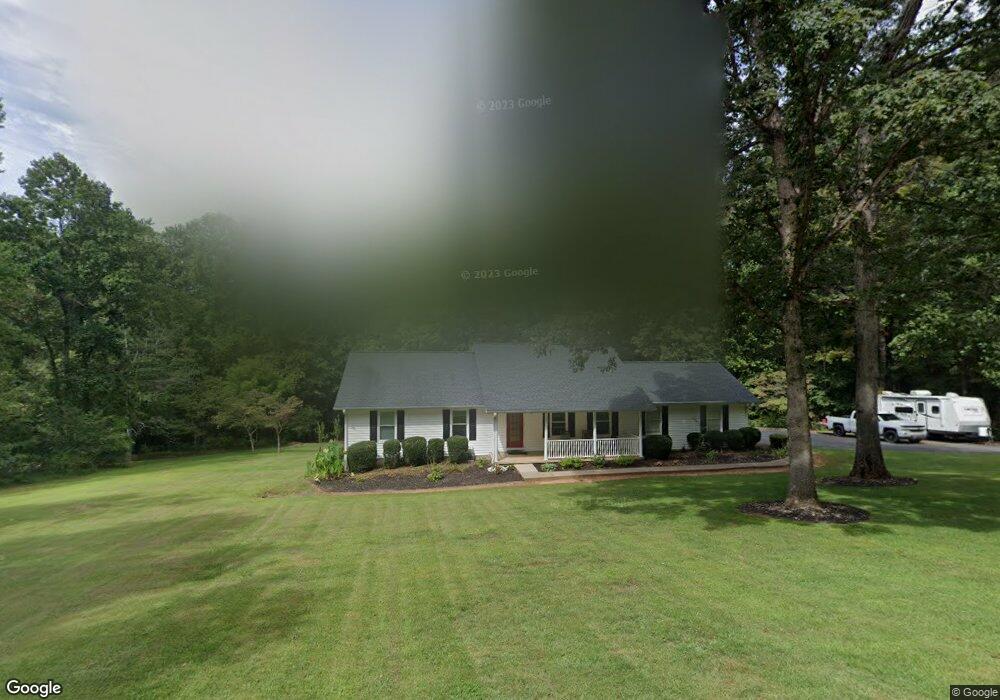

190 Laurel Park Dr Cleveland, GA 30528

Estimated Value: $408,260 - $485,000

3

Beds

4

Baths

1,536

Sq Ft

$288/Sq Ft

Est. Value

About This Home

This home is located at 190 Laurel Park Dr, Cleveland, GA 30528 and is currently estimated at $442,315, approximately $287 per square foot. 190 Laurel Park Dr is a home located in White County with nearby schools including White County 9th Grade Academy, Tesnatee Gap Elementary (Old White County Intermediate), and Jack P. Nix Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2021

Sold by

Tanner Adam Edward

Bought by

Breen James Patrick and Breen Linda Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Outstanding Balance

$67,903

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$374,412

Purchase Details

Closed on

Sep 7, 2017

Sold by

Howard Michael Ryan

Bought by

Tanner Adam Edward and Tanner Virginia Allison

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,976

Interest Rate

3.37%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 1, 2007

Sold by

Not Provided

Bought by

Howard Michael Ryan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

6.55%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Breen James Patrick | $325,000 | -- | |

| Tanner Adam Edward | $194,500 | -- | |

| Howard Michael Ryan | $175,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Breen James Patrick | $75,000 | |

| Previous Owner | Tanner Adam Edward | $190,976 | |

| Previous Owner | Howard Michael Ryan | $140,000 | |

| Previous Owner | Howard Michael Ryan | $21,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,532 | $157,344 | $12,000 | $145,344 |

| 2024 | $2,532 | $157,344 | $12,000 | $145,344 |

| 2023 | $2,099 | $137,004 | $10,000 | $127,004 |

| 2022 | $2,403 | $119,684 | $10,000 | $109,684 |

| 2021 | $2,109 | $78,676 | $8,000 | $70,676 |

| 2020 | $1,929 | $68,540 | $6,000 | $62,540 |

| 2019 | $1,935 | $68,540 | $6,000 | $62,540 |

| 2018 | $1,555 | $55,096 | $6,000 | $49,096 |

| 2017 | $1,400 | $50,028 | $6,000 | $44,028 |

| 2016 | $1,400 | $50,028 | $6,000 | $44,028 |

| 2015 | $1,336 | $125,070 | $6,000 | $44,028 |

| 2014 | $1,233 | $115,250 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 22 Laurel Park Dr

- 0 Highway 115 E Unit 10627896

- 0 Black Rd Unit 7662078

- 0 Black Rd Unit 10620540

- 1021 Black Rd

- 0 Highland Forest Rd Unit TRACT "2" 10559371

- 79 Hampton Hills Ln

- 164 Leatherford Rd

- 77 N Shore Dr

- 338 Black Rd

- 675 Washboard Rd

- 841 Yonah Meadow Dr

- 97 E Lake Laceola Rd S

- 141 Willows Ct

- 37 Stone Hearth Dr

- 31 Willows Ct

- # 47 Chimney Ln

- LOT 138 Timber Rock Dr

- 179 Pine Brook Dr

- LOT 239 Shore Dr

- 166 Laurel Park Dr

- 228 Laurel Park Dr

- 171 Laurel Park Dr

- 491 Dock Dorsey Rd

- 225 Laurel Park Dr

- 225 Laurel Park Dr

- 225 Laurel Park Dr

- 118 Laurel Park Dr

- 131 Laurel Park Dr

- 3190 Highway 115 E

- 0 Laurel Park Dr Unit 7174343

- 0 Laurel Park Dr

- 117 Laurel Park Dr

- 318 Holly Hills Rd

- 228 Holly Hills Rd Unit 7

- 228 Holly Hills Rd

- 193 Apple Tree Ln

- 62 Laurel Park Dr

- 334 Holly Hills Rd

- 112 Holly Hills Rd