Estimated Value: $202,757 - $256,000

3

Beds

2

Baths

1,400

Sq Ft

$166/Sq Ft

Est. Value

About This Home

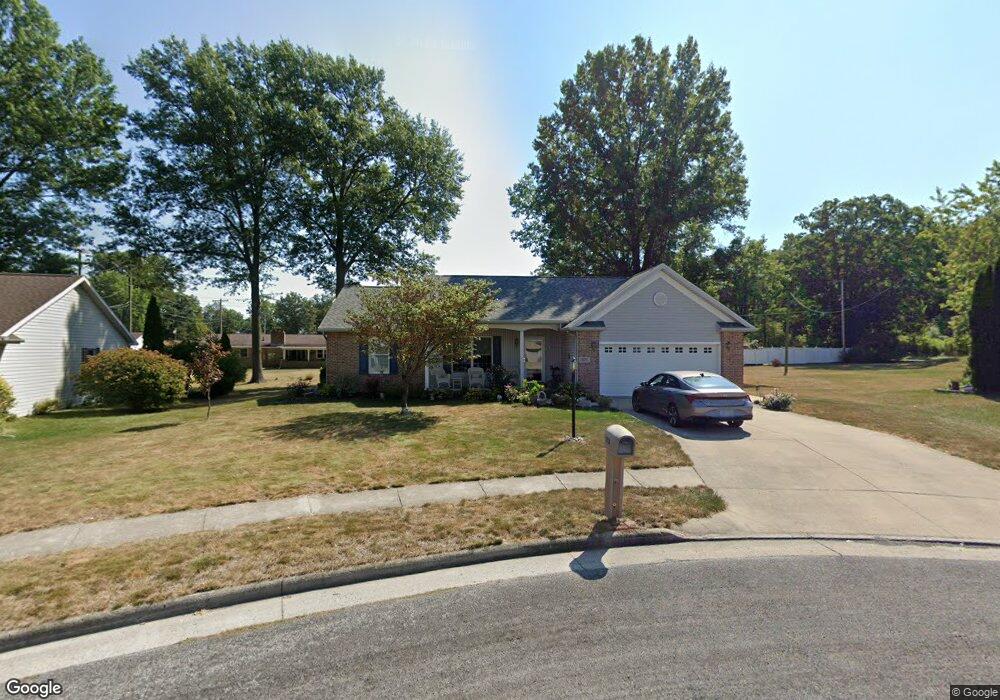

This home is located at 2028 Augusta Dr, Lima, OH 45805 and is currently estimated at $232,439, approximately $166 per square foot. 2028 Augusta Dr is a home located in Allen County with nearby schools including Elida Elementary School, Elida Middle School, and Elida High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 13, 2012

Sold by

Price Gary W

Bought by

Jpmorgan Chase Bank Na

Current Estimated Value

Purchase Details

Closed on

Dec 12, 2012

Sold by

Miller Paul A and Miller Marie B

Bought by

Miller Paul A and Miller Marie B

Purchase Details

Closed on

Aug 20, 1998

Sold by

B T M Builders

Bought by

Price Gary and Price Judy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,000

Interest Rate

6.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 27, 1998

Sold by

D K Enterprises

Bought by

B T M Builders

Purchase Details

Closed on

Aug 9, 1995

Sold by

Degen William

Bought by

D & K Enterprises

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jpmorgan Chase Bank Na | $69,000 | None Available | |

| Miller Paul A | -- | None Available | |

| Price Gary | $112,241 | -- | |

| B T M Builders | $16,200 | -- | |

| D & K Enterprises | $21,875 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Price Gary | $106,000 | |

| Closed | D & K Enterprises | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,346 | $62,130 | $10,850 | $51,280 |

| 2023 | $2,098 | $50,510 | $8,820 | $41,690 |

| 2022 | $2,170 | $50,510 | $8,820 | $41,690 |

| 2021 | $2,162 | $50,510 | $8,820 | $41,690 |

| 2020 | $1,958 | $43,960 | $9,310 | $34,650 |

| 2019 | $1,958 | $43,960 | $9,310 | $34,650 |

| 2018 | $1,926 | $43,960 | $9,310 | $34,650 |

| 2017 | $1,649 | $38,960 | $9,310 | $29,650 |

| 2016 | $1,645 | $38,960 | $9,310 | $29,650 |

| 2015 | $1,702 | $38,960 | $9,310 | $29,650 |

| 2014 | $1,702 | $39,100 | $8,580 | $30,520 |

| 2013 | $1,532 | $39,100 | $8,580 | $30,520 |

Source: Public Records

Map

Nearby Homes

- 1919 Jared Place

- 2268 N Glenwood Ave

- 1848 Edgewood Dr

- 125 Lansing Ln

- 00 Homeward Ave

- 1730 Homeward Ave

- 000 Arthur Ave

- 1619 Northbrook Dr

- 2108 Elida Rd

- 1580 W Robb Ave

- 2511 Debbie Dr

- 2275 N 2275 N Cable Rd Unit 34

- 1743 Sherry Lee Dr

- 2615 Kenny Lee Dr

- 1132 Crestwood Dr

- 2275 N Cable Rd Unit 70

- 2275 N Cable Rd Unit 93

- 2275 N Cable Rd Unit 178

- 2275 N Cable Rd Unit 193

- 2275 N Cable Rd Unit 25