20025 E Lakeshore Dr Magnolia, TX 77355

Estimated Value: $364,000 - $441,000

2

Beds

1

Bath

1,880

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 20025 E Lakeshore Dr, Magnolia, TX 77355 and is currently estimated at $404,064, approximately $214 per square foot. 20025 E Lakeshore Dr is a home located in Montgomery County with nearby schools including Willie E. Williams Elementary School, Magnolia Sixth Grade Campus, and Magnolia Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 30, 2012

Sold by

Terrasson Margaret

Bought by

Bell Tommy W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,687

Outstanding Balance

$88,195

Interest Rate

3.91%

Mortgage Type

VA

Estimated Equity

$315,869

Purchase Details

Closed on

Jun 29, 2001

Sold by

Yurk Fredda O

Bought by

Terrasson Edward L and Terrasson Keira C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,000

Interest Rate

7.2%

Purchase Details

Closed on

Jun 26, 1995

Sold by

Olive Elsie M

Bought by

Yurk Fredda O

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bell Tommy W | -- | Stewart Title | |

| Terrasson Edward L | -- | Chicago Title | |

| Yurk Fredda O | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bell Tommy W | $127,687 | |

| Previous Owner | Terrasson Edward L | $101,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,960 | $312,998 | $83,283 | $229,715 |

| 2024 | $5,044 | $313,314 | $83,283 | $230,031 |

| 2023 | $5,044 | $319,490 | $83,280 | $236,210 |

| 2022 | $5,360 | $303,730 | $83,280 | $220,450 |

| 2021 | $4,480 | $241,010 | $74,360 | $166,650 |

| 2020 | $4,371 | $216,010 | $74,360 | $141,650 |

| 2019 | $3,996 | $198,400 | $74,360 | $160,200 |

| 2018 | $2,825 | $180,360 | $8,370 | $176,540 |

| 2017 | $3,477 | $163,960 | $8,370 | $162,300 |

| 2016 | $3,161 | $149,050 | $8,370 | $150,070 |

| 2015 | $1,656 | $135,500 | $8,370 | $147,090 |

| 2014 | $1,656 | $123,180 | $8,370 | $114,810 |

Source: Public Records

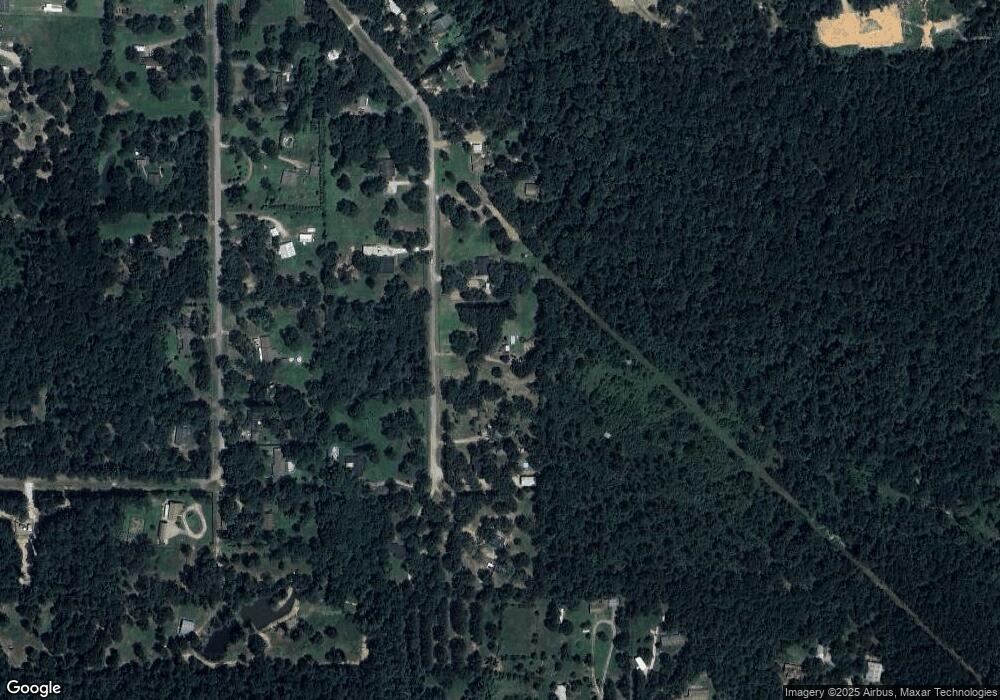

Map

Nearby Homes

- 20075 Forestview Dr

- 20024 W Lakeshore Dr

- 19725 Lakeshore Dr W

- 19701 Lakeshore Dr W

- 26601 Buchanan Ct

- 27055 Sandy Creek Dr

- 19757 Dorris Dr

- 26410 Yaupon Creek

- 19844 Alford Rd

- 21138 Titian Dr

- 19801 Whispering Creek Trail

- 19397 Loafers Ln

- 19489 Tall Pines

- 26563 Lazy Ln

- 26870 E Lazy Ln

- 19588 Alford Rd

- 26603 Ezemily Dr

- 26775 Lazy Ln

- 23128 Shakespeare Dr

- 19331 E Lakeshore Dr

- 20081 E Lakeshore Dr

- 19973 E Lakeshore Dr

- 19976 E Lakeshore Dr

- 19972 E Lakeshore Dr

- 20103 E Lakeshore Dr

- 19901 E Lakeshore Dr

- 20106 E Lakeshore Dr

- 20135 E Lakeshore Dr

- 19902 E Lakeshore Dr

- 20029 W Lakeshore Dr

- 19975 W Lakeshore Dr

- 20134 E Lakeshore Dr

- 20103 W Lakeshore Dr

- 20071 W Lakeshore Dr

- 19871 E Lakeshore Dr

- 19860 E Lakeshore Dr

- 19903 W Lakeshore Dr

- 20107 W Lakeshore Dr

- 0 Sandy Creek Unit 52277455

- 0 Sandy Creek Unit 24297462