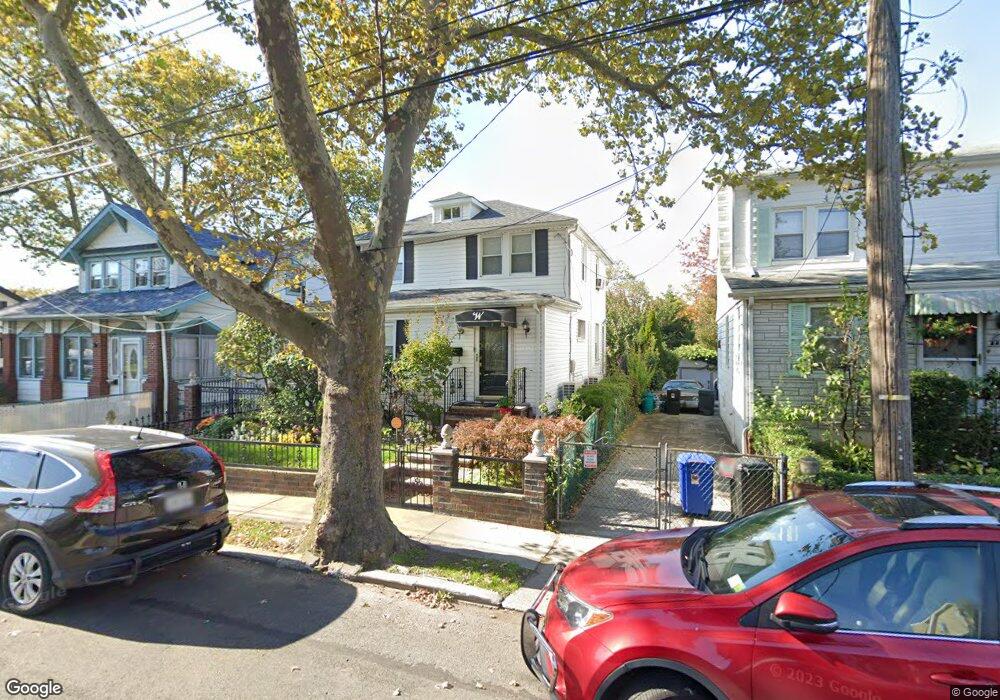

188-05 Jordan Ave Jamaica, NY 11412

Hollis NeighborhoodEstimated Value: $594,000 - $751,000

3

Beds

3

Baths

1,352

Sq Ft

$515/Sq Ft

Est. Value

About This Home

This home is located at 188-05 Jordan Ave, Jamaica, NY 11412 and is currently estimated at $696,023, approximately $514 per square foot. 188-05 Jordan Ave is a home located in Queens County with nearby schools including P.S. 118 Lorraine Hansberry, I.S. 192 The Linden, and True Deliverance Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2021

Sold by

Walthour Millicent D

Bought by

Chowdhury Israt and Haque Mohammad A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$647,638

Outstanding Balance

$587,631

Interest Rate

2.9%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$108,392

Purchase Details

Closed on

Nov 30, 1999

Sold by

Galit Development Corp

Bought by

Walthour Warren K and Walthour Millicent D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$213,242

Interest Rate

7.71%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 3, 1999

Sold by

Reid George W and Reid Audrey E

Bought by

Galit Development Corp

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$213,242

Interest Rate

7.71%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 7, 1987

Sold by

Nyc Commissioner Of Finance

Bought by

City Of New York

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chowdhury Israt | $670,000 | -- | |

| Walthour Warren K | $215,000 | Fidelity National Title Ins | |

| Galit Development Corp | $128,000 | -- | |

| City Of New York | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chowdhury Israt | $647,638 | |

| Previous Owner | Walthour Warren K | $213,242 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,157 | $27,217 | $7,624 | $19,593 |

| 2024 | $4,613 | $25,678 | $7,172 | $18,506 |

| 2023 | $5,157 | $25,678 | $6,420 | $19,258 |

| 2022 | $5,087 | $40,200 | $11,580 | $28,620 |

| 2021 | $4,763 | $38,100 | $11,580 | $26,520 |

| 2020 | $4,505 | $32,760 | $11,580 | $21,180 |

| 2019 | $4,183 | $28,080 | $11,580 | $16,500 |

| 2018 | $4,064 | $21,398 | $8,604 | $12,794 |

| 2017 | $4,029 | $21,235 | $8,968 | $12,267 |

| 2016 | $3,695 | $21,235 | $8,968 | $12,267 |

| 2015 | $2,196 | $18,901 | $9,214 | $9,687 |

| 2014 | $2,196 | $17,832 | $10,426 | $7,406 |

Source: Public Records

Map

Nearby Homes

- 187-44 Jordan Ave

- 186-16 Hilburn Ave

- 188-31 Jordan Ave

- 188-25 Mangin Ave

- 18823 Mangin Ave

- 188-07 Mangin Ave

- 111-06 Farmers Blvd

- 18833 Keeseville Ave

- 187-23 Brinkerhoff Ave

- 183-34 Fonda Ave

- 19022 111th Rd

- 183-29 Brinkerhoff Ave

- 183-12 Elmira Ave

- 10533 Farmers Blvd

- 19027 109th Rd

- 183-67 Dunlop Ave

- 190-59 112th Ave

- 191-40 112th Rd

- 190-63 112th Ave

- 18908 114th Rd

- 18805 Jordan Ave

- 18809 Jordan Ave

- 18803 Jordan Ave

- 188-03 Jordan Ave

- 18815 Jordan Ave

- 18810 Jordan Ave

- 18817 Jordan Ave

- 18810 Ilion Ave

- 18804 Ilion Ave

- 188-14 Jordan Ave

- 18814 Jordan Ave

- 18810 Jordan Ave

- 188-04 Jordan Ave

- 18804 Jordan Ave

- 18747 Jordan Ave

- 18814 Jordan Ave

- 18814 Ilion Ave

- 18821 Jordan Ave

- 18818 Jordan Ave

- 187-48 Jordan Ave Unit 1