19405 Yearling Way Edmond, OK 73012

West Edmond NeighborhoodEstimated Value: $419,336 - $530,000

4

Beds

4

Baths

3,201

Sq Ft

$145/Sq Ft

Est. Value

About This Home

This home is located at 19405 Yearling Way, Edmond, OK 73012 and is currently estimated at $465,084, approximately $145 per square foot. 19405 Yearling Way is a home located in Oklahoma County with nearby schools including Frontier Elementary, Heartland Middle School, and Santa Fe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2013

Sold by

Hughes James Lee

Bought by

Hughes Lola Diane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,000

Outstanding Balance

$47,967

Interest Rate

3.57%

Mortgage Type

New Conventional

Estimated Equity

$417,117

Purchase Details

Closed on

Mar 25, 2008

Sold by

Hughes James Lee and Hughes Lola Diane

Bought by

Hughes Lola Diane

Purchase Details

Closed on

Jul 26, 2006

Sold by

Cook James E B and Cook Sara K

Bought by

Hughes James Lee and Hughes Lola Diane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$268,654

Interest Rate

6.62%

Mortgage Type

VA

Purchase Details

Closed on

Jun 1, 2004

Sold by

Cat Enterprises

Bought by

Cook James E B and Cook Sara K

Purchase Details

Closed on

Apr 30, 2004

Sold by

Zenisek Steve Francis and Zenisek Tiffany

Bought by

Cat Enterprises

Purchase Details

Closed on

Jun 9, 2003

Sold by

Zenisek Steve Francis and Case #Cj-2002-9069

Bought by

Wachovia Bank Of Delaware Na

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hughes Lola Diane | -- | The Oklahoma City Abstract | |

| Hughes Lola Diane | -- | The Oklahoma City Abstract & | |

| Hughes James Lee | $263,000 | First American Title & Tr Co | |

| Cook James E B | $187,000 | Lawyers Title Of Ok City Inc | |

| Cat Enterprises | $167,500 | -- | |

| Wachovia Bank Of Delaware Na | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hughes Lola Diane | $233,000 | |

| Previous Owner | Hughes James Lee | $268,654 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,352 | $38,392 | $5,247 | $33,145 |

| 2023 | $4,352 | $36,564 | $5,314 | $31,250 |

| 2022 | $4,182 | $34,823 | $5,745 | $29,078 |

| 2021 | $3,943 | $33,165 | $6,306 | $26,859 |

| 2020 | $3,935 | $32,615 | $6,297 | $26,318 |

| 2019 | $3,797 | $31,295 | $6,297 | $24,998 |

| 2018 | $3,773 | $30,911 | $0 | $0 |

| 2017 | $3,803 | $31,349 | $6,297 | $25,052 |

| 2016 | $3,676 | $30,470 | $6,523 | $23,947 |

| 2015 | $3,714 | $30,611 | $6,393 | $24,218 |

| 2014 | $3,528 | $29,153 | $6,414 | $22,739 |

Source: Public Records

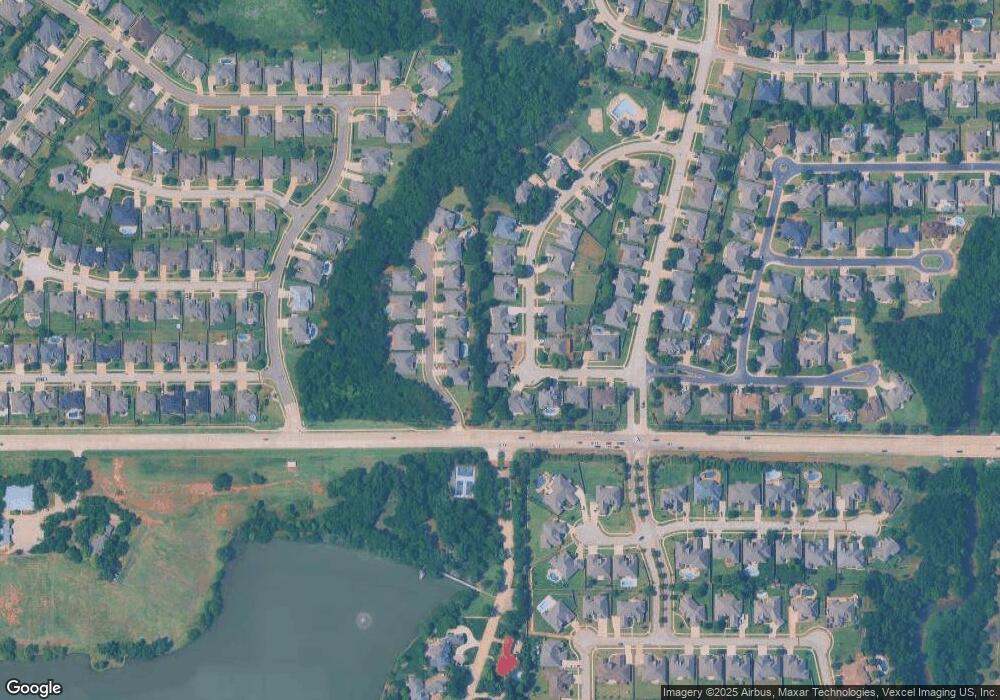

Map

Nearby Homes

- 1716 NW 196th St

- 1505 NW 189th St

- 18909 Saddle River Dr

- 19213 Canyon Creek Place

- 1800 NW 198th St

- 19541 Talavera Ln

- 19640 Stratmore Way

- 18900 Shilstone Way

- 19705 Stratmore Way

- 0 NW 192nd St Unit 1167400

- 1225 NW 198th St

- 1204 NW 190th Place

- 2008 Bretton Cir

- 18804 Shilstone Way

- 1405 NW 187th St

- 19608 Harness Ct

- 19608 Dalemead Way

- 19605 Dalemead Way

- 1200 NW 199th St

- 1117 NW 198th St

- 19409 Yearling Way

- 19401 Yearling Way

- 19308 Cade Ct

- 19316 Cade Ct

- 19300 Cade Ct

- 19413 Yearling Way

- 19400 Yearling Way

- 1512 NW 193rd St

- 19400 Cade Ct

- 19404 Yearling Way

- 19408 Cade Ct

- 19417 Yearling Way

- 1504 NW 193rd St

- 19309 Cade Ct

- 1501 NW 193rd St

- 19317 Cade Ct

- 19412 Yearling Way

- 19416 Cade Ct

- 19401 Cade Ct

- 19405 Danforth Farms Blvd