2013 Variations Dr NE Unit 2013 Atlanta, GA 30329

Estimated Value: $328,000 - $366,000

3

Beds

3

Baths

1,827

Sq Ft

$190/Sq Ft

Est. Value

About This Home

This home is located at 2013 Variations Dr NE Unit 2013, Atlanta, GA 30329 and is currently estimated at $347,243, approximately $190 per square foot. 2013 Variations Dr NE Unit 2013 is a home located in DeKalb County with nearby schools including John Robert Lewis Elementary School, Sequoyah Middle School, and Cross Keys High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2010

Sold by

Kemper Philip R

Bought by

Smiley Stephen L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,011

Outstanding Balance

$105,711

Interest Rate

4.75%

Mortgage Type

FHA

Estimated Equity

$241,532

Purchase Details

Closed on

Dec 2, 1998

Sold by

Denmork Celito

Bought by

Kemper Philip

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,750

Interest Rate

6.77%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 8, 1995

Sold by

Etheridge Caroline P

Bought by

Denmark Celita L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smiley Stephen L | $165,000 | -- | |

| Kemper Philip | $145,800 | -- | |

| Denmark Celita L | $100,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Smiley Stephen L | $162,011 | |

| Previous Owner | Kemper Philip | $137,750 | |

| Closed | Denmark Celita L | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,106 | $135,840 | $20,000 | $115,840 |

| 2024 | $3,747 | $130,200 | $20,000 | $110,200 |

| 2023 | $3,747 | $129,280 | $20,000 | $109,280 |

| 2022 | $3,358 | $115,440 | $14,000 | $101,440 |

| 2021 | $2,946 | $103,600 | $14,000 | $89,600 |

| 2020 | $2,797 | $96,840 | $14,000 | $82,840 |

| 2019 | $2,687 | $89,920 | $14,000 | $75,920 |

| 2018 | $2,110 | $79,960 | $14,000 | $65,960 |

| 2017 | $2,592 | $77,400 | $14,000 | $63,400 |

| 2016 | $2,117 | $64,840 | $2,520 | $62,320 |

| 2014 | $1,055 | $35,040 | $2,520 | $32,520 |

Source: Public Records

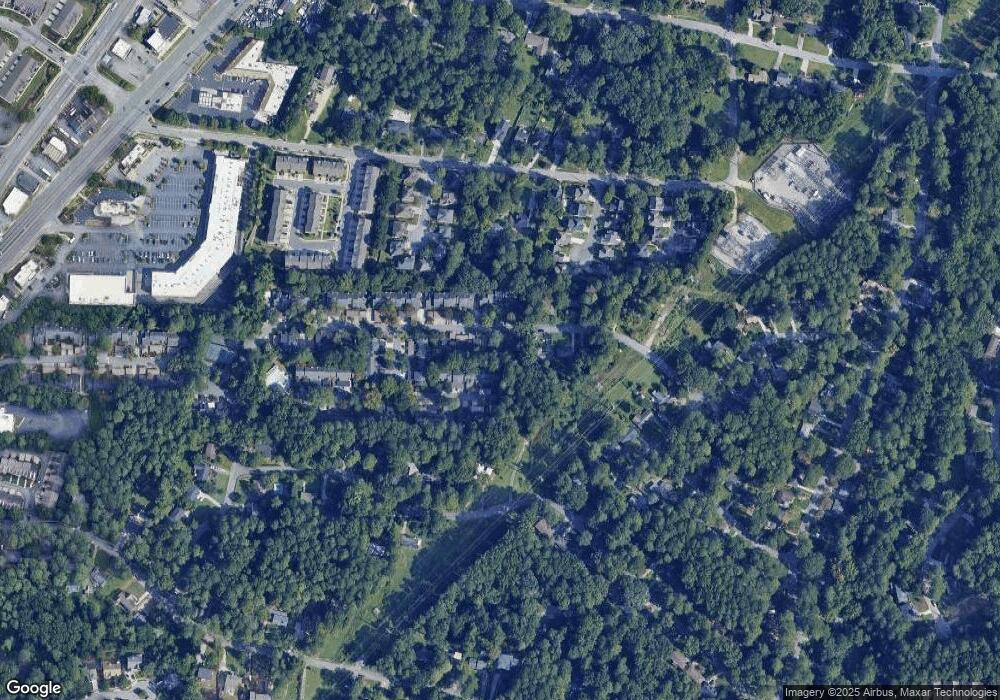

Map

Nearby Homes

- 1929 Variations Dr NE

- 1924 Variations Dr NE

- 2072 Clairmont Terrace NE

- 2080 Clairmont Terrace NE

- 1931 Gregory Run NE

- 1956 Skyfall Cir NE

- 2099 Clairmont Terrace NE

- 2440 Skyland Way NE

- 1799 Falling Sky Ct NE

- 1807 Falling Sky Ct

- 2601 Stoland Dr NE

- 2531 Skyland Dr NE

- 2539 Skyland Dr NE

- 2504 Skyland Dr NE Unit 18

- 2536 Skyland Dr NE

- 2493 Warwick Cir NE

- 1912 Canmont Dr NE

- 1951 Dresden Dr NE

- 3293 NE Clairmont North NE

- 2226 Medfield Trail NE

- 2011 Variations Dr NE

- 2015 Variations Dr NE Unit 2015

- 2017 Variations Dr NE

- 2009 Variations Dr NE Unit 2009

- 2112 Clairmeade Valley Rd NE

- 2110 Clairmeade Valley Rd NE

- 2110 Clairmeade Valley Rd NE Unit 2110

- 2110 Clairmeade Valley Rd NE

- 2108 Clairmeade Valley Rd NE Unit 2108

- 2003 Variations Dr NE

- 2008 Variations Dr NE

- 2016 Variations Dr NE

- 2010 Variations Dr NE

- 2010 Variations Dr NE Unit 2350

- 2014 Variations Dr NE

- 2104 Clairmeade Valley Rd NE

- 2001 Variations Dr NE

- 2001 Variations Dr NE Unit 2001

- 2006 Variations Dr NE

- 2102 Clairmeade Valley Rd NE