Estimated Value: $150,939 - $170,000

3

Beds

1

Bath

1,056

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 208 Pine Tree Dr, Carey, OH 43316 and is currently estimated at $159,485, approximately $151 per square foot. 208 Pine Tree Dr is a home located in Wyandot County with nearby schools including Carey Elementary School, Carey High School, and Our Lady of Consolation School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 2, 2021

Sold by

Johnson Lori A

Bought by

Stacy Terena A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,353

Interest Rate

2.6%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 24, 2018

Sold by

May Dawn A and Gerten Dawn A

Bought by

Johnson Lori A

Purchase Details

Closed on

Nov 10, 2006

Sold by

Deutsche Bank National Trust Co

Bought by

May Randall and May Dawn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,000

Interest Rate

6.47%

Purchase Details

Closed on

Jun 12, 2006

Sold by

Hendricks Erica D and Hendricks Michael

Bought by

Deutsche Bank National Trust Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stacy Terena A | $118,500 | None Available | |

| Stacy Terena A | -- | None Listed On Document | |

| Johnson Lori A | $87,000 | None Available | |

| May Randall | $64,000 | None Available | |

| Deutsche Bank National Trust Co | $48,334 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stacy Terena A | $116,353 | |

| Previous Owner | May Randall | $54,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,675 | $53,140 | $6,660 | $46,480 |

| 2024 | $1,314 | $39,940 | $5,340 | $34,600 |

| 2023 | $1,314 | $39,940 | $5,340 | $34,600 |

| 2022 | $1,315 | $30,910 | $4,340 | $26,570 |

| 2021 | $1,048 | $30,910 | $4,340 | $26,570 |

| 2020 | $1,048 | $30,910 | $4,340 | $26,570 |

| 2019 | $1,081 | $30,910 | $4,340 | $26,570 |

| 2018 | $947 | $27,140 | $3,840 | $23,300 |

| 2017 | $985 | $26,380 | $3,840 | $22,540 |

| 2016 | $912 | $26,380 | $3,840 | $22,540 |

| 2015 | -- | $25,250 | $3,840 | $21,410 |

| 2014 | -- | $25,250 | $3,840 | $21,410 |

| 2013 | -- | $25,250 | $3,840 | $21,410 |

Source: Public Records

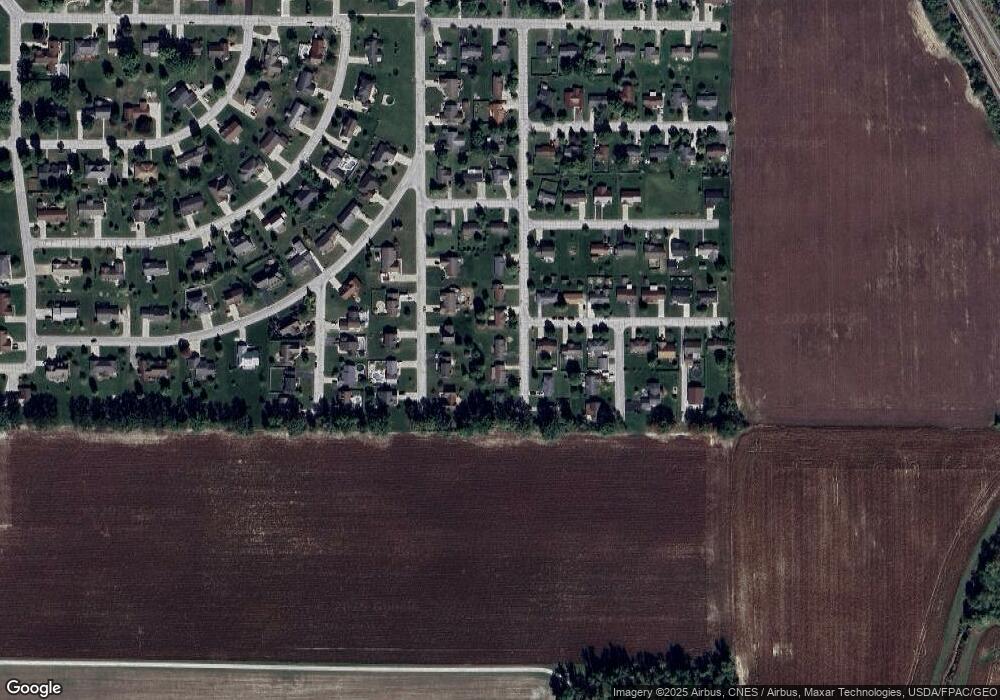

Map

Nearby Homes

- 131 High St

- 319 E South St

- 517 E Findlay St

- 436 E South St

- 608 West St

- 208 Dow St

- 18 Summer Dr

- 19 Summer Dr

- 16 Summer Dr

- 0 Sr 23 103 Unit 6104429

- 0 West St

- 400 N Vance St

- 15 Summer Dr

- 57 Autumn Ave

- 702 Winter Ct

- 10778 County Highway 5

- 8943 County Road 57

- 6166 County Highway 107

- 6497 County Road 87

- 6497 County Highway 87

- 206 Pine Tree Dr

- 210 Pine Tree Dr

- 207 Appleblossom Ln

- 209 Appleblossom Ln

- 204 Pine Tree Dr

- 101 Lindenwood Place

- 212 Pine Tree Dr

- 205 Appleblossom Ln

- 211 Appleblossom Ln

- 211 Pine Tree Dr

- 102 Lindenwood Place

- 103 Lindenwood Place

- 202 Pine Tree Dr

- 213 Pine Tree Dr

- 201 Appleblossom Ln

- 104 Lindenwood Place

- 105 Lindenwood Place

- 102 Hazelwood Place

- 208 Appleblossom Ln

- 210 Appleblossom Ln