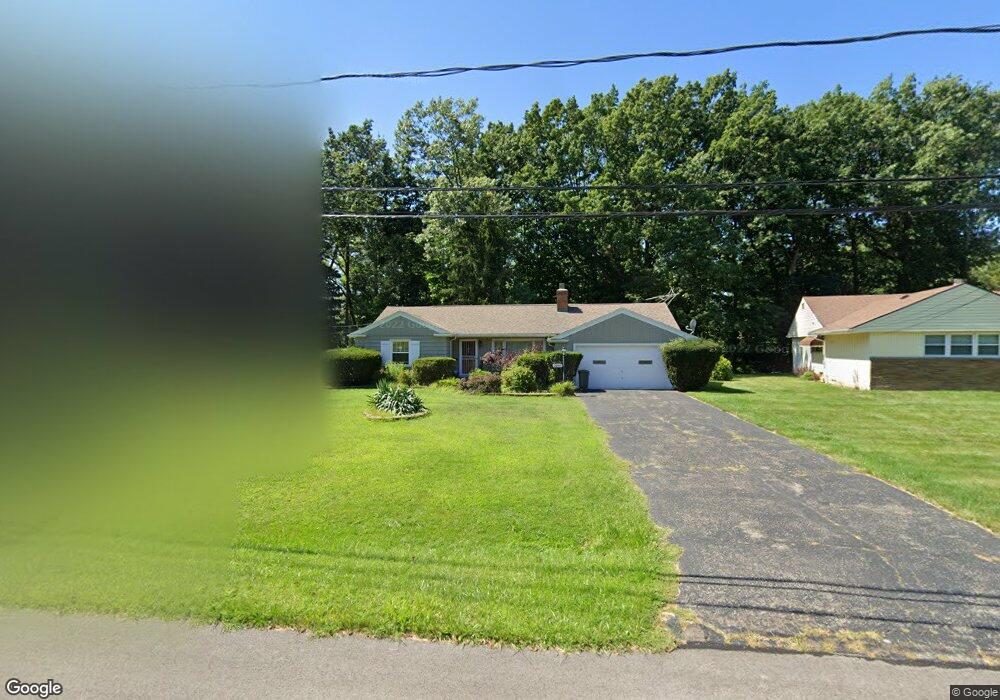

2050 Miami Rd Euclid, OH 44117

Estimated Value: $172,000 - $225,000

3

Beds

2

Baths

1,274

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 2050 Miami Rd, Euclid, OH 44117 and is currently estimated at $191,819, approximately $150 per square foot. 2050 Miami Rd is a home located in Cuyahoga County with nearby schools including Bluestone Elementary School, Euclid Middle School, and Euclid High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2000

Sold by

Farkas Ruth M and Farkas Susan F

Bought by

Hancock Earlene Williams

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,000

Interest Rate

7.83%

Mortgage Type

Balloon

Purchase Details

Closed on

Jun 25, 1993

Sold by

Farkas Susan Ellen

Bought by

Farkas Ruth M

Purchase Details

Closed on

Feb 16, 1988

Sold by

Dahl Harold A and M B

Bought by

Farkas Susan Ellen

Purchase Details

Closed on

Jan 1, 1975

Bought by

Dahl Harold A and M B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hancock Earlene Williams | $110,000 | Title Xperts Agency Inc | |

| Farkas Ruth M | $78,000 | -- | |

| Farkas Susan Ellen | $74,500 | -- | |

| Dahl Harold A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Hancock Earlene Williams | $88,000 | |

| Closed | Hancock Earlene Williams | $22,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,842 | $49,455 | $12,110 | $37,345 |

| 2023 | $2,568 | $38,510 | $9,490 | $29,020 |

| 2022 | $2,544 | $38,500 | $9,490 | $29,020 |

| 2021 | $2,822 | $38,500 | $9,490 | $29,020 |

| 2020 | $2,166 | $29,160 | $7,180 | $21,980 |

| 2019 | $1,946 | $83,300 | $20,500 | $62,800 |

| 2018 | $1,822 | $29,160 | $7,180 | $21,980 |

| 2017 | $1,821 | $24,440 | $5,710 | $18,730 |

| 2016 | $1,825 | $24,440 | $5,710 | $18,730 |

| 2015 | $1,665 | $24,440 | $5,710 | $18,730 |

| 2014 | $1,665 | $24,440 | $5,710 | $18,730 |

Source: Public Records

Map

Nearby Homes

- 2337 Greenvale Rd

- 2441 Malden Rd

- 19201 Shawnee Rd

- 19871 Upper Valley Dr

- 2217 Belvoir Blvd

- 2150 Glenridge Rd

- 19201 Genesee Rd

- 2536 Greenvale Rd

- 1777 Catalpa Rd

- 1897 Torbenson Dr

- 3803 Bridgeview Dr

- 1849 Torbenson Dr

- 565 Quilliams Rd

- 1769 Burgess Rd

- 3757 Princeton Blvd

- 1707 Catalpa Rd

- 1738 Burgess Rd

- 3595 Runnymede Blvd

- 18120 Olympia Rd

- 4002 Lancaster Rd