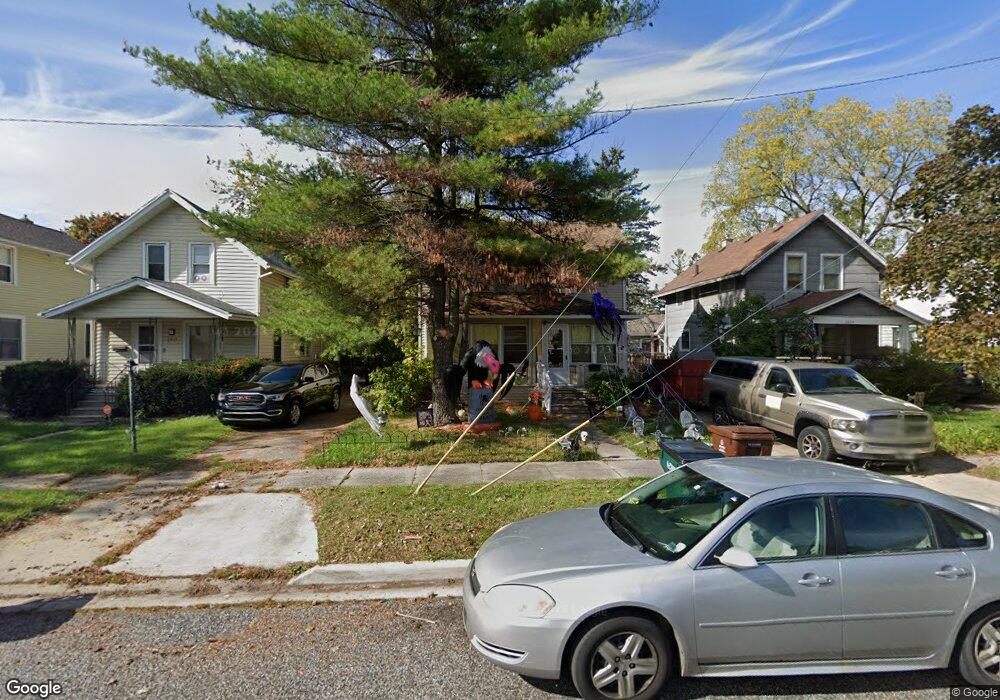

2008 Beal Ave Lansing, MI 48910

Greencroft Park NeighborhoodEstimated Value: $87,498 - $110,000

3

Beds

1

Bath

838

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 2008 Beal Ave, Lansing, MI 48910 and is currently estimated at $98,875, approximately $117 per square foot. 2008 Beal Ave is a home located in Ingham County with nearby schools including Averill Elementary School, Attwood School, and J.W. Sexton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2011

Sold by

Opanasenko Terry

Bought by

Barker Street Llc

Current Estimated Value

Purchase Details

Closed on

May 27, 2010

Sold by

Edgar John H and Edgar Cynthia F

Bought by

Bac Home Loans Servicing Lp

Purchase Details

Closed on

Mar 20, 2002

Sold by

Delaney Daniel E and Delaney Martha

Bought by

Edgar John H and Edgar Cynthia F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,800

Interest Rate

6.93%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 1, 1995

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barker Street Llc | -- | None Available | |

| Bac Home Loans Servicing Lp | $108,151 | None Available | |

| Edgar John H | $75,000 | -- | |

| -- | $35,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Edgar John H | $73,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,561 | $37,400 | $3,400 | $34,000 |

| 2024 | $21 | $35,700 | $3,400 | $32,300 |

| 2023 | $2,411 | $32,600 | $3,400 | $29,200 |

| 2022 | $2,202 | $30,400 | $4,700 | $25,700 |

| 2021 | $2,151 | $27,600 | $4,100 | $23,500 |

| 2020 | $2,136 | $27,100 | $4,100 | $23,000 |

| 2019 | $3,715 | $26,500 | $4,100 | $22,400 |

| 2018 | $1,957 | $25,400 | $4,100 | $21,300 |

| 2017 | $1,883 | $25,400 | $4,100 | $21,300 |

| 2016 | $3,378 | $25,000 | $4,100 | $20,900 |

| 2015 | $3,378 | $24,200 | $8,271 | $15,929 |

| 2014 | $3,378 | $24,000 | $4,652 | $19,348 |

Source: Public Records

Map

Nearby Homes

- 712 Lenore Ave

- 907 Lenore Ave

- 2011 Osband Ave

- 1836 Osband Ave

- 1913 Stirling Ave

- 511 W Mount Hope Ave

- 2313 S Rundle Ave

- 2112 Stirling Ave

- 815 Woodbine Ave

- 2310 Stirling Ave

- 2011 S Martin Luther King jr Blvd

- 2001 S Martin Luther King Junior Blvd

- 1723 Osband Ave

- 2421 Stirling Ave

- 1721 Fletcher St

- 917 W Barnes Ave

- 1032 Kelsey Ave

- 1114 Goodrich St

- 1010 W Barnes Ave

- 1116 George St