19 NE 14th Ct Battle Ground, WA 98604

Estimated Value: $538,000 - $557,000

3

Beds

2

Baths

1,879

Sq Ft

$292/Sq Ft

Est. Value

About This Home

This home is located at 19 NE 14th Ct, Battle Ground, WA 98604 and is currently estimated at $549,388, approximately $292 per square foot. 19 NE 14th Ct is a home located in Clark County with nearby schools including Tukes Valley Primary School, Tukes Valley Middle School, and Battle Ground High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 7, 2019

Sold by

Gayle Sikinger Revocable Living Trust

Bought by

Sikinger Noadiah

Current Estimated Value

Purchase Details

Closed on

Oct 7, 2010

Sold by

Darley Gary and Darley Sharon

Bought by

Sikinger Gayle

Purchase Details

Closed on

Apr 23, 2004

Sold by

Castle Troy and Castle Christina Felicia

Bought by

Darley Gary and Darley Sharon

Purchase Details

Closed on

Feb 1, 2001

Sold by

Fieldstone Construction Llc

Bought by

Castle Troy and Castle Christina Felicia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,500

Interest Rate

7.08%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sikinger Noadiah | -- | None Available | |

| Sikinger Gayle | $210,000 | Clark County Title Co | |

| Darley Gary | $222,000 | Clark County Title | |

| Castle Troy | $166,900 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Castle Troy | $133,500 | |

| Closed | Castle Troy | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,040 | $512,650 | $165,000 | $347,650 |

| 2024 | $3,614 | $495,549 | $165,000 | $330,549 |

| 2023 | $3,707 | $504,318 | $165,000 | $339,318 |

| 2022 | $3,926 | $471,632 | $137,000 | $334,632 |

| 2021 | $3,930 | $434,075 | $125,000 | $309,075 |

| 2020 | $3,276 | $398,570 | $115,000 | $283,570 |

| 2019 | $2,737 | $376,368 | $118,000 | $258,368 |

| 2018 | $3,368 | $367,861 | $0 | $0 |

| 2017 | $2,789 | $330,077 | $0 | $0 |

| 2016 | $2,804 | $297,201 | $0 | $0 |

| 2015 | $2,761 | $274,164 | $0 | $0 |

| 2014 | -- | $256,169 | $0 | $0 |

| 2013 | -- | $225,728 | $0 | $0 |

Source: Public Records

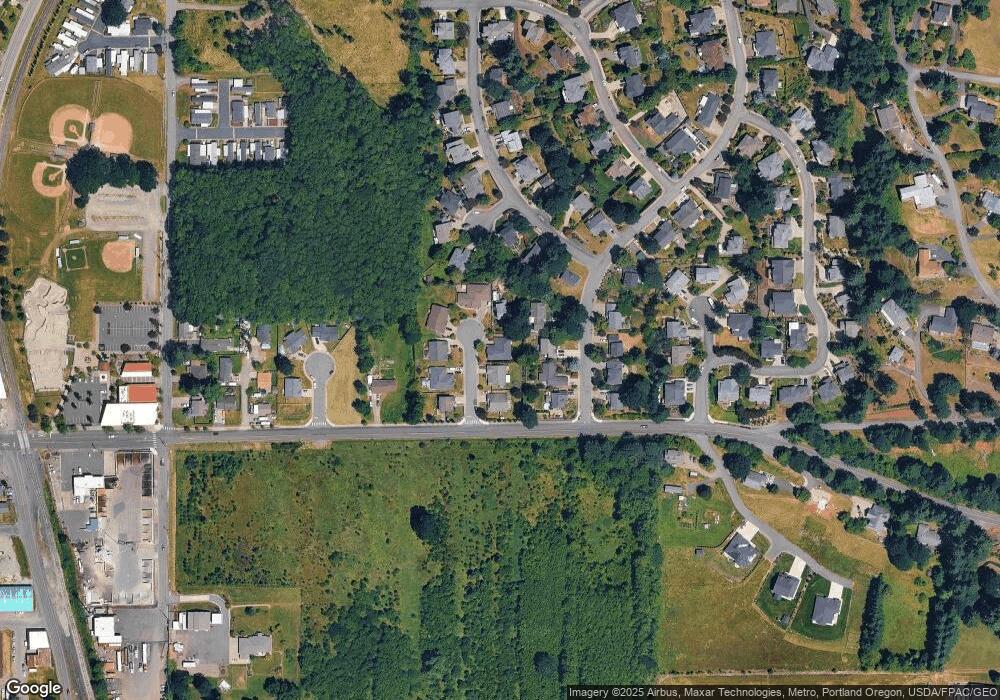

Map

Nearby Homes

- 722 NE 4th Way

- 711 NE 6th St

- 1001 30th St

- 1116 SE 6th St

- 1106 SE 6th St

- 1124 SE 33rd St

- 1116 SE 33rd St

- 1128 SE 33rd St

- 710 SE 5th Way Unit E13

- 1012 NE 11th Ct

- 1350 NE 8th Ave

- 1334 NE 8th Ave

- 1328 NE 8th Ave

- 1342 NE 8th Ave

- 1306 NE 8th Ave

- 1006 NE 11th Cir

- 506 SE 5th St

- 1216 NE 17th Ave

- 1308 NE 18th Ave

- 3301 SE 12th Ave