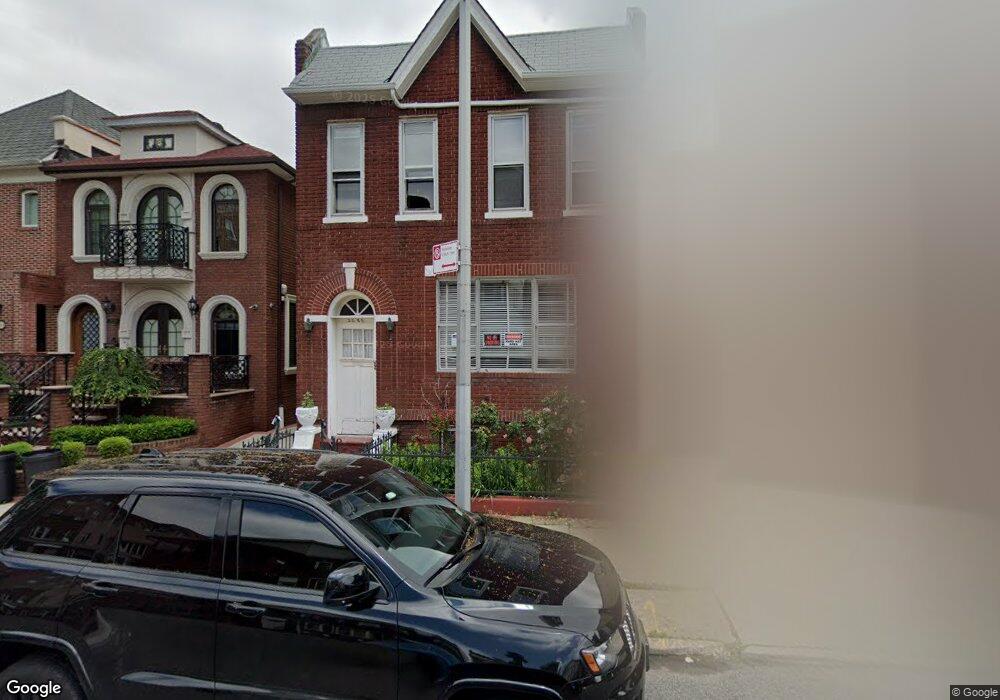

2085 E 7th St Brooklyn, NY 11223

Homecrest NeighborhoodEstimated Value: $1,682,000 - $3,452,000

Studio

--

Bath

3,670

Sq Ft

$769/Sq Ft

Est. Value

About This Home

This home is located at 2085 E 7th St, Brooklyn, NY 11223 and is currently estimated at $2,820,812, approximately $768 per square foot. 2085 E 7th St is a home located in Kings County with nearby schools including P.S. 153 - Homecrest, Jhs 234 Arthur W Cunningham, and Abraham Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 5, 2018

Sold by

Keeler Mary and Laiken Stuart

Bought by

Frastai As Trustee Noura and Frastai As Trustee Robert

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,800,000

Outstanding Balance

$1,517,397

Interest Rate

3.99%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$1,303,415

Purchase Details

Closed on

Mar 30, 2007

Sold by

Hastings Claire and Spatola Concetta

Bought by

Laiken Stuart and Stack-Laiken Mary

Purchase Details

Closed on

Oct 15, 2003

Sold by

Hastings Claire and Spatola Concetta

Bought by

Hastings Claire and Spatola Concetta

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Frastai As Trustee Noura | $2,000,000 | -- | |

| Frastai As Trustee Noura | $2,000,000 | -- | |

| Frastai As Trustee Noura | $2,000,000 | -- | |

| Laiken Stuart | $600,000 | -- | |

| Laiken Stuart | $600,000 | -- | |

| Hastings Claire | -- | -- | |

| Hastings Claire | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Frastai As Trustee Noura | $1,800,000 | |

| Closed | Frastai As Trustee Noura | $1,800,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $19,146 | $148,500 | $13,800 | $134,700 |

| 2024 | $19,146 | $117,300 | $13,800 | $103,500 |

| 2023 | $18,264 | $103,680 | $13,800 | $89,880 |

| 2022 | $16,937 | $84,840 | $13,800 | $71,040 |

| 2021 | $12,700 | $335,250 | $103,500 | $231,750 |

| 2020 | $6,244 | $325,350 | $103,500 | $221,850 |

| 2019 | $12,644 | $303,300 | $103,500 | $199,800 |

| 2018 | $11,811 | $92,862 | $29,500 | $63,362 |

| 2017 | $10,939 | $86,008 | $28,963 | $57,045 |

| 2016 | $10,267 | $79,640 | $29,930 | $49,710 |

| 2015 | $6,665 | $79,640 | $35,916 | $43,724 |

| 2014 | $6,665 | $77,116 | $32,604 | $44,512 |

Source: Public Records

Map

Nearby Homes

- 812 Avenue T

- 1980 E 8th St

- 602 Avenue T Unit 6D

- 602 Avenue T Unit 6A

- 2035 E 7th St Unit 3E

- 2035 E 7th St Unit 4D

- 2035 E 7th St Unit 5F

- 2035 E 7th St Unit 3J

- 2044 E 12th St

- 1115 Avenue U

- 2125 E 9th St

- 2069 E 12th St

- 1118 Avenue U

- 2247 Coney Island Ave

- 2053 Homecrest Ave

- 2132 E 13th St

- 2255 Adam Clayton Powell Jr Blvd Unit 3-A

- 1727 E East 14th St

- 1811 Ocean Pkwy Unit 6M

- 1811 Ocean Pkwy Unit 5L