19364 SW 60th Ct Southwest Ranches, FL 33332

Estimated Value: $702,178 - $842,000

4

Beds

2

Baths

2,366

Sq Ft

$333/Sq Ft

Est. Value

About This Home

This home is located at 19364 SW 60th Ct, Southwest Ranches, FL 33332 and is currently estimated at $788,545, approximately $333 per square foot. 19364 SW 60th Ct is a home located in Broward County with nearby schools including Manatee Bay Elementary School, Silver Trail Middle School, and West Broward High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2008

Sold by

Pledged Property Ii Llc

Bought by

Mejia Rene and Mejia Jennifer

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,939

Interest Rate

5.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 18, 2007

Sold by

Reid Lisa S and Reid Karl Joseph

Bought by

Pledged Property Ii Llc

Purchase Details

Closed on

Oct 8, 2005

Sold by

Navaratna Ajay and Rao Neeta R

Bought by

Reid Karl Joseph and Reid Lisa S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,600

Interest Rate

6.99%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 30, 2003

Sold by

Transeastern Laguna Properties Inc

Bought by

Navaratna Ajay B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$286,800

Interest Rate

5.79%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mejia Rene | $303,300 | Watson Title Insurance Inc | |

| Pledged Property Ii Llc | -- | Attorney | |

| Reid Karl Joseph | $525,000 | Florida State Title & Escrow | |

| Navaratna Ajay B | $318,800 | Century Title Insurance Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mejia Rene | $272,939 | |

| Previous Owner | Reid Karl Joseph | $104,400 | |

| Previous Owner | Reid Karl Joseph | $417,600 | |

| Previous Owner | Navaratna Ajay B | $286,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,579 | $609,180 | $51,900 | $557,280 |

| 2024 | $10,482 | $609,180 | $51,900 | $557,280 |

| 2023 | $10,482 | $524,880 | $0 | $0 |

| 2022 | $9,297 | $477,170 | $51,900 | $425,270 |

| 2021 | $4,466 | $257,300 | $0 | $0 |

| 2020 | $4,418 | $253,750 | $0 | $0 |

| 2019 | $4,339 | $248,050 | $0 | $0 |

| 2018 | $4,175 | $243,430 | $0 | $0 |

| 2017 | $4,123 | $238,430 | $0 | $0 |

| 2016 | $4,104 | $233,530 | $0 | $0 |

| 2015 | $4,162 | $231,910 | $0 | $0 |

| 2014 | $4,157 | $230,070 | $0 | $0 |

| 2013 | -- | $251,930 | $51,890 | $200,040 |

Source: Public Records

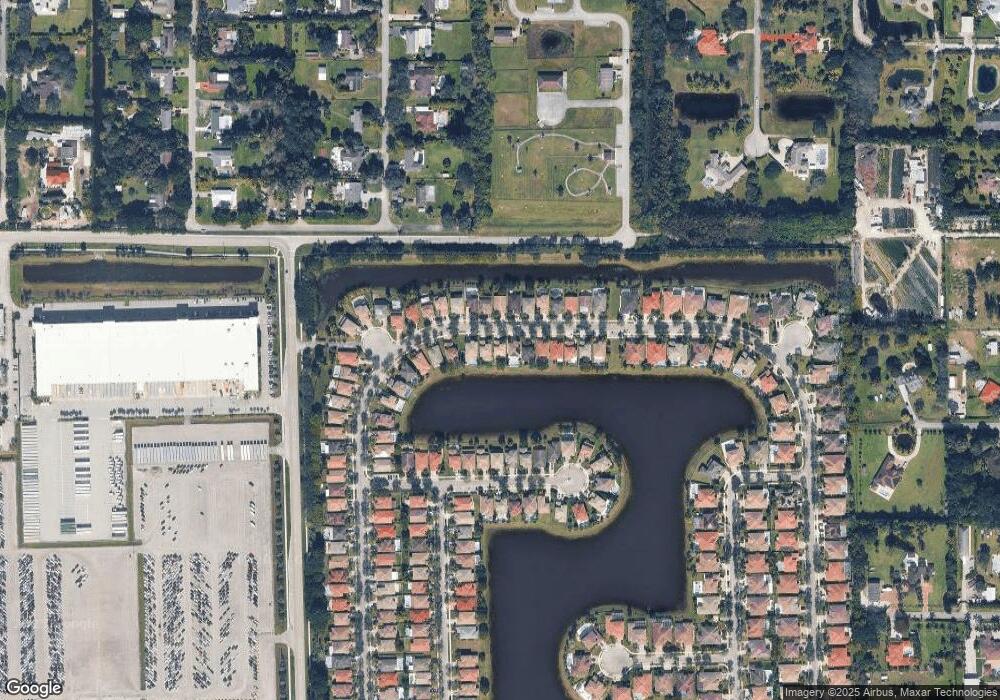

Map

Nearby Homes

- 19353 SW 60th Ct

- 6231 SW 195th Ave

- 6306 SW 191st Ave

- 5650 SW 192nd Terrace

- 5600 SW 195th Terrace

- 19427 SW 65th St

- 5601 SW 195th Terrace

- 6300 SW 190th Ave

- 5911 SW 199th Ave

- 18901 SW 63rd St

- 6231 SW 188th Ave

- 19324 SW 66th St

- 19405 SW 67th St

- 5941 SW 185th Way

- 6411 SW 185th Way

- 18951 SW 53rd St

- 6402 SW 185th Way

- 6453 SW 185th Way

- 5191 SW 188th Ave

- 6200 SW 183rd Way

- 19384 SW 60th Ct

- 19344 SW 60th Ct

- 19324 SW 60th Ct

- 19304 SW 60th Ct

- 19434 SW 60th Ct

- 19363 SW 60th Ct

- 19353 SW 60th Ct Unit 19353

- 19353 SW 60th Ct Unit 1

- 19383 SW 60th Ct

- 19343 SW 60th Ct

- 19284 SW 60th Ct

- 19393 SW 60th Ct

- 19464 SW 60th Ct

- 19333 SW 60th Ct

- 19264 SW 60th Ct

- 19403 SW 60th Ct

- 19323 SW 60th Ct

- 19484 SW 60th Ct