2043 Shelbourne Ct Wesley Chapel, FL 33543

Estimated Value: $354,000 - $390,000

3

Beds

2

Baths

1,514

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 2043 Shelbourne Ct, Wesley Chapel, FL 33543 and is currently estimated at $366,222, approximately $241 per square foot. 2043 Shelbourne Ct is a home located in Pasco County with nearby schools including Wiregrass Elementary School, Dr. John Long Middle School, and Wiregrass Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 12, 2009

Sold by

Deutsche Bank National Trust Company

Bought by

Masseus Elisha T and Saint Fort Kizzie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,446

Outstanding Balance

$87,096

Interest Rate

4.77%

Mortgage Type

FHA

Estimated Equity

$279,126

Purchase Details

Closed on

Mar 4, 2009

Sold by

Escobar Mario A and Escobar Yvette

Bought by

Deutsche Bank National Trust Company and Gsamp Trust 2005-Wmc2

Purchase Details

Closed on

Aug 26, 2005

Sold by

Klein Russell G

Bought by

Escobar Mario A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,600

Interest Rate

6.5%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Apr 24, 2003

Sold by

Pulte Home Corp

Bought by

Klein Russell G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,982

Interest Rate

5.86%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Masseus Elisha T | $141,000 | Fairview Title | |

| Deutsche Bank National Trust Company | -- | Attorney | |

| Escobar Mario A | $217,000 | Companion Title Services Inc | |

| Klein Russell G | $131,100 | -- | |

| Klein Russell G | $131,100 | Phc Title Corporation |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Masseus Elisha T | $138,446 | |

| Previous Owner | Escobar Mario A | $173,600 | |

| Previous Owner | Klein Russell G | $129,982 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,172 | $316,225 | $86,067 | $230,158 |

| 2024 | $7,172 | $331,576 | $86,067 | $245,509 |

| 2023 | $6,736 | $236,530 | $0 | $0 |

| 2022 | $5,762 | $275,114 | $65,487 | $209,627 |

| 2021 | $5,100 | $202,731 | $58,728 | $144,003 |

| 2020 | $4,858 | $177,724 | $35,390 | $142,334 |

| 2019 | $4,861 | $176,489 | $35,390 | $141,099 |

| 2018 | $4,768 | $170,467 | $35,390 | $135,077 |

| 2017 | $4,672 | $163,839 | $35,390 | $128,449 |

| 2016 | $2,831 | $110,155 | $0 | $0 |

| 2015 | $2,800 | $109,389 | $0 | $0 |

| 2014 | $2,759 | $118,439 | $28,810 | $89,629 |

Source: Public Records

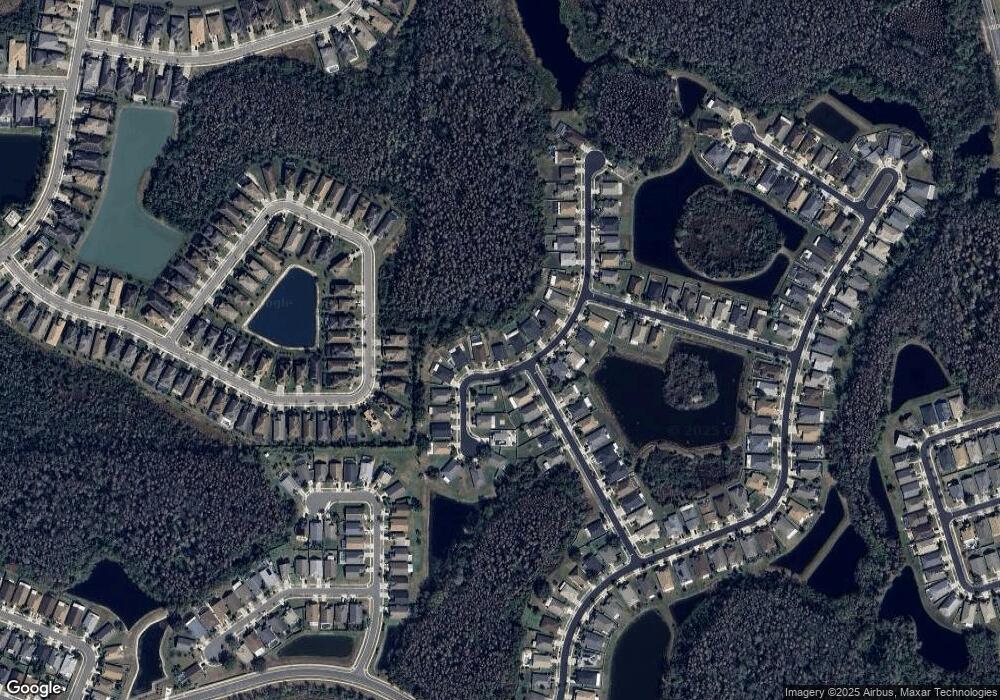

Map

Nearby Homes

- 1944 Blanchard Ct

- 1948 Blanchard Ct

- 31382 Chesapeake Bay Dr

- 31306 Heatherstone Dr

- 30772 Lindentree Dr

- 31215 Flannery Ct

- 31052 Wrencrest Dr

- 30715 Tumbleberry St

- 31215 Claridge Place

- 31203 Wrencrest Dr

- 31241 Claridge Place

- 30946 Burleigh Dr

- 30643 Tremont Dr Unit 2

- 30707 Wrencrest Dr

- 30639 Tremont Dr

- 2330 Nesslewood Dr

- 31215 Wrencrest Dr

- 30638 Nickerson Loop

- 30912 Burleigh Dr

- 31308 Wrencrest Dr

- 2051 Shelbourne Ct

- 2035 Shelbourne Ct

- 2101 Shelbourne Ct

- 2029 Shelbourne Ct

- 2025 Folkstone Place Unit 2A

- 2109 Shelbourne Ct

- 2018 Shelbourne Ct

- 2025 Shelbourne Ct

- 2115 Shelbourne Ct Unit 2B

- 2017 Folkstone Place

- 2104 Shelbourne Ct

- 2010 Shelbourne Ct

- 2019 Shelbourne Ct

- 2119 Shelbourne Ct

- 2016 Folkstone Place

- 2110 Shelbourne Ct Unit 2A

- 2013 Shelbourne Ct

- 2011 Folkstone Place

- 2004 Shelbourne Ct