20447 Ahha Ln Bend, OR 97702

Old Farm District NeighborhoodEstimated Value: $614,000 - $693,000

4

Beds

2

Baths

1,920

Sq Ft

$333/Sq Ft

Est. Value

About This Home

This home is located at 20447 Ahha Ln, Bend, OR 97702 and is currently estimated at $639,402, approximately $333 per square foot. 20447 Ahha Ln is a home located in Deschutes County with nearby schools including R.E. Jewell Elementary School, High Desert Middle School, and Deschutes River Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2021

Sold by

Johnston Deborah Ann

Bought by

Johnston Deborah Ann and Deborah Ann Johnston Family Tr

Current Estimated Value

Purchase Details

Closed on

May 5, 2008

Sold by

St Marie Chris

Bought by

Johnston Deborah Ann

Purchase Details

Closed on

May 10, 2007

Sold by

Watkins Pamela Gail

Bought by

St Marie Chris

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

6.14%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 18, 2005

Sold by

Wilson Pamela Gail and Watkins Pamela Gail

Bought by

Watkins Pamela Gail

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,750

Interest Rate

5.67%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnston Deborah Ann | -- | None Available | |

| Johnston Deborah Ann | $240,000 | Western Title & Escrow Co | |

| St Marie Chris | $235,000 | Amerititle | |

| Watkins Pamela Gail | -- | Amerititle |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | St Marie Chris | $188,000 | |

| Previous Owner | Watkins Pamela Gail | $64,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,719 | $220,090 | -- | -- |

| 2024 | $3,578 | $213,680 | -- | -- |

| 2023 | $3,317 | $207,460 | $0 | $0 |

| 2022 | $3,094 | $195,560 | $0 | $0 |

| 2021 | $3,099 | $189,870 | $0 | $0 |

| 2020 | $2,940 | $189,870 | $0 | $0 |

| 2019 | $2,858 | $184,340 | $0 | $0 |

| 2018 | $2,778 | $178,980 | $0 | $0 |

| 2017 | $2,696 | $173,770 | $0 | $0 |

| 2016 | $2,571 | $168,710 | $0 | $0 |

| 2015 | $2,500 | $163,800 | $0 | $0 |

| 2014 | $2,426 | $159,030 | $0 | $0 |

Source: Public Records

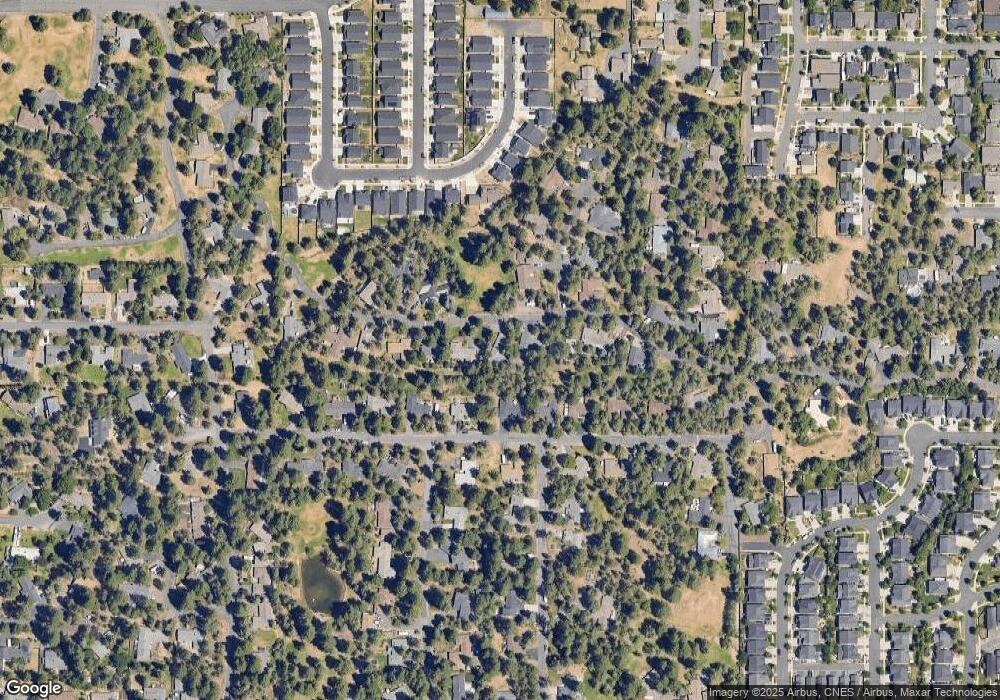

Map

Nearby Homes

- 61441 SE Daybreak Ct Unit Lot 10

- 61366 SE Preston St

- 61429 SE Daybreak Ct Unit Lot 7

- 61433 SE Daybreak Ct Unit Lot 8

- 61413 SE Daybreak

- 61405 SE Daybreak Ct

- 61409 SE Daybreak Ct Unit Lot 2

- 20450 Jacklight Ln

- 20528 Dylan Loop

- 61172 Splendor Ln

- 20575 Conifer Ave

- 61159 Splendor Ln

- 61160 Splendor Ln

- 61147 Splendor Ln

- 20487 SE Bard Ct Unit 11

- 20495 SE Bard Ct Unit 7

- 20572 Conifer Ave

- 20580 Klahani Dr

- 61217 SE Wagyu Dr Unit 151

- 61221 SE Wagyu Dr Unit Lot 152