1914 N Cedar Park Dr Point Roberts, WA 98281

Estimated Value: $518,217 - $693,000

3

Beds

2

Baths

1,965

Sq Ft

$300/Sq Ft

Est. Value

About This Home

This home is located at 1914 N Cedar Park Dr, Point Roberts, WA 98281 and is currently estimated at $589,304, approximately $299 per square foot. 1914 N Cedar Park Dr is a home located in Whatcom County with nearby schools including Point Roberts Primary School, Blaine Middle School, and Blaine High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2007

Sold by

Baker Tyler and Cooper Robert

Bought by

Roberts Steve F and Roberts Meredith Lee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,000

Interest Rate

5.85%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 31, 2006

Sold by

Baker Brian

Bought by

Baker Tyler and Cooper Robert

Purchase Details

Closed on

Mar 20, 2006

Sold by

Hazzi Joe

Bought by

Baker Brian

Purchase Details

Closed on

Mar 22, 2005

Sold by

Nielsen Poul E and Nielsen Bridget Gavigan

Bought by

Hazzi Joe

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roberts Steve F | $365,280 | Whatcom Land Title | |

| Baker Tyler | -- | None Available | |

| Baker Brian | -- | Whatcom Land Title Co | |

| Hazzi Joe | $35,000 | Whatcom Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Roberts Steve F | $292,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,696 | $464,756 | $102,383 | $362,373 |

| 2023 | $3,696 | $455,448 | $93,075 | $362,373 |

| 2022 | $3,493 | $415,934 | $85,000 | $330,934 |

| 2021 | $3,479 | $356,869 | $40,128 | $316,741 |

| 2020 | $3,460 | $330,429 | $37,155 | $293,274 |

| 2019 | $3,203 | $316,956 | $35,640 | $281,316 |

| 2018 | $3,128 | $284,940 | $32,040 | $252,900 |

| 2017 | $2,712 | $272,134 | $30,600 | $241,534 |

| 2016 | $2,995 | $266,798 | $30,000 | $236,798 |

| 2015 | $3,186 | $286,653 | $32,847 | $253,806 |

| 2014 | -- | $299,671 | $34,340 | $265,331 |

| 2013 | -- | $286,179 | $32,980 | $253,199 |

Source: Public Records

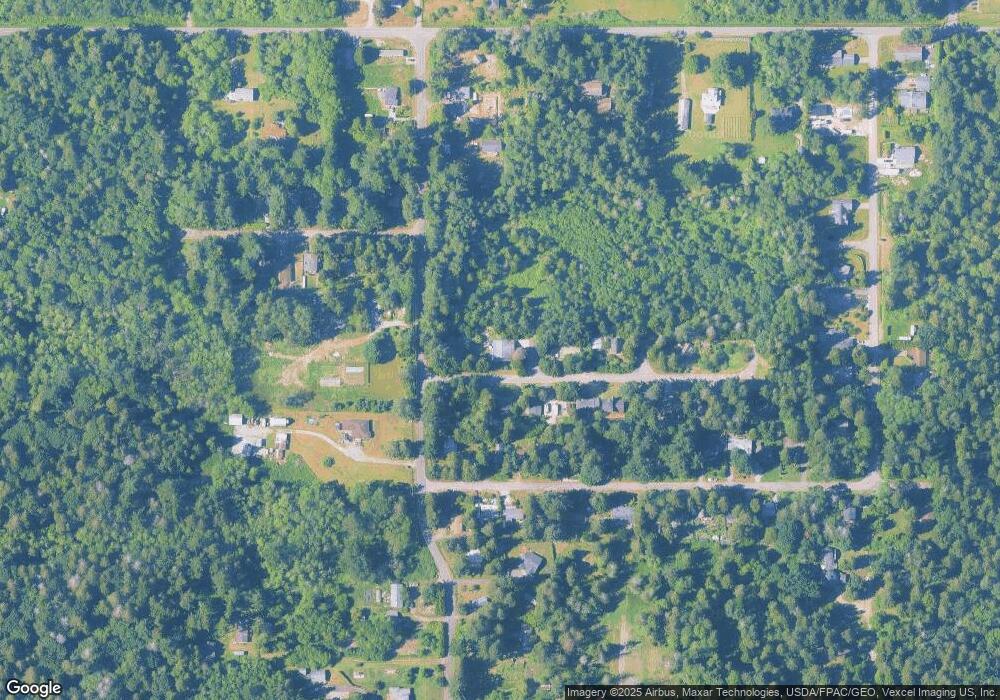

Map

Nearby Homes

- 0 6 39 Acres South Beach Rd

- lot 14 Cedar Park Dr Unit 14

- 1976 Cedar Park Dr

- Lot 2 Greenwood Dr

- 2 Benson Rd

- 1940 Apa Rd

- 1911 Apa Rd

- 8 Heather Way

- 634 S Beach Rd

- 2045 Apa Rd

- 661 Driftwood Ln

- 1934 Waters Rd

- 1927 Orcas View Way

- 2138 Benson Rd

- 675 Sylvia Dr

- 698 Kendor Dr

- 1 Mill Rd

- 2 Mill Rd

- 1920 Patos Way

- 1871 Johnson Rd

- 1906 N Cedar Park Dr

- 1915 N Cedar Park Dr

- 1921 N Cedar Park Dr

- 450 S Beach Rd

- 1902 Cedar Park Dr

- 1920 Cedar Park Dr

- 1912 Cedar Park Dr

- 1932 N Cedar Park Dr

- 1931 Cedar Park Dr

- 1937 N Cedar Park Dr

- 1987 Cedar Park Dr

- 1944 Cedar Park Dr

- 1972 Cedar Park Dr

- 1943 Cedar Park Dr

- 479 S Beach Rd

- 1913 Cedar Park Dr

- 500 S Beach Rd

- 1921 Cedar Park Dr

- 1883 Anderson Rd