19620 104th Ave E Unit 76 Graham, WA 98338

Estimated Value: $429,000 - $466,000

3

Beds

3

Baths

1,652

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 19620 104th Ave E Unit 76, Graham, WA 98338 and is currently estimated at $446,210, approximately $270 per square foot. 19620 104th Ave E Unit 76 is a home located in Pierce County with nearby schools including Nelson Elementary School, Frontier Middle School, and Graham Kapowsin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2018

Sold by

Moreno April H and Moreno Jose Oscar

Bought by

Brett Zackary D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$268,055

Outstanding Balance

$234,500

Interest Rate

5.12%

Mortgage Type

FHA

Estimated Equity

$211,710

Purchase Details

Closed on

Oct 19, 2011

Sold by

Dinelt April and Moren Jose O

Bought by

Dinelt April

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,800

Interest Rate

4.01%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 11, 2006

Sold by

Evergreen Ridge Development Co Llc

Bought by

Dinelt April

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,560

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brett Zackary D | $272,719 | Fidelity National Title | |

| Dinelt April | -- | First American Els | |

| Dinelt April | $231,950 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brett Zackary D | $268,055 | |

| Previous Owner | Dinelt April | $186,800 | |

| Previous Owner | Dinelt April | $185,560 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,369 | $406,100 | $137,100 | $269,000 |

| 2024 | $4,369 | $400,900 | $137,100 | $263,800 |

| 2023 | $4,369 | $368,000 | $142,400 | $225,600 |

| 2022 | $4,343 | $377,300 | $135,000 | $242,300 |

| 2021 | $3,849 | $269,600 | $86,300 | $183,300 |

| 2019 | $2,887 | $242,300 | $74,300 | $168,000 |

| 2018 | $3,152 | $227,200 | $62,300 | $164,900 |

| 2017 | $2,736 | $198,800 | $49,100 | $149,700 |

| 2016 | $2,245 | $153,300 | $29,600 | $123,700 |

| 2014 | $1,952 | $129,500 | $29,600 | $99,900 |

| 2013 | $1,952 | $115,100 | $27,900 | $87,200 |

Source: Public Records

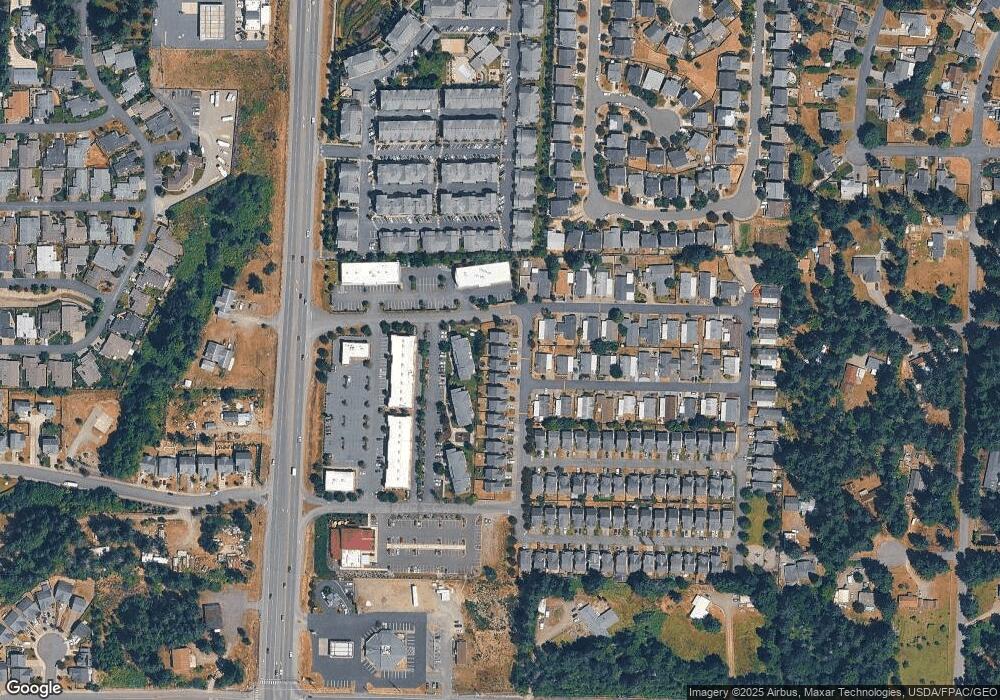

Map

Nearby Homes

- 10525 197th Street Ct E Unit 51

- 10609 197th St E

- 10415 194th Street Ct E

- 10508 192nd Street Ct E

- 19411 107th Avenue Ct E

- 10509 192nd Street Ct E

- 9806 196 St E

- 20008 99th Ave E

- 10527 192nd Street Ct E

- 19110 101st Ave E

- 9822 201st St E

- 19815 97th Avenue Ct E

- 10022 191st St E

- 20018 98th Ave E

- 9721 194th St E

- 18918 105th Ave E

- 19605 95th Avenue Ct E

- 20024 96th Avenue Ct E

- 0 (Lot 2) 95th Avenue Ct E

- 19601 95th Ave E

- 19616 104th Ave E

- 19618 104th Ave E

- 19628 104th Ave E Unit 74

- 10306 196th Street Ct E

- 19702 104th Ave E Unit 73

- 10403 197th St E Unit 29

- 19710 104th Ave E Unit 71

- 10407 197th St E Unit 28

- 10404 197th St E Unit 30

- 10406 196th St E

- 10406 196th Street Ct E

- 10305 196th Street Ct E

- 19714 104th Avenue Ct E Unit 70

- 10401 196th Street Ct E Unit 9

- 19714 104th Ave E Unit 70

- 10408 197th St E Unit 31

- 10410 196th St E

- 10410 196th Street Ct E

- 10401 197th Street Ct E Unit 65

- 19718 104th Ave E