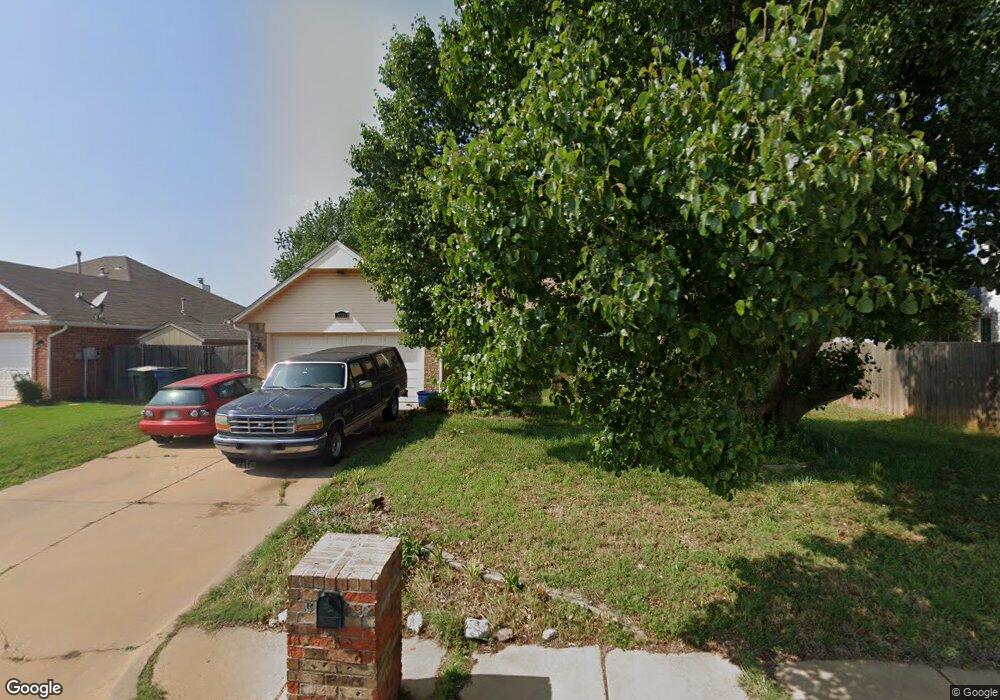

2021 Summer Hollow Ln Edmond, OK 73013

Traditions-Ripple Creek NeighborhoodEstimated Value: $263,256 - $287,000

3

Beds

2

Baths

2,103

Sq Ft

$131/Sq Ft

Est. Value

About This Home

This home is located at 2021 Summer Hollow Ln, Edmond, OK 73013 and is currently estimated at $275,314, approximately $130 per square foot. 2021 Summer Hollow Ln is a home located in Oklahoma County with nearby schools including Sunset Elementary School, Summit Middle School, and Santa Fe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 24, 2014

Sold by

Phillips Paul E and Phillips Kristen M

Bought by

Ross Andrew K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,047

Outstanding Balance

$122,790

Interest Rate

4.12%

Mortgage Type

FHA

Estimated Equity

$152,524

Purchase Details

Closed on

May 29, 2009

Sold by

Phillips Paul E and Phillips Kristen M

Bought by

Phillips Paul E and Phillips Kristen M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,456

Interest Rate

4.76%

Mortgage Type

FHA

Purchase Details

Closed on

May 28, 2009

Sold by

Garrett Clint and Garrett Kacy

Bought by

Phillips Paul E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,456

Interest Rate

4.76%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 22, 2005

Sold by

Cheney John T and Cheney Tanya E

Bought by

Garrett Clint and Garrett Kacy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ross Andrew K | $163,000 | Old Republic Title Co Of Okl | |

| Phillips Paul E | -- | None Available | |

| Phillips Paul E | $135,000 | The Oklahoma City Abstract & | |

| Garrett Clint | $119,000 | Stewart Abstract & Title Of |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ross Andrew K | $160,047 | |

| Previous Owner | Phillips Paul E | $132,456 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,250 | $22,665 | $3,332 | $19,333 |

| 2023 | $2,250 | $21,586 | $3,352 | $18,234 |

| 2022 | $2,151 | $20,559 | $3,824 | $16,735 |

| 2021 | $2,039 | $19,580 | $3,536 | $16,044 |

| 2020 | $1,994 | $18,920 | $3,536 | $15,384 |

| 2019 | $2,049 | $19,346 | $3,503 | $15,843 |

| 2018 | $1,963 | $18,425 | $0 | $0 |

| 2017 | $1,972 | $18,595 | $2,997 | $15,598 |

| 2016 | $1,874 | $17,709 | $3,040 | $14,669 |

| 2015 | $1,808 | $17,106 | $3,040 | $14,066 |

| 2014 | $1,593 | $16,093 | $2,990 | $13,103 |

Source: Public Records

Map

Nearby Homes

- 15536 Monarch Ln

- 17 Red Admiral Way

- 25 Red Admiral Way

- 15400 Monarch Ln

- 15541 Swallowtail Rd

- 1632 Camden Way

- 2201 Tracys Terrace

- 1617 Camden Way

- 1800 Napa Valley Rd

- 2104 Tanglewood Dr

- 15321 Salem Creek Place

- 2013 Tanglewood Dr

- 2200 Lazy Brook Trail

- 1916 Woodside Dr

- 2909 Marigold Ln

- 16001 Sheffield Blvd

- 15304 Old Lake Ln

- 1912 Whispering Creek Dr

- 2125 Hidden Prairie Ct

- 15400 Kestral Park Ct

- 2101 Summer Hollow Ln

- 2617 Redwood Ln

- 2613 Redwood Ln

- 2028 Summer Oak Dr

- 2100 Summer Oak Dr

- 2105 Summer Hollow Ln

- 2609 Redwood Ln

- 2020 Summer Hollow Ln

- 2705 Redwood Ln

- 2104 Summer Oak Dr

- 2100 Summer Hollow Ln

- 2109 Summer Hollow Ln

- 2104 Summer Hollow Ln

- 2108 Summer Oak Dr

- 2709 Redwood Ln

- 2616 Redwood Ln

- 2612 Redwood Ln

- 2700 Redwood Ln

- 2108 Summer Hollow Ln

- 2113 Summer Hollow Ln