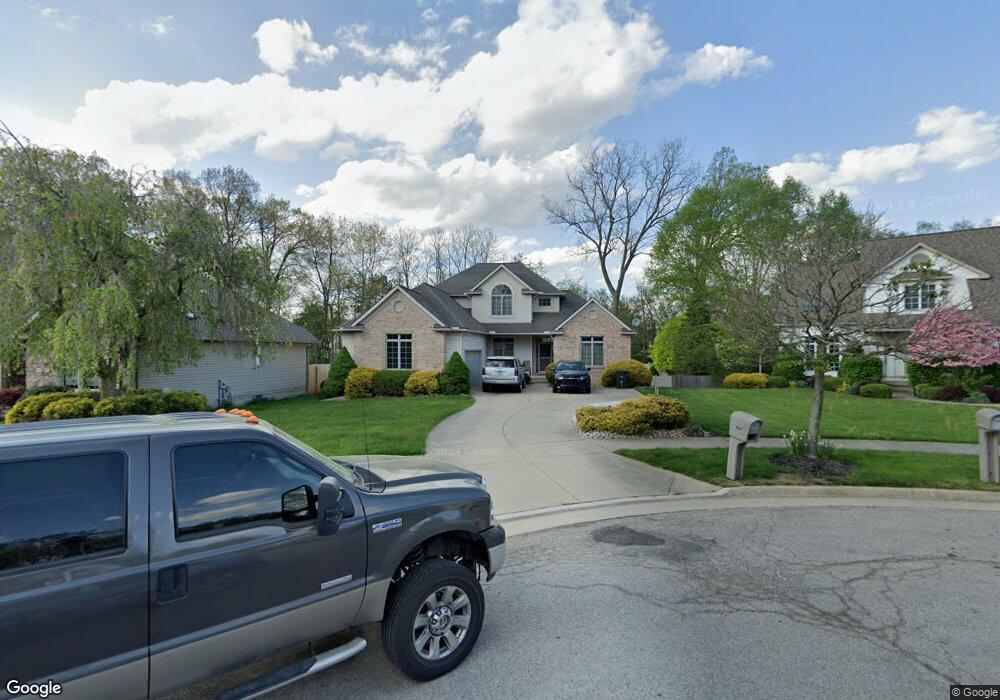

1977 Wells Creek Run Akron, OH 44312

Ellet NeighborhoodEstimated Value: $366,000 - $409,000

4

Beds

4

Baths

2,198

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 1977 Wells Creek Run, Akron, OH 44312 and is currently estimated at $384,325, approximately $174 per square foot. 1977 Wells Creek Run is a home located in Summit County with nearby schools including Ellet High School, Summit Academy Akron Elementary School, and Akron Preparatory school.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2005

Sold by

Howe William A and Howe Beth I

Bought by

Richardson Lamard D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,400

Outstanding Balance

$109,771

Interest Rate

5.75%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$274,554

Purchase Details

Closed on

Nov 29, 2000

Sold by

L

Bought by

Howe William A and Howe Beth I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,000

Interest Rate

7.86%

Purchase Details

Closed on

Oct 1, 1998

Sold by

Rolenz John S and Rolenz Lori A

Bought by

Russell Warren L and Russell Robyn M

Purchase Details

Closed on

Sep 30, 1998

Sold by

Peter Nicholas Dev Corp

Bought by

Rolenz John S and Rolenz Lori A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richardson Lamard D | $263,000 | The Talon Group | |

| Howe William A | $49,000 | Bond & Associates Title Agen | |

| Russell Warren L | $16,500 | -- | |

| Rolenz John S | $33,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Richardson Lamard D | $210,400 | |

| Previous Owner | Howe William A | $194,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,711 | $108,546 | $21,704 | $86,842 |

| 2024 | $5,711 | $108,546 | $21,704 | $86,842 |

| 2023 | $5,711 | $108,546 | $21,704 | $86,842 |

| 2022 | $4,889 | $72,682 | $14,375 | $58,307 |

| 2021 | $4,894 | $72,682 | $14,375 | $58,307 |

| 2020 | $4,820 | $72,690 | $14,380 | $58,310 |

| 2019 | $4,682 | $64,040 | $13,800 | $50,240 |

| 2018 | $4,619 | $64,040 | $13,800 | $50,240 |

| 2017 | $4,693 | $64,040 | $13,800 | $50,240 |

| 2016 | $4,697 | $64,040 | $13,800 | $50,240 |

| 2015 | $4,693 | $64,040 | $13,800 | $50,240 |

| 2014 | $4,655 | $64,040 | $13,800 | $50,240 |

| 2013 | $4,581 | $64,340 | $13,800 | $50,540 |

Source: Public Records

Map

Nearby Homes

- 198 Hilbish Ave

- 159 Dellenberger Ave

- 181 Hilbish Ave

- 364 Stanley Rd

- 274 Fulmer Ave

- 195 Prairie Dr

- 1835 Penthley Ave

- 452 Herbert Rd

- 427 Fulmer Ave

- 57 Carlton Dr

- 406 Baldwin Rd

- 490 Stephens Rd

- 172 Emmons Ave

- 547 Lansing Rd

- 586 Hillman Rd

- 1955 Preston Ave Unit 1957

- 594 Hillman Rd Unit 596

- 597 Hillman Rd

- 1947 Preston Ave Unit 1949

- 600 Hillman Rd Unit 602

- 1973 Wells Creek Run

- 1981 Wells Creek Run

- 1969 Wells Creek Run

- 1983 Wells Creek Run

- 246 Akers Ave

- 238 Akers Ave

- 234 Akers Ave

- 1965 Wells Creek Run

- 228 Akers Ave

- 250 Akers Ave

- 220 Akers Ave

- 274 Hilbish Ave

- 1974 Wells Creek Run

- 1961 Wells Creek Run

- 264 Hilbish Ave

- 280 Hilbish Ave

- 1978 Wells Creek Run

- 1982 Wells Creek Run

- 1970 Wells Creek Run

- 286 Hilbish Ave