20 Ajax Ct Hackettstown, NJ 07840

Estimated Value: $321,869 - $370,000

--

Bed

--

Bath

932

Sq Ft

$369/Sq Ft

Est. Value

About This Home

This home is located at 20 Ajax Ct, Hackettstown, NJ 07840 and is currently estimated at $343,967, approximately $369 per square foot. 20 Ajax Ct is a home located in Warren County with nearby schools including Mountain Villa School, Allamuchy Township Elementary School, and Tranquility Adventist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2008

Sold by

Mcdonnell Scott E and Mcdonnell Jodie A

Bought by

Riker Gail

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,000

Outstanding Balance

$84,048

Interest Rate

6.58%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$259,919

Purchase Details

Closed on

Nov 1, 2002

Sold by

Willison David

Bought by

Mcdonneli Scott E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,600

Interest Rate

6.07%

Purchase Details

Closed on

Aug 13, 1998

Sold by

Floegel Scott R and Floegel Jody E

Bought by

Willison David H

Purchase Details

Closed on

May 27, 1994

Sold by

Robinson Ricky A and Bauer Rosemarie A

Bought by

Floegel Scott R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Riker Gail | $220,000 | None Available | |

| Mcdonneli Scott E | $159,500 | -- | |

| Willison David H | $104,000 | Chicago Title Insurance Co | |

| Floegel Scott R | $110,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Riker Gail | $126,000 | |

| Previous Owner | Mcdonneli Scott E | $127,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,215 | $131,300 | $60,000 | $71,300 |

| 2024 | $4,955 | $131,300 | $60,000 | $71,300 |

| 2023 | $4,883 | $131,300 | $60,000 | $71,300 |

| 2022 | $4,415 | $131,300 | $60,000 | $71,300 |

| 2021 | $3,217 | $131,300 | $60,000 | $71,300 |

| 2020 | $3,877 | $131,300 | $60,000 | $71,300 |

| 2019 | $3,814 | $131,300 | $60,000 | $71,300 |

| 2018 | $4,638 | $131,300 | $60,000 | $71,300 |

| 2017 | $3,855 | $131,300 | $60,000 | $71,300 |

| 2016 | $3,826 | $131,300 | $60,000 | $71,300 |

| 2015 | $4,728 | $131,300 | $60,000 | $71,300 |

| 2014 | $4,559 | $131,300 | $60,000 | $71,300 |

Source: Public Records

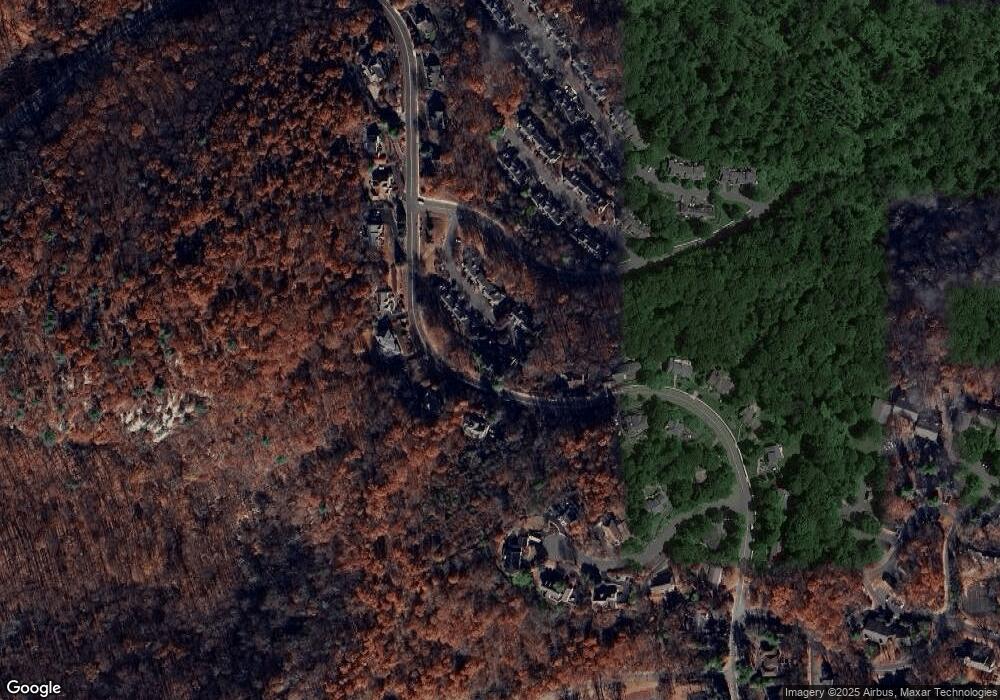

Map

Nearby Homes

- 5 Ajax Ct

- 15 Ajax Ct

- 10 Rushmore Ln

- 25 Osprey Unit C2G3

- 57 Marsh Hawk Unit 8

- 156 Osprey Unit 5

- 300 Alphano Rd

- 26 Goldfinch Dr

- 38 Goldfinch Dr

- 108 Goldfinch Meadows

- 41 Killdeer Place

- 17 Alexanders Rd

- 11 Pheasant Run

- 41 Green Heron Dr

- 44 Wood Duck Ct Unit 135

- 7 Poplar Ct

- 94 Ridge Rd

- 102 Ridge Rd

- 34 Ryan Rd

- 159 Alphano Rd