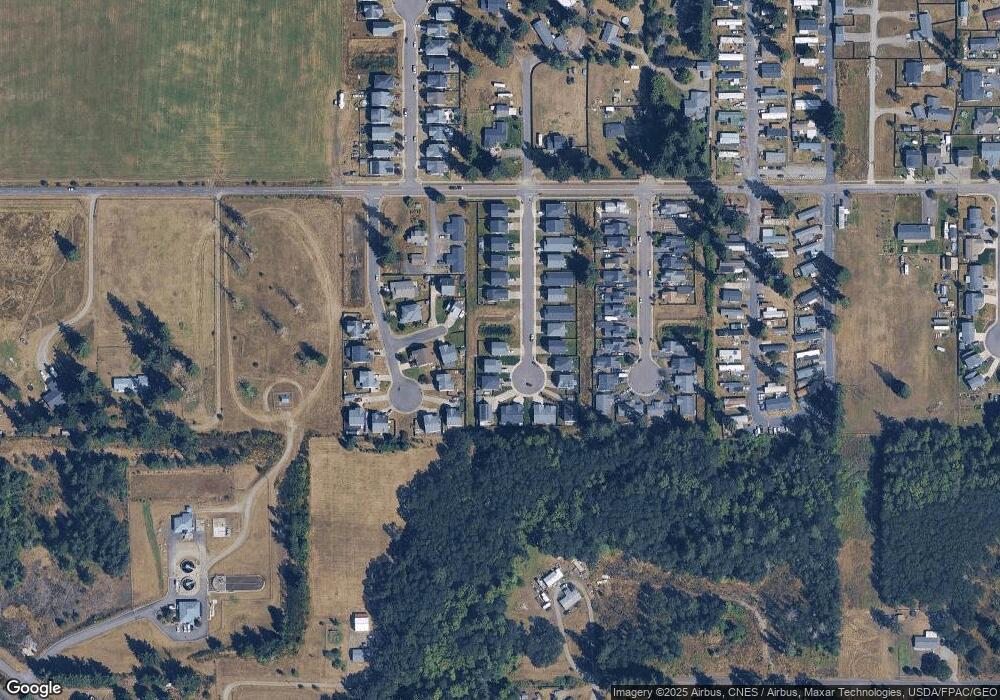

20133 Weston Ct SW Unit SW Centralia, WA 98531

Grand Mound NeighborhoodEstimated Value: $472,000 - $537,000

3

Beds

3

Baths

1,858

Sq Ft

$268/Sq Ft

Est. Value

About This Home

This home is located at 20133 Weston Ct SW Unit SW, Centralia, WA 98531 and is currently estimated at $497,567, approximately $267 per square foot. 20133 Weston Ct SW Unit SW is a home located in Thurston County with nearby schools including Rochester Primary School, Grand Mound Elementary School, and Rochester Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 29, 2020

Sold by

Hinkle Properties Inc

Bought by

Leighton James and Lamm Roxanne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,957

Outstanding Balance

$256,798

Interest Rate

3.1%

Mortgage Type

New Conventional

Estimated Equity

$240,769

Purchase Details

Closed on

Jan 13, 2020

Sold by

Cjsd Llc

Bought by

Hinkle Properties Inc and Hinkle Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,000

Interest Rate

3.6%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Leighton James | $339,950 | Thurston County Title | |

| Hinkle Properties Inc | $56,250 | Thurston County Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Leighton James | $288,957 | |

| Previous Owner | Hinkle Properties Inc | $247,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,647 | $450,100 | $87,100 | $363,000 |

| 2023 | $3,647 | $422,100 | $47,200 | $374,900 |

| 2022 | $3,089 | $367,600 | $33,200 | $334,400 |

| 2021 | $2,326 | $300,400 | $29,200 | $271,200 |

| 2020 | $46 | $206,500 | $21,300 | $185,200 |

Source: Public Records

Map

Nearby Homes

- 6521 201st Ave SW

- 20000 Kuper Ct

- 6411 201st Ave SW Unit 21

- 6511 203rd Ave SW

- 19714 Aspenwood Ct SW

- 6201 203rd Ave SW Unit 14

- 0 Hwy 12 SW Unit NWM2363119

- 20333 Old Highway 99 SW

- 20102 Rainy Ln SW

- 7140 196th Ave SW

- 19838 Bear View Ln SW

- 19140 Rosemary St SW

- 19139 Rosemary St SW

- 7140 191st Ave SW Unit 26

- 20005 Carper Rd SW

- 18905 Prairie St SW

- 19115 Old Ranch Ln SW

- 6123 186th Trail SW

- 5916 187th Ln SW

- 7245 185th Ln SW

- 20133 Weston Ct SW

- 20137 Weston Ct SW

- 20139 Weston Ct SW

- 6515 201st Ave SW

- 6517 201st Ct SW

- 6518 201st Ct SW

- 20132 Weston Ct SW

- 20130 Weston Ct SW

- 20143 Weston Ct SW

- 20136 Weston Ct SW

- 20118 Dakota Ct

- 20126 Weston Ct SW

- 20119 Weston Ct SW

- 20138 Weston Ct SW

- 20112 Dakota Ct

- 20122 Weston Ct SW

- 6514 201st Ct SW

- 20122 Dakota Ct

- 20142 Weston Ct SW

- 20115 Weston Ct SW