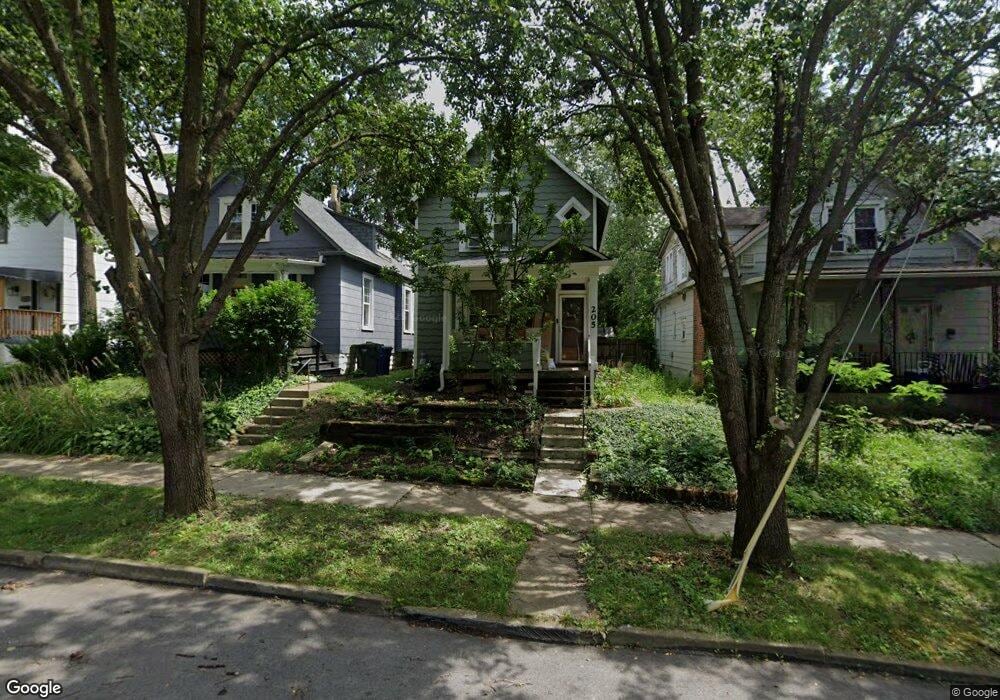

205 E Tompkins St Columbus, OH 43202

Old North Columbus NeighborhoodEstimated Value: $246,000 - $302,797

3

Beds

1

Bath

1,296

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 205 E Tompkins St, Columbus, OH 43202 and is currently estimated at $273,699, approximately $211 per square foot. 205 E Tompkins St is a home located in Franklin County with nearby schools including Hubbard Elementary School, Dominion Middle School, and Whetstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2010

Sold by

Everett Wendy E

Bought by

Everett Wendy E and Ringhiser Chase E

Current Estimated Value

Purchase Details

Closed on

Aug 20, 2001

Sold by

Austin Kacy L

Bought by

Everett Wendy E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,500

Outstanding Balance

$32,843

Interest Rate

7.11%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$240,856

Purchase Details

Closed on

Jun 20, 1995

Sold by

May Russell

Bought by

Patrick A Mcbride

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$41,500

Interest Rate

8.27%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 26, 1990

Purchase Details

Closed on

Apr 15, 1987

Sold by

Mcbride Patrick A and Mcbride Meredith

Bought by

Austin Kacy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,250

Interest Rate

7.27%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Everett Wendy E | -- | Independent | |

| Everett Wendy E | $88,500 | -- | |

| Patrick A Mcbride | $44,000 | -- | |

| -- | $28,500 | -- | |

| Austin Kacy L | $64,100 | Northwest Title Worthington |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Everett Wendy E | $88,500 | |

| Previous Owner | Patrick A Mcbride | $41,500 | |

| Previous Owner | Austin Kacy L | $51,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,650 | $103,600 | $28,980 | $74,620 |

| 2024 | $4,650 | $103,600 | $28,980 | $74,620 |

| 2023 | $4,590 | $103,600 | $28,980 | $74,620 |

| 2022 | $2,253 | $43,440 | $13,020 | $30,420 |

| 2021 | $2,257 | $43,440 | $13,020 | $30,420 |

| 2020 | $2,260 | $43,440 | $13,020 | $30,420 |

| 2019 | $2,416 | $39,830 | $10,430 | $29,400 |

| 2018 | $1,974 | $39,830 | $10,430 | $29,400 |

| 2017 | $2,415 | $39,830 | $10,430 | $29,400 |

| 2016 | $1,693 | $25,560 | $6,690 | $18,870 |

| 2015 | $1,537 | $25,560 | $6,690 | $18,870 |

| 2014 | $1,541 | $25,560 | $6,690 | $18,870 |

| 2013 | $1,052 | $35,385 | $6,090 | $29,295 |

Source: Public Records

Map

Nearby Homes

- 2458- 2458 1 2 Deming Ave

- 363 E Hudson St Unit 365

- 2680 Deming Ave

- 109 E Arcadia Ave

- 2395 Summit St Unit 397

- 2362 Indiana Ave

- 6 E Blake Ave

- 415 Glen Echo Cir

- 2540 Neil Ave

- 102 W Tompkins St

- 2295 N 4th St

- 53 Olentangy St

- 2394 Neil Ave

- 2683 Neil Ave Unit 685

- 2836-2838 Indianola Ave Unit 2836

- 9 E Norwich Ave Unit 15

- 2210-2212 N 4th St

- 497 E Oakland Ave

- 580 Crestview Rd

- 2733 Beulah Rd

- 201 E Tompkins St

- 209 E Tompkins St

- 213 E Tompkins St

- 197 E Tompkins St

- 2499 Medary Ave

- 200 Wilcox St

- 193 E Tompkins St

- 200 E Tompkins St

- 219 E Tompkins St

- 189 E Tompkins St

- 192 Clinton St

- 204 Clinton St

- 2479 Medary Ave

- 181 E Tompkins St

- 212 E Tompkins St

- 179 E Tompkins St

- 235 E Tompkins St

- 220 E Tompkins St

- 2515 Medary Ave

- 208 E Tompkins St

Your Personal Tour Guide

Ask me questions while you tour the home.