Estimated Value: $74,906 - $136,000

--

Bed

--

Bath

540

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 2079 Gibson Rd, Knox, PA 16232 and is currently estimated at $103,227, approximately $191 per square foot. 2079 Gibson Rd is a home located in Clarion County with nearby schools including Keystone Elementary School, Keystone Junior/Senior High School, and Meadow View Amish School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2021

Sold by

Beck David M

Bought by

Watkins Joseph R and Watkins Sasha M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Outstanding Balance

$74,977

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$28,250

Purchase Details

Closed on

May 15, 2018

Sold by

Hopper Marion R and Estate Of Marion R Hopper

Bought by

Watkins Joseph R and Watkins Sasha M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$19,000

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 11, 1977

Bought by

Hopper Marion R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Watkins Joseph R | $57,720 | None Available | |

| Watkins Joseph R | $15,000 | None Available | |

| Hopper Marion R | $29,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Watkins Joseph R | $90,000 | |

| Previous Owner | Watkins Joseph R | $19,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $926 | $11,008 | $1,390 | $9,618 |

| 2024 | $874 | $11,008 | $1,390 | $9,618 |

| 2023 | $810 | $10,650 | $1,390 | $9,260 |

| 2022 | $800 | $10,650 | $1,390 | $9,260 |

| 2021 | $805 | $10,650 | $1,390 | $9,260 |

| 2020 | $805 | $10,650 | $1,390 | $9,260 |

| 2019 | $792 | $10,650 | $1,390 | $9,260 |

| 2018 | $792 | $10,650 | $1,390 | $9,260 |

| 2017 | $792 | $10,650 | $1,390 | $9,260 |

| 2016 | $792 | $10,650 | $1,390 | $9,260 |

| 2014 | -- | $10,650 | $1,390 | $9,260 |

Source: Public Records

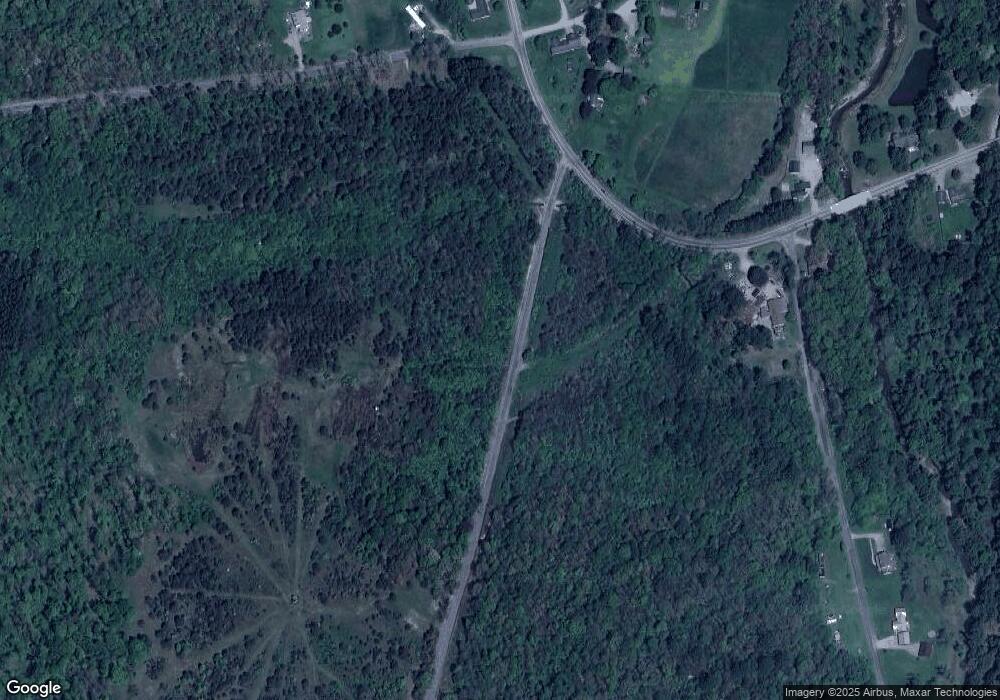

Map

Nearby Homes

- 216 High Point Rd

- 28 Graff Rd

- 725 River Bends Dr

- 1278 Wentlings Corners Rd

- 1248 Chestnut Ridge Rd

- 3765/3905

- 429 Main St

- 3176 Pennsylvania 58

- 0 Willow Ave

- 630 S Main St

- 601 S Main St

- 180 Railroad St

- 485 Harvey Rd

- 427 Main St

- 518 E Penn Ave

- 336 Best Ave

- 2404 Pennsylvania 208

- 327 Mendenhall Ave

- 374 E Penn Ave

- 223 Emlenton St

- 1707 Gibson Rd

- 1659 Gibson Rd

- 3673 Blairs Corner Rd

- 2916 Blairs Corner Rd

- 3488 Blairs Corner Rd

- 3488 Blairs Corner Rd

- 36 Strawberry Farm Rd

- 3522 Blairs Corner Rd

- 2645 Blairs Corner Rd

- 16028 Blairs Corner Rd

- 0 Blairs Corner Rd

- 4932 Route 338

- 3340 Blairs Corner Rd

- 4968 Route 338

- 2655 Ritts Station Rd

- 4979 Route 338

- 22 Strawberry Farm Rd

- 4724 Route 338

- 40 Strawberry Farm Rd

- 29 Strawberry Farm Rd