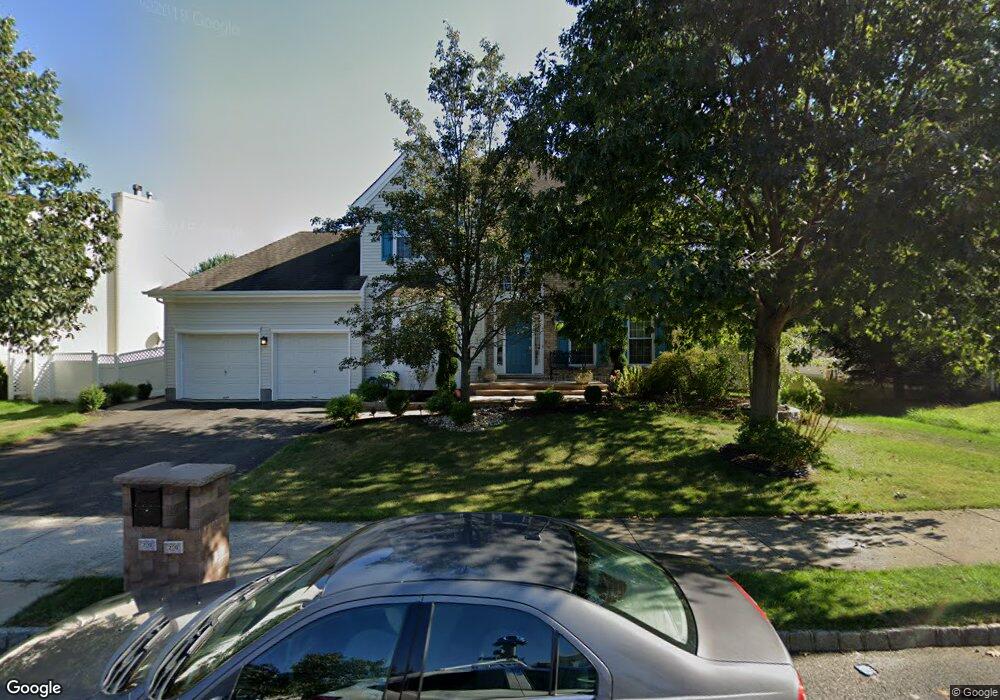

20 Aster Way Dayton, NJ 08810

Estimated Value: $905,000 - $1,050,000

Studio

--

Bath

2,494

Sq Ft

$386/Sq Ft

Est. Value

About This Home

This home is located at 20 Aster Way, Dayton, NJ 08810 and is currently estimated at $961,784, approximately $385 per square foot. 20 Aster Way is a home located in Middlesex County with nearby schools including Indian Fields Elementary School, Crossroads South Middle School, and South Brunswick High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2020

Sold by

Pereira Marcelino and Pereira Sandra M

Bought by

Sivasubramanian Satheeshkumar and Somasundaram Radhika

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$611,800

Outstanding Balance

$543,325

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$418,459

Purchase Details

Closed on

Jun 24, 1999

Sold by

Sharbell Dev Corp

Bought by

Pereira Marcelino and Pereira Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,400

Interest Rate

7.49%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sivasubramanian Satheeshkumar | $644,000 | Associated Title | |

| Pereira Marcelino | $264,127 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sivasubramanian Satheeshkumar | $611,800 | |

| Previous Owner | Pereira Marcelino | $224,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,720 | $272,500 | $60,000 | $212,500 |

| 2024 | $14,192 | $272,500 | $60,000 | $212,500 |

| 2023 | $14,192 | $272,500 | $60,000 | $212,500 |

| 2022 | $13,769 | $272,500 | $60,000 | $212,500 |

| 2021 | $10,598 | $272,500 | $60,000 | $212,500 |

| 2020 | $13,854 | $272,500 | $60,000 | $212,500 |

| 2019 | $13,979 | $272,500 | $60,000 | $212,500 |

| 2018 | $13,521 | $272,500 | $60,000 | $212,500 |

| 2017 | $13,502 | $272,500 | $60,000 | $212,500 |

| 2016 | $13,361 | $272,500 | $60,000 | $212,500 |

| 2015 | $12,952 | $272,500 | $60,000 | $212,500 |

| 2014 | $12,742 | $272,500 | $60,000 | $212,500 |

Source: Public Records

Map

Nearby Homes

- 34 Scenic Dr

- 1209 Blossom Cir

- 408 Blossom Cir

- 48 Woodland Way

- Q10 Quincy Cir Unit Q-10

- 23 Woodland Way

- 4 Quincy Cir

- 13 Quincy Cir Unit K

- 10-Q Dayton Cir

- 430 Ridge Rd

- 26 Isaac Dr

- 342 Ridge Rd

- 76 Regal Dr

- 6 Isaac Dr

- 126 Leah Ct

- 24 Pullman Loop

- 430-B Ridge Rd

- 430-A Ridge Rd

- 44 Lexington Rd

- 2707 Hayden Ct