18850 Shadow Canyon Dr Helotes, TX 78023

Estimated Value: $593,000 - $873,426

4

Beds

4

Baths

3,225

Sq Ft

$232/Sq Ft

Est. Value

About This Home

This home is located at 18850 Shadow Canyon Dr, Helotes, TX 78023 and is currently estimated at $747,857, approximately $231 per square foot. 18850 Shadow Canyon Dr is a home located in Bexar County with nearby schools including Los Reyes Elementary School, John M. Folks Middle, and O'Connor High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2025

Sold by

Aquino Andres C and Aquino Nieva V

Bought by

Aquino Andres C and Aquino Nieva V

Current Estimated Value

Purchase Details

Closed on

Jun 8, 2016

Sold by

Jeffrey Marshall Haubenreiser

Bought by

Acquino Andres and Acquino Nieva

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,400

Interest Rate

3.66%

Purchase Details

Closed on

Oct 13, 2005

Sold by

Shadow Creek Canyon Ltd

Bought by

Aquino Andres C and Aquino Nieva V

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$49,500

Interest Rate

5.75%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Aquino Andres C | -- | None Listed On Document | |

| Acquino Andres | -- | -- | |

| Aquino Andres C | -- | Alamo Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Acquino Andres | $50,400 | |

| Previous Owner | Acquino Andres | -- | |

| Previous Owner | Aquino Andres C | $49,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $766,618 | $134,360 | $690,830 |

| 2024 | -- | $696,925 | $134,360 | $698,930 |

| 2023 | $8,309 | $633,568 | $116,870 | $651,130 |

| 2022 | $11,699 | $575,971 | $101,630 | $657,020 |

| 2021 | $11,023 | $523,610 | $83,900 | $439,710 |

| 2020 | $11,197 | $520,670 | $83,900 | $436,770 |

| 2019 | $11,325 | $510,000 | $83,900 | $426,100 |

| 2018 | $11,024 | $496,090 | $83,900 | $412,190 |

| 2017 | $10,395 | $466,770 | $83,900 | $382,870 |

| 2016 | $11,447 | $514,000 | $81,279 | $432,721 |

| 2015 | $9,980 | $485,130 | $83,900 | $401,230 |

| 2014 | $9,980 | $467,790 | $0 | $0 |

Source: Public Records

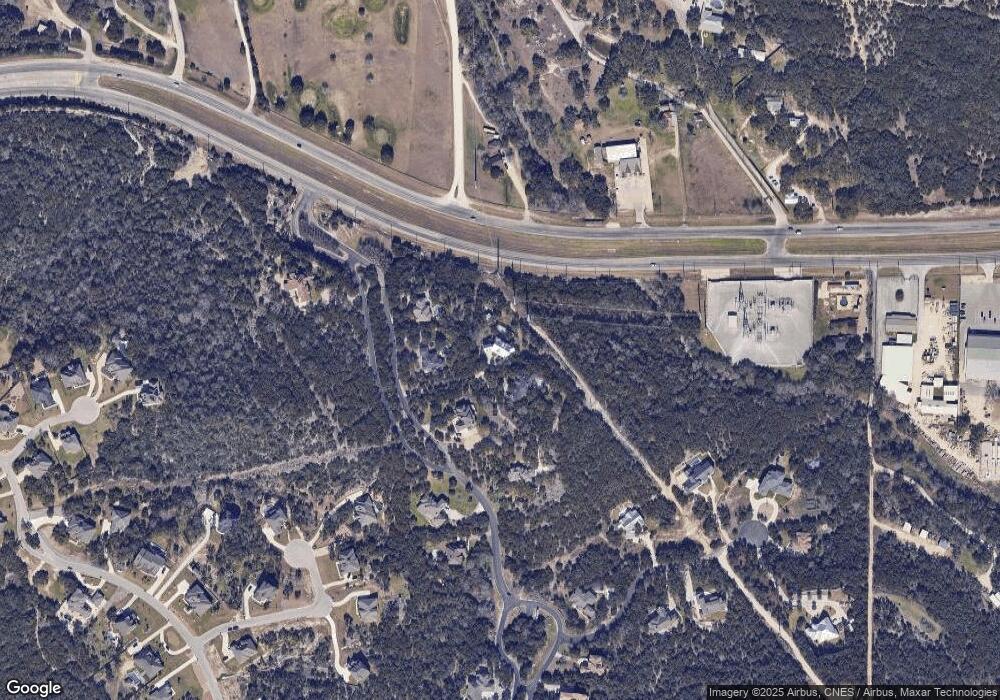

Map

Nearby Homes

- 12330 Cross Cut

- 18810 Canyon View Pass

- 12307 van de Carr

- 18720 Bandera Rd

- 18688 Morales Ranch Rd

- LOT 8 Clear Water Canyon

- TBD Pr 177

- 1724 Caprock

- LOT 41 Canyon Creek Preserve Phase 6

- 439 Private Road 1706

- 0 Arrowhead Point Unit 24930545

- LOT 7 Canyon Creek Preserve

- 431 Private Road 1706

- 437 Private Rd 1706

- 18961 Bandera

- 17820 Oxford Mount

- 11407 Massive Mount

- 11330 Hill Top Bend

- 11314 Hill Top Bend

- 11243 Hill Top Loop

- 18840 Shadow Canyon Dr

- 18860 Shadow Canyon Dr

- 18870 Shadow Canyon Dr

- 18830 Shadow Canyon Dr

- 18764 Shadow Canyon Dr

- 18754 Shadow Canyon Dr

- 18865 Shadow Canyon Dr

- 18628 Wildcat Canyon Creek

- 18755 Shadow Canyon Dr

- 18875 Shadow Canyon Dr

- 18744 Shadow Canyon Dr

- 12331 Calvert

- 18745 Shadow Canyon Dr

- 12323 Calvert

- 18624 Wildcat Canyon Creek

- 18634 Wildcat Canyon Creek

- 18734 Shadow Canyon Dr

- 18735 Shadow Canyon Dr

- 18618 Wildcat Canyon Creek

- 12303 Calvert