18930 Mink Lake Dr Magnolia, TX 77355

Estimated Value: $216,000 - $389,000

3

Beds

2

Baths

1,997

Sq Ft

$154/Sq Ft

Est. Value

About This Home

This home is located at 18930 Mink Lake Dr, Magnolia, TX 77355 and is currently estimated at $306,595, approximately $153 per square foot. 18930 Mink Lake Dr is a home located in Montgomery County with nearby schools including Nichols Sawmill Elementary School, Magnolia Sixth Grade Campus, and Magnolia Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 3, 2000

Sold by

Bell Dennis Joseph and Bell Margaret Marie

Bought by

Barton Rachel and Schlott Karsten

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,887

Outstanding Balance

$44,153

Interest Rate

7.9%

Mortgage Type

FHA

Estimated Equity

$262,442

Purchase Details

Closed on

Jan 5, 1999

Sold by

Steltzer Susan G and Credit Based Asset Servicing &

Bought by

Pledged Property Iv Llc

Purchase Details

Closed on

Nov 22, 1991

Sold by

Aguila Benjamin

Bought by

Barton Rachel

Purchase Details

Closed on

Sep 20, 1991

Sold by

Steltzer Elizabeth

Bought by

Barton Rachel

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barton Rachel | -- | Alamo Title Company | |

| Pledged Property Iv Llc | $42,500 | -- | |

| Barton Rachel | -- | -- | |

| Barton Rachel | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Barton Rachel | $122,887 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,382 | $200,689 | $33,600 | $167,089 |

| 2024 | $2,069 | $224,433 | -- | -- |

| 2023 | $2,069 | $204,030 | $33,600 | $204,310 |

| 2022 | $3,273 | $185,480 | $33,600 | $204,310 |

| 2021 | $3,134 | $168,620 | $33,600 | $159,410 |

| 2020 | $3,102 | $153,290 | $33,600 | $198,020 |

| 2019 | $2,806 | $139,350 | $33,600 | $144,320 |

| 2018 | $2,194 | $126,680 | $6,300 | $178,140 |

| 2017 | $2,442 | $115,160 | $6,300 | $108,860 |

| 2016 | $2,492 | $117,530 | $6,300 | $111,230 |

| 2015 | $2,958 | $147,870 | $6,300 | $141,570 |

| 2014 | $2,958 | $147,870 | $6,300 | $141,570 |

Source: Public Records

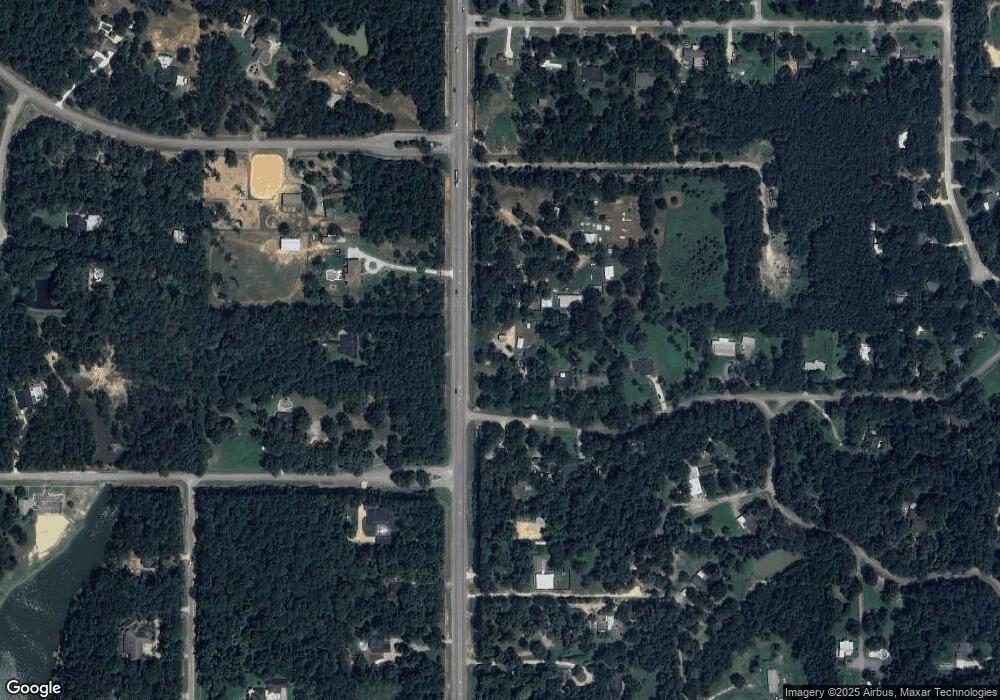

Map

Nearby Homes

- 28208 Nichols Sawmill Rd

- 28103 Hitching Rack Ln

- 28418 Teal Ct

- 18631 Mink Lake Dr

- Resolution 3K Plan at Waterford Run - Clayton

- Colossal Plan at Waterford Run - Clayton

- The Jackson Plan at Waterford Run - Jessup

- Crazy Eights Plan at Waterford Run - Clayton

- 28002 Hitching Rack Ln

- 18742 Mink Lake Dr

- 28915 Pine Forest Dr

- 29010 Legacy Ct

- TBD Legacy Ct

- 28915 Forest Hill Dr

- TBD Fm 1774 Rd

- 24569 Fm 1488

- 28322 Meadow Forest

- 28242 Forest Green Dr

- 19926 Indigo Lake Dr

- 28046 Crossway Oaks

- 18922 Mink Lake Dr

- 000 Mink Branch Valley

- 28520 Nichols Sawmill Rd

- 18918 Mink Lake Dr

- 18931 Mink Lake Dr

- 8+ AC Nichols Sawmill Rd

- 18927 Mink Lake Dr

- 0 Mink Lake Dr Dr

- 18923 Mink Lake Dr

- L4 B1 Country Lake Dr

- LOT3 Country Lake Dr

- 18915 Mink Lake Dr

- 28315 Nichols Sawmill Rd

- 18910 Mink Cir

- 18902 Mink Lake Dr

- TBD Nicholas Sawmill

- 18906 Mink Cir

- 28202 Nichols Sawmill Rd

- 19101 Country Lake Dr

- 28403 Nichols Sawmill Rd