2032 Road 10 8 NW Ephrata, WA 98823

Estimated Value: $127,000 - $145,251

--

Bed

--

Bath

--

Sq Ft

4.79

Acres

About This Home

This home is located at 2032 Road 10 8 NW, Ephrata, WA 98823 and is currently estimated at $136,084. 2032 Road 10 8 NW is a home located in Grant County with nearby schools including Ephrata High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 4, 2025

Sold by

Ohl Dennis L and Ohl Loc

Bought by

Tempel Jessika and Tempel Matthew

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,800

Outstanding Balance

$111,952

Interest Rate

7%

Mortgage Type

New Conventional

Estimated Equity

$24,132

Purchase Details

Closed on

Jun 24, 2020

Sold by

Brown Clinton L and Brown Clington L

Bought by

Ohl Dennis L and Ohl Loc

Purchase Details

Closed on

Aug 12, 2015

Sold by

Matheson Joshua A and Matheson Benita

Bought by

Livi Brown Clinton L and Livi Clinton L Brown Revocable

Purchase Details

Closed on

Jan 9, 2008

Sold by

Livi Brown Clinton L

Bought by

Matheson Joshua A and Matheson Benita

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

7%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tempel Jessika | $141,000 | Frontier Title | |

| Ohl Dennis L | $44,000 | Stewart Title Moses Lake | |

| Livi Brown Clinton L | -- | None Available | |

| Matheson Joshua A | $83,000 | Security Title Guaranty |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tempel Jessika | $112,800 | |

| Previous Owner | Matheson Joshua A | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $728 | $60,250 | $60,250 | $0 |

| 2023 | $694 | $35,080 | $35,080 | $0 |

| 2022 | $454 | $35,080 | $35,080 | $0 |

| 2021 | $472 | $35,080 | $35,080 | $0 |

| 2020 | $493 | $35,080 | $35,080 | $0 |

| 2019 | $380 | $35,080 | $35,080 | $0 |

| 2018 | $660 | $45,000 | $45,000 | $0 |

| 2017 | $618 | $45,000 | $45,000 | $0 |

| 2016 | $652 | $45,000 | $45,000 | $0 |

| 2013 | -- | $45,000 | $45,000 | $0 |

Source: Public Records

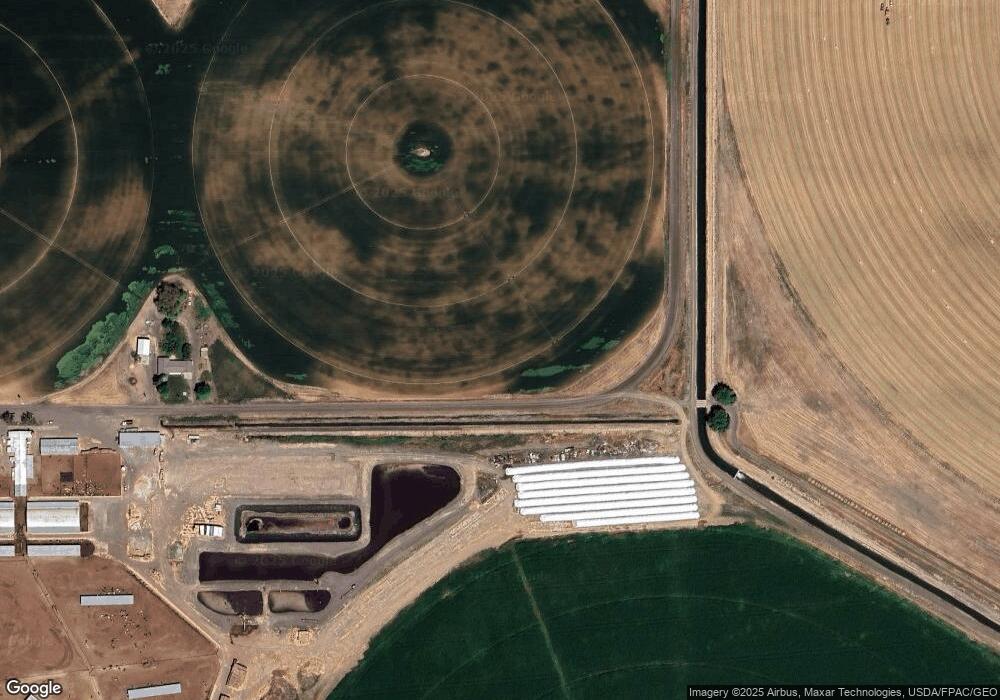

Map

Nearby Homes

- 0 NW 11 3 Rd Unit NWM2419631

- 0 NW 11 3 Rd Unit NWM2419794

- 11137 Dodson Rd NW

- 11397 Dodson Rd NW

- 3198 Road 10 9 NW

- 12455 Dodson Rd NW

- 0 Parcel 160914002 Rd A 5 NW

- 12687 Dodson Rd NW

- 0 Parcel 160906000 Unit NWM2346757

- 2923 Road 12.8 NW

- 13382 Road A 5 NW

- 13434 Road A 5 NW

- 2396 Pacific St

- 2391 Hunters St

- 70 Sunwest Dr

- 2383 Pacific St

- 000 State Route 282 12mg9a8rk0nh

- 34 Grant Dr

- 344 Oatman (Lots 15 & 7) Place

- 40 Sacagawea Dr

- 0 10 8 Rd NE Unit NWM1924528

- 0 10 8 Rd NE

- 2092 Road 10 8 NW

- 1 10 8

- 1968 NW 10 8 Rd

- 2 10 8

- 2152 Road 10 8 NW

- 2103 Road 10.8 NW

- 2184 Road 10.8 NW

- 2175 Road 11 NW

- 3 10 8

- 10783 Road B.3 NW

- 10736 Road B.3 NW

- 10729 Road B.3 NW

- 10732 Road B.3 NW

- 0 Rd 10 8 Unit 1251178

- 2410 Road 10.8 NW

- 0 NW Road 10 8 Unit 949693

- 0 NW Road 10 8 Unit 949682

- 0 NW Road 10 8 Unit 949651