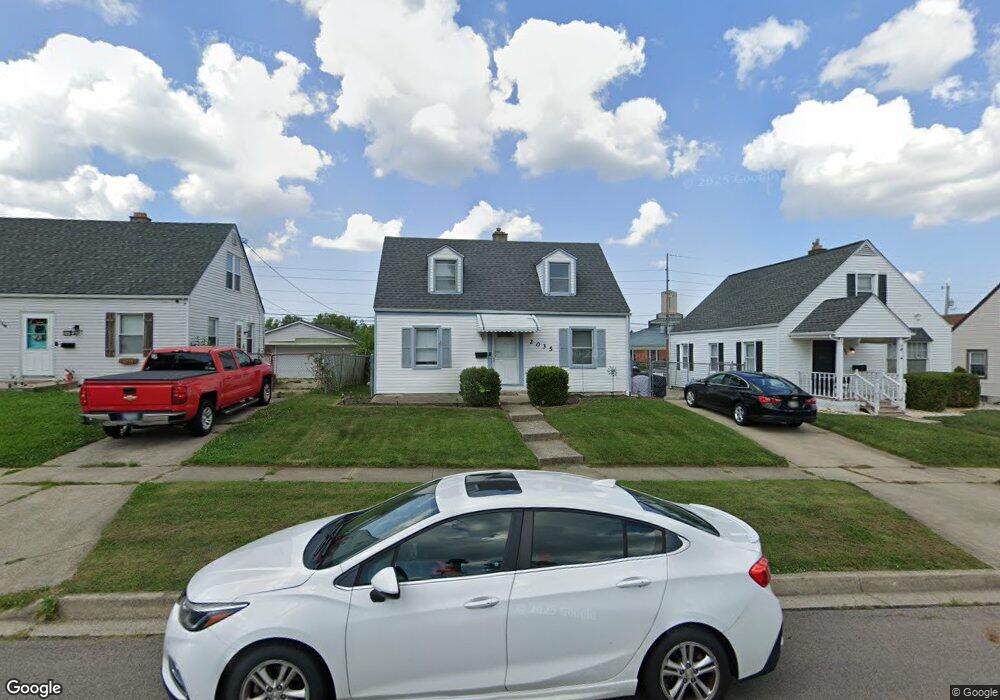

2035 W Bataan Dr Dayton, OH 45420

Estimated Value: $160,002 - $178,000

3

Beds

1

Bath

1,008

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 2035 W Bataan Dr, Dayton, OH 45420 and is currently estimated at $169,501, approximately $168 per square foot. 2035 W Bataan Dr is a home located in Montgomery County with nearby schools including Greenmont Elementary School, Kettering Middle School, and Kettering Fairmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 8, 2018

Sold by

Rogers Gloria M

Bought by

Smith Stephen T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,109

Outstanding Balance

$66,526

Interest Rate

4.8%

Mortgage Type

FHA

Estimated Equity

$102,975

Purchase Details

Closed on

Oct 25, 2011

Sold by

Salo Glenn H and Salo Debra

Bought by

Rogers Gloria M

Purchase Details

Closed on

Nov 13, 1997

Sold by

Salo Glen H

Bought by

Salo Glen H and Salo Peggy

Purchase Details

Closed on

Oct 24, 1997

Sold by

Salo Glenn H and Salo Peggy V

Bought by

Salo Glen H

Purchase Details

Closed on

Mar 7, 1997

Sold by

Salo Glenn H and Salo Peggy V

Bought by

Salo Glenn H and Salo Peggy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Stephen T | $81,800 | First Central Title | |

| Rogers Gloria M | $52,000 | Attorney | |

| Salo Glen H | -- | -- | |

| Salo Glen H | $1,000 | -- | |

| Salo Glenn H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Smith Stephen T | $76,109 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,547 | $39,340 | $11,010 | $28,330 |

| 2024 | $2,475 | $39,340 | $11,010 | $28,330 |

| 2023 | $2,475 | $39,340 | $11,010 | $28,330 |

| 2022 | $2,191 | $27,460 | $7,700 | $19,760 |

| 2021 | $2,029 | $27,460 | $7,700 | $19,760 |

| 2020 | $2,035 | $27,460 | $7,700 | $19,760 |

| 2019 | $2,275 | $27,220 | $7,700 | $19,520 |

| 2018 | $2,287 | $27,220 | $7,700 | $19,520 |

| 2017 | $2,109 | $27,220 | $7,700 | $19,520 |

| 2016 | $1,976 | $23,920 | $7,700 | $16,220 |

| 2015 | $1,889 | $23,920 | $7,700 | $16,220 |

| 2014 | $1,889 | $23,920 | $7,700 | $16,220 |

| 2012 | -- | $30,170 | $8,400 | $21,770 |

Source: Public Records

Map

Nearby Homes

- 2291 Patterson Rd

- 1634 Horlacher Ave

- 1534 Horlacher Ave

- 2105 Pittsfield St

- 2004 Hazel Ave

- 1513 Horlacher Ave

- 1618 Briedweng Ave Unit 1616

- 1701 Rockhurst Ave

- 2408 Homeland Ct

- 2009 Hazel Ave

- 2251 Vale Dr

- 2301 Rockwell Ct

- 1814 Ewalt Ave

- 2618 Kennedy Ave

- 3019 Dwight Ave

- 1629 Beaver Creek Ln

- 1409 Highview Ave

- 1521 Beaver Creek Ln

- 1436 Glenn Abbey Dr

- 2808 Whitehorse Ave

- 2039 W Bataan Dr

- 2031 W Bataan Dr

- 2027 W Bataan Dr

- 2127 Adventure Dr

- 2023 W Bataan Dr

- 2034 W Bataan Dr

- 2042 W Bataan Dr

- 2030 W Bataan Dr

- 2019 W Bataan Dr

- 2108 Adventure Dr

- 2026 W Bataan Dr

- 2159 Adventure Dr

- 2022 W Bataan Dr

- 2015 W Bataan Dr

- 2107 W Bataan Dr

- 2163 Adventure Dr

- 2104 W Bataan Dr

- 2018 W Bataan Dr

- 2011 W Bataan Dr Unit 45

- 2029 Malcom Dr

Your Personal Tour Guide

Ask me questions while you tour the home.