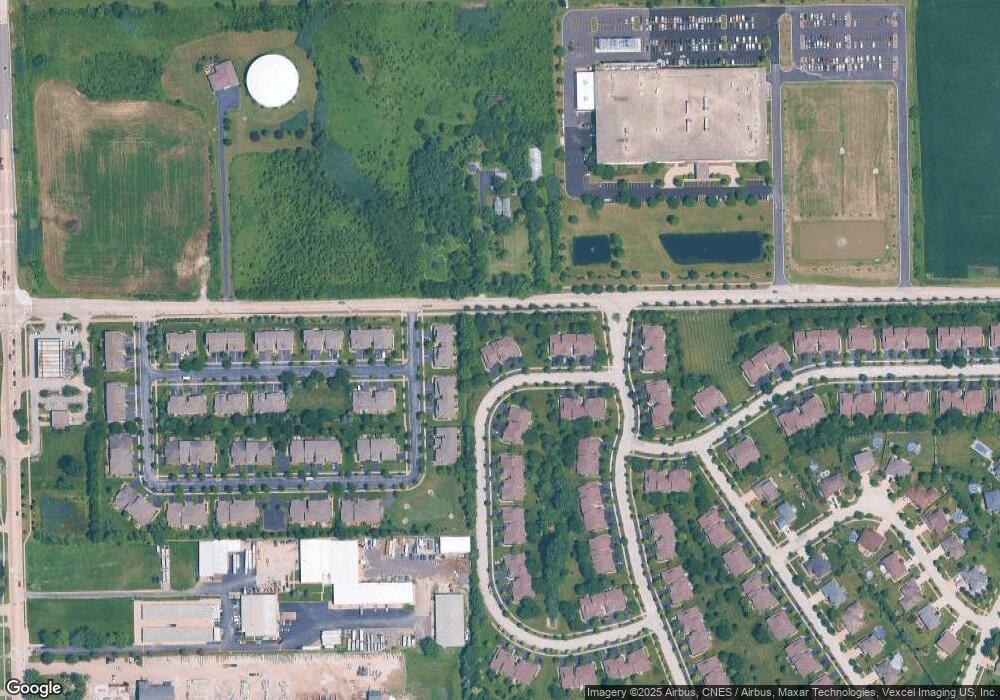

Map

Nearby Homes

- 18714 Wren Cir

- 18740 Kestrel Ave

- 12 187th St

- 11325 Hummingbird Ln

- 10658 Revere Cir

- 11254 192nd St

- 11108 Waters Edge Dr

- 18115 Georgia Ct Unit 132

- 19300 Wolf Rd Unit 2

- 11421 192nd St

- Vacant 191st St

- Lots 4,5, & 6 191st St

- 19360 Wolf Rd Unit 1

- 10549 Illinois Ct Unit 184

- W Maple Rd

- 19380 Wolf Rd Unit 5

- 19380 Wolf Rd Unit 6

- 18032 Erickson Ct

- 10551 Eagle Ridge Dr Unit 127

- 10935 California Ct Unit 185

- 18724 Wren Cir Unit 2

- 18720 Wren Cir

- 18709 Dove Ave

- 18713 Dove Ave

- 18716 Wren Cir

- 18705 Dove Ave

- 18701 Dove Ave

- 18717 Dove Ave

- 18721 Dove Ave

- 18739 Wren Cir Unit 2

- 18725 Dove Ave

- 18725 Dove Ave Unit 1

- 18712 Wren Cir

- 18741 Wren Cir

- 18729 Dove Ave

- 18743 Wren Cir

- 18710 Wren Cir

- 18731 Wren Cir Unit 2

- 18733 Dove Ave

- Lot 56 187th St