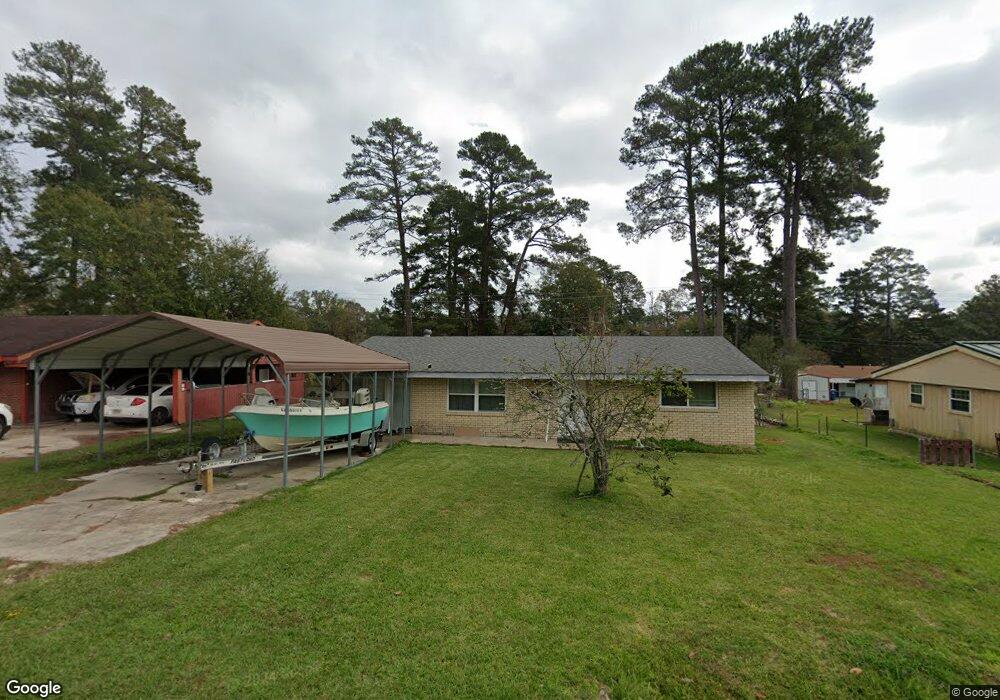

2009 Kings Rd Leesville, LA 71446

Estimated Value: $114,685 - $140,000

3

Beds

1

Bath

1,401

Sq Ft

$90/Sq Ft

Est. Value

About This Home

This home is located at 2009 Kings Rd, Leesville, LA 71446 and is currently estimated at $126,171, approximately $90 per square foot. 2009 Kings Rd is a home located in Vernon Parish with nearby schools including First Assembly Christian Academy, Faith Training Christian Academy Elementary, and Faith Training Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 22, 2013

Sold by

Moya Richard V and Moya Kassidy

Bought by

Somvang Keomahavong

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Outstanding Balance

$36,401

Interest Rate

3.44%

Mortgage Type

Stand Alone First

Estimated Equity

$89,770

Purchase Details

Closed on

Jul 27, 2007

Sold by

Utter Curtis Michael and Utter Lesley Erin Krueger

Bought by

Moya Richard and Moya Kassidey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

6.69%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Somvang Keomahavong | $72,000 | -- | |

| Moya Richard | $75,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Somvang Keomahavong | $52,000 | |

| Previous Owner | Moya Richard | $75,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $814 | $6,910 | $470 | $6,440 |

| 2023 | $748 | $6,380 | $470 | $5,910 |

| 2022 | $736 | $6,380 | $470 | $5,910 |

| 2021 | $783 | $6,380 | $470 | $5,910 |

| 2020 | $807 | $6,380 | $470 | $5,910 |

| 2019 | $832 | $6,380 | $470 | $5,910 |

| 2018 | $829 | $6,380 | $470 | $5,910 |

| 2017 | $828 | $6,380 | $470 | $5,910 |

| 2015 | $809 | $6,380 | $470 | $5,910 |

| 2014 | $724 | $6,380 | $470 | $5,910 |

| 2013 | $858 | $6,380 | $470 | $5,910 |

Source: Public Records

Map

Nearby Homes

- 0 Sartor St

- 1404 Aaron Ave

- 1402 Aaron Ave

- 2001 Ginger St

- TBD Boone St

- 190 Roberts Acres Rd

- 2105 Miriam St

- 1307 S 11th St Unit Street

- 1104 John Paul Jones Ave

- 1112 Anderson Dr

- 0 Iowa St

- 0 Aaron Milton and Karen Lots Unit 29-1413

- 0 Congress Ave

- 1007 Pinckney Ave

- 0 9th St S

- 1110 Spruce St

- 1201 S 10th St

- 1008 Spruce St

- 612 Stanton St