200 Ballantrae Dr Northfield, OH 44067

Estimated Value: $506,721 - $699,000

4

Beds

3

Baths

2,600

Sq Ft

$216/Sq Ft

Est. Value

About This Home

This home is located at 200 Ballantrae Dr, Northfield, OH 44067 and is currently estimated at $561,680, approximately $216 per square foot. 200 Ballantrae Dr is a home located in Summit County with nearby schools including Lee Eaton Elementary School, Nordonia Middle School, and Nordonia High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2011

Sold by

Liverpool Joseph E and Liverpool Connie

Bought by

Williams Barbara L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,000

Outstanding Balance

$177,188

Interest Rate

4.8%

Mortgage Type

New Conventional

Estimated Equity

$384,492

Purchase Details

Closed on

Jun 1, 1999

Sold by

Commercial Properties Inc

Bought by

Wells David A and Steinfurth Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,252

Interest Rate

6.94%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Williams Barbara L | $325,000 | Barristers Of Ohio | |

| Wells David A | $284,463 | Midland Commerce Group |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Williams Barbara L | $255,000 | |

| Previous Owner | Wells David A | $255,252 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $15,629 | $140,519 | $38,336 | $102,183 |

| 2024 | $6,654 | $140,519 | $38,336 | $102,183 |

| 2023 | $15,629 | $140,519 | $38,336 | $102,183 |

| 2022 | $7,015 | $121,139 | $33,051 | $88,088 |

| 2021 | $6,931 | $121,139 | $33,051 | $88,088 |

| 2020 | $6,762 | $121,140 | $33,050 | $88,090 |

| 2019 | $6,863 | $111,320 | $31,400 | $79,920 |

| 2018 | $6,046 | $111,320 | $31,400 | $79,920 |

| 2017 | $5,696 | $111,320 | $31,400 | $79,920 |

| 2016 | $5,636 | $102,440 | $31,400 | $71,040 |

| 2015 | $5,696 | $102,440 | $31,400 | $71,040 |

| 2014 | $5,661 | $102,440 | $31,400 | $71,040 |

| 2013 | $5,623 | $102,580 | $31,400 | $71,180 |

Source: Public Records

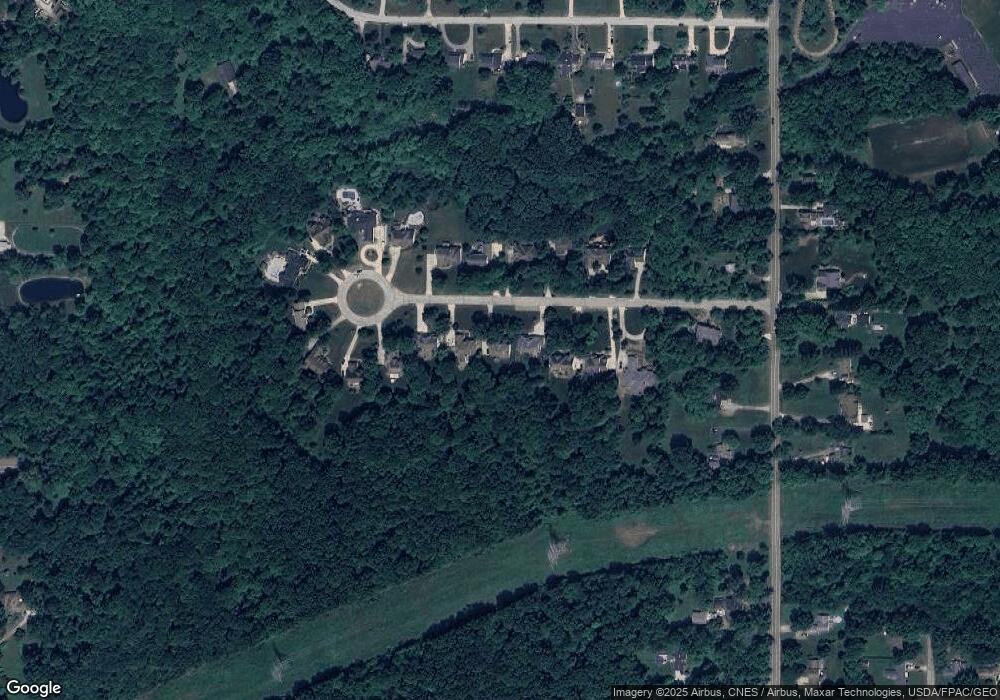

Map

Nearby Homes

- 50 Dover Place Ln

- S/L Carlin Dr

- 7872 French Dr

- 419 Mcneil Dr

- 9434 Olde 8 Rd

- 648 Rehwinkle Rd

- 8961 Lowell Ln

- 688 Greenwood Ct

- 285 Skylane Dr

- 188 Timberlane Dr

- 7484 Millrace Ln

- 161 Marwyck Place Ln Unit 33

- 628 Windsor Ln

- 8134 N Boyden Rd

- 8282 Fairlane Dr

- 171 Butternut Ln

- 874 Hemlock Ln

- 7571 Silverleaf Ct

- 804 Arboretum Cir Unit 804

- 8505 Olde 8 Rd

- 210 Ballantrae Dr

- 190 Ballantrae Dr

- 180 Ballantrae Dr

- 220 Ballantrae Dr

- 199 Ballantrae Dr

- 209 Ballantrae Dr

- 189 Ballantrae Dr

- 170 Ballantrae Dr

- 230 Ballantrae Dr

- 169 Ballantrae Dr

- 160 Ballantrae Dr

- 240 Ballantrae Dr

- 219 Ballantrae Dr

- 159 Ballantrae Dr

- 249 Ballantrae Dr

- 250 Ballantrae Dr

- 229 Ballantrae Dr

- 260 Ballantrae Dr

- 9340 Brandywine Rd

- 9322 Brandywine Rd