1938 SW Panther Trace Stuart, FL 34997

South Stuart NeighborhoodEstimated Value: $793,000 - $895,000

6

Beds

4

Baths

4,323

Sq Ft

$197/Sq Ft

Est. Value

About This Home

This home is located at 1938 SW Panther Trace, Stuart, FL 34997 and is currently estimated at $852,170, approximately $197 per square foot. 1938 SW Panther Trace is a home located in Martin County with nearby schools including Crystal Lake Elementary School, Dr. David L. Anderson Middle School, and South Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 12, 2019

Sold by

Baur Jonathan S and Baur Victoria L

Bought by

Baur Jonathan S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$409,000

Outstanding Balance

$268,408

Interest Rate

3.5%

Mortgage Type

New Conventional

Estimated Equity

$583,762

Purchase Details

Closed on

Feb 26, 2009

Sold by

Multiple Owners

Bought by

Baur Jonathan S and Baur Victoria

Purchase Details

Closed on

Feb 26, 2008

Sold by

Gmac Model Home Finance Llc

Bought by

Baur Jonathan S and Rose Victoria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$360,000

Interest Rate

5.65%

Mortgage Type

Unknown

Purchase Details

Closed on

Jan 23, 2004

Sold by

Mercedes Homes Inc

Bought by

Gmac Model Home Finance Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100

Interest Rate

5.85%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Baur Jonathan S | -- | Attorney | |

| Baur Jonathan S | -- | -- | |

| Baur Jonathan S | $450,000 | Merit Title Inc | |

| Gmac Model Home Finance Inc | $399,500 | B D R Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Baur Jonathan S | $409,000 | |

| Previous Owner | Baur Jonathan S | $360,000 | |

| Previous Owner | Gmac Model Home Finance Inc | $100 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,627 | $430,027 | -- | -- |

| 2024 | $6,501 | $417,908 | -- | -- |

| 2023 | $6,501 | $405,736 | $0 | $0 |

| 2022 | $6,277 | $393,919 | $0 | $0 |

| 2021 | $6,300 | $382,446 | $0 | $0 |

| 2020 | $6,185 | $377,166 | $0 | $0 |

| 2019 | $6,089 | $368,686 | $0 | $0 |

| 2018 | $5,940 | $361,812 | $0 | $0 |

| 2017 | $5,283 | $354,370 | $0 | $0 |

| 2016 | $5,526 | $347,081 | $0 | $0 |

| 2015 | -- | $344,669 | $0 | $0 |

| 2014 | -- | $340,386 | $0 | $0 |

Source: Public Records

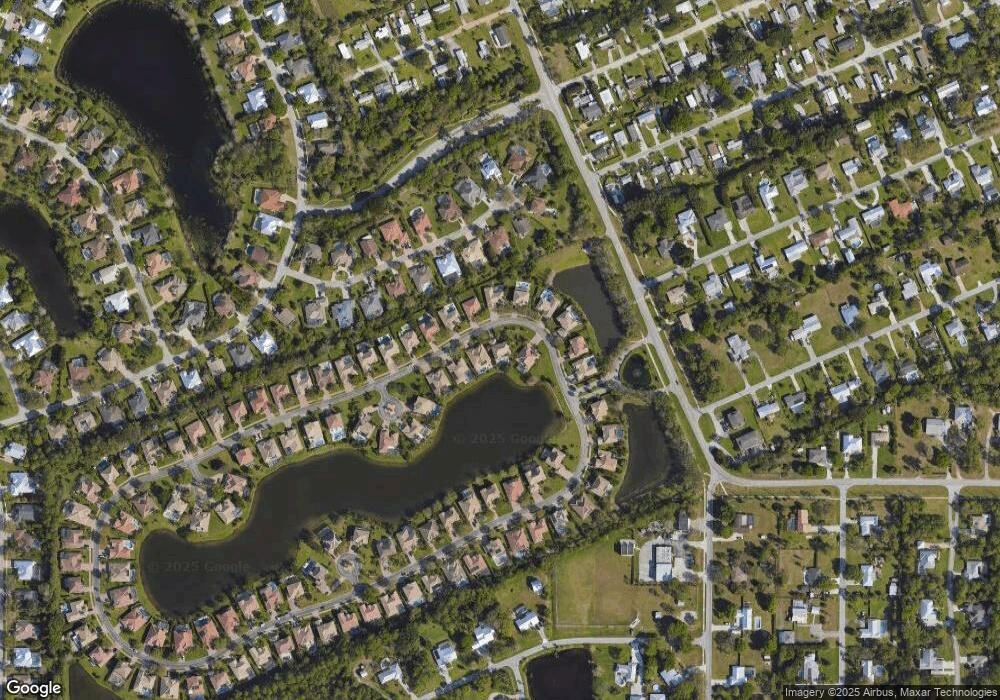

Map

Nearby Homes

- 2242 SW Panther Trace

- 2189 SW Panther Trace

- 1944 SW College St

- 2136 SW Panther Trace

- 0 Unassigned St Unit R11141160

- 8006 SW Yachtsmans Dr

- 8388 SW Masthead Dr

- 8300 SW Cattleya Dr

- 2650 SW Windship Way

- 8836 SW Fishermans Wharf Dr

- 8905 SW Cherry Ln

- 8821 SW Kanner Oaks Dr

- 8831 SW Kanner Oaks Dr

- 8841 SW Kanner Oaks Dr

- Delray Plan at Twin Oaks

- 8851 SW Kanner Oaks Dr

- Hayden Plan at Twin Oaks

- Cali Plan at Twin Oaks

- 1286 SW Tropical Terrace

- 1245 SW Kanner Hwy

- 1926 SW Panther Trace

- 1946 SW Panther Trace

- 1952 SW Panther Trace

- 1945 SW Panther Trail

- 1945 SW Panther Trace

- 1939 SW Panther Trace

- 1933 SW Panther Trace

- 1951 SW Panther Trace

- 1927 SW Panther Trace

- 1921 SW Panther Trace

- 1958 SW Panther Trace

- 1957 SW Panther Trace

- 1909 SW Panther Trace

- 2174 SW Mainsail Terrace

- 2178 SW Mainsail Terrace

- 1963 SW Panther Trace

- 8339 SW Sundance Cir

- 2182 SW Mainsail Terrace

- 2170 SW Mainsail Terrace

- 1969 SW Panther Trace