20 Juniper Ct Lake In the Hills, IL 60156

Estimated Value: $479,545 - $528,000

3

Beds

--

Bath

1,895

Sq Ft

$262/Sq Ft

Est. Value

About This Home

This home is located at 20 Juniper Ct, Lake In the Hills, IL 60156 and is currently estimated at $496,136, approximately $261 per square foot. 20 Juniper Ct is a home located in McHenry County with nearby schools including Glacier Ridge Elementary School, Richard F Bernotas Middle School, and Crystal Lake South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 18, 2022

Sold by

Falk Larry A and Falk Anne E

Bought by

Falk Family Trust

Current Estimated Value

Purchase Details

Closed on

Nov 18, 2005

Sold by

Hahnfield Roy

Bought by

Falk Larry A and Falk Anne E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$368,000

Interest Rate

5.18%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 30, 2001

Sold by

Hahnfeld Roy C and Hahnfeld Darlene

Bought by

Hahnfeld Roy C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,000

Interest Rate

5%

Purchase Details

Closed on

Oct 18, 2001

Sold by

Par Development Inc

Bought by

Hahnfeld Roy C and Hahnfeld Darlene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,000

Interest Rate

5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Falk Family Trust | -- | Law Firm Keith D Sloan Pc | |

| Falk Larry A | $460,000 | Ticor Title Insurance Compan | |

| Hahnfeld Roy C | -- | -- | |

| Hahnfeld Roy C | $409,722 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Falk Larry A | $368,000 | |

| Previous Owner | Hahnfeld Roy C | $308,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,584 | $138,934 | $6,989 | $131,945 |

| 2023 | $10,135 | $124,806 | $6,278 | $118,528 |

| 2022 | $9,857 | $113,646 | $5,717 | $107,929 |

| 2021 | $9,411 | $107,031 | $5,384 | $101,647 |

| 2020 | $9,288 | $104,176 | $5,240 | $98,936 |

| 2019 | $9,115 | $101,516 | $5,106 | $96,410 |

| 2018 | $9,689 | $104,289 | $5,747 | $98,542 |

| 2017 | $9,675 | $98,284 | $5,416 | $92,868 |

| 2016 | $9,655 | $93,443 | $5,149 | $88,294 |

| 2013 | -- | $79,768 | $11,254 | $68,514 |

Source: Public Records

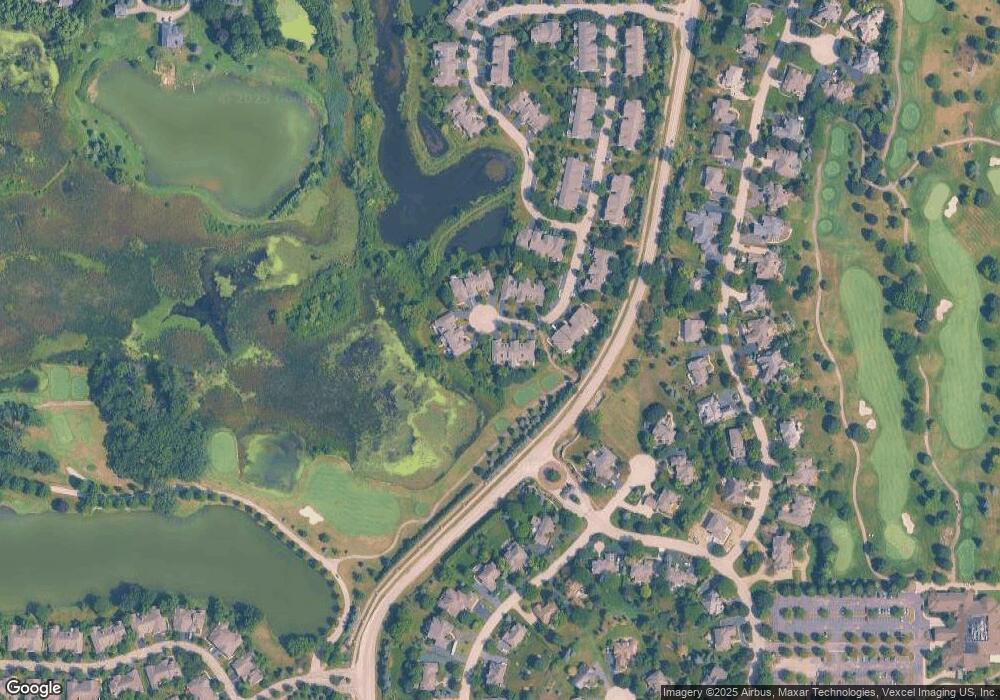

Map

Nearby Homes

- 3891 Willow View Dr

- 641 Mason Ln

- 675 White Pine Cir

- 775 White Pine Cir

- 4015 Peartree Dr

- 6 Sugar Maple Ct

- 1849 Moorland Ln

- 7 Shoal Creek Ct

- 1123 Village Rd

- 9103 Miller Rd Unit 2

- 9103 Miller Rd Unit 3

- 9103 Miller Rd Unit 4

- 9103 Miller Rd Unit 1

- 9103 Miller Rd Unit 5

- 10 Barrington Ct

- 1108 Heavens Gate

- 9105 Algonquin Rd

- 3260 Nottingham Dr

- 432 Thunder Ridge

- 16 Springbrook Ln