1907 Seclusion Dr Port Orange, FL 32128

Samsula-Spruce Creek NeighborhoodEstimated Value: $443,000 - $531,000

3

Beds

2

Baths

2,203

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 1907 Seclusion Dr, Port Orange, FL 32128 and is currently estimated at $492,407, approximately $223 per square foot. 1907 Seclusion Dr is a home located in Volusia County with nearby schools including Cypress Creek Elementary School, Creekside Middle School, and Spruce Creek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 5, 2014

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Craig Karl D and Craig Barbara C

Current Estimated Value

Purchase Details

Closed on

Feb 17, 2014

Sold by

Wells Fargo Bank N A

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Feb 4, 2014

Sold by

Beaudin Raymond P and Beaudin Shirley R

Bought by

Wells Fargo Bank N A

Purchase Details

Closed on

Sep 30, 2005

Sold by

Fiumara Suzanne

Bought by

Beaudin Raymond P and Beaudin Shirley R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$242,400

Interest Rate

5.72%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 5, 1998

Sold by

Lamura John V and Lamura Cynthia J

Bought by

Fiumara Michael T and Fiumara Suzanne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,800

Interest Rate

7.15%

Purchase Details

Closed on

Jun 15, 1983

Bought by

Craig Karl D and Craig Barbara C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Craig Karl D | $239,000 | Attorney | |

| Federal Home Loan Mortgage Corporation | -- | New House Title Llc | |

| Wells Fargo Bank N A | -- | None Available | |

| Beaudin Raymond P | $303,000 | Associated Land Title Group | |

| Fiumara Michael T | $156,000 | -- | |

| Craig Karl D | $16,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Beaudin Raymond P | $242,400 | |

| Previous Owner | Fiumara Michael T | $124,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,200 | $213,403 | -- | -- |

| 2024 | $3,200 | $207,389 | -- | -- |

| 2023 | $3,200 | $201,349 | $0 | $0 |

| 2022 | $3,134 | $195,484 | $0 | $0 |

| 2021 | $3,215 | $189,790 | $0 | $0 |

| 2020 | $3,162 | $187,170 | $0 | $0 |

| 2019 | $3,221 | $182,962 | $0 | $0 |

| 2018 | $3,190 | $179,551 | $0 | $0 |

| 2017 | $3,183 | $175,858 | $0 | $0 |

| 2016 | $3,272 | $172,241 | $0 | $0 |

| 2015 | $3,352 | $171,044 | $0 | $0 |

| 2014 | $3,422 | $174,561 | $0 | $0 |

Source: Public Records

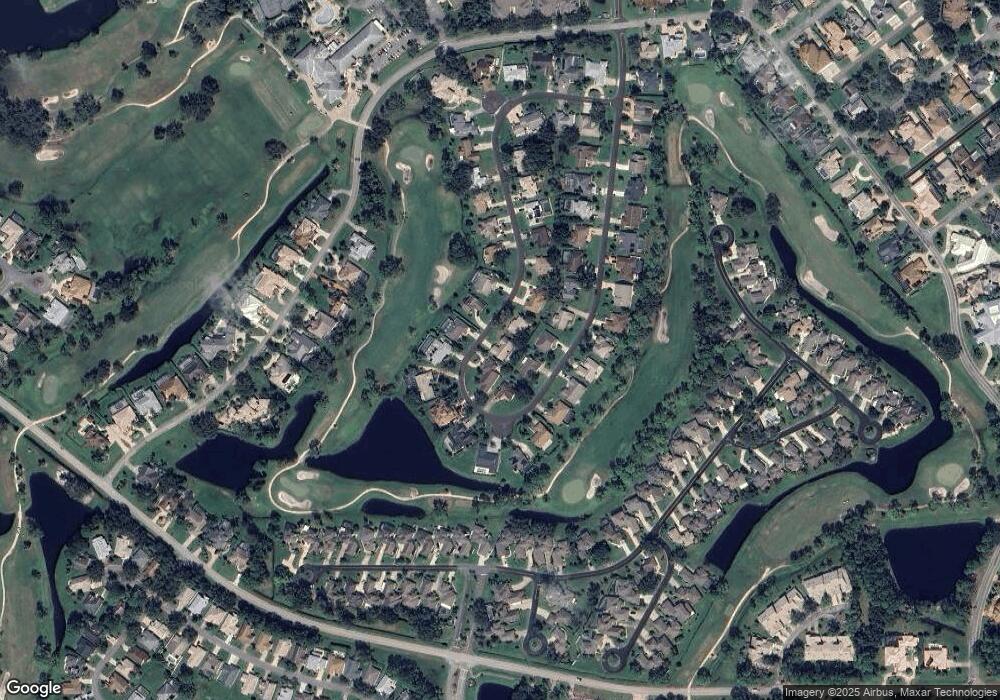

Map

Nearby Homes

- 1889 Seclusion Dr

- 1888 Seclusion Dr

- 3158 Royal Birkdale Way

- 3184 Royal Birkdale Way

- 1995 Royal Saint George Ct

- 1978 Country Club Dr

- 3237 Vail View Dr

- 1991 Rutgers Place Unit 44

- 1981 Rutgers Place

- 1981 Rutgers Place Unit 49

- 2017 Cornell Place

- 2012 Cornell Place

- 2016 Cornell Place

- 3311 Oak Vista Dr

- 1903 Sprucewood Way

- 1917 Sprucewood Way

- 2916 Cypress Ridge Trail

- 2005 Teakwood Ln Unit 18

- 14 Taxiway Lindy

- 2633 Slow Flight Dr

- 1909 Seclusion Dr

- 1903 Seclusion Dr

- 1885 Seclusion Dr

- 1895 Seclusion Dr

- 1908 Seclusion Dr

- 1906 Seclusion Dr

- 1911 Seclusion Dr

- 1910 Seclusion Dr

- 1904 Seclusion Dr

- 1883 Seclusion Dr

- 1902 Seclusion Dr

- 1890 Seclusion Dr Unit LOT 237

- 1890 Seclusion Dr

- 1900 Seclusion Dr

- 1912 Seclusion Dr

- 1886 Seclusion Dr

- 1913 Seclusion Dr Unit IIA

- 1879 Seclusion Dr

- 1892 Seclusion Dr

- 1898 Seclusion Dr