20860 20860 San Simeon Way # 204-6 Unit 204-6 Miami, FL 33179

Ives Estates NeighborhoodEstimated Value: $225,000 - $259,000

2

Beds

2

Baths

1,468

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 20860 20860 San Simeon Way # 204-6 Unit 204-6, Miami, FL 33179 and is currently estimated at $241,903, approximately $164 per square foot. 20860 20860 San Simeon Way # 204-6 Unit 204-6 is a home located in Miami-Dade County with nearby schools including Norland Elementary School, Andover Middle School, and Miami Norland Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 10, 2017

Sold by

Nicolao Victor D and Suarez Evelyn

Bought by

Nicolao Brothers Llc

Current Estimated Value

Purchase Details

Closed on

Dec 23, 2015

Sold by

U S Bank National Association

Bought by

Nicolao Victor D and Suarez Evelyn

Purchase Details

Closed on

Feb 10, 2015

Sold by

Gedeon Jean Robert

Bought by

U S Bank National Association

Purchase Details

Closed on

Oct 23, 2006

Sold by

Gedeon Jean Robert and Artiste Nedine

Bought by

Gedeon Jean Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,500

Interest Rate

9.55%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 16, 1997

Sold by

Hoecherl Joanne

Bought by

Gedeon Jean R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,250

Interest Rate

7.19%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nicolao Brothers Llc | -- | None Available | |

| Nicolao Victor D | $96,000 | Premium Title Services Inc | |

| U S Bank National Association | $91,100 | None Available | |

| Gedeon Jean Robert | -- | Chicago Title | |

| Gedeon Jean R | $62,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gedeon Jean Robert | $218,500 | |

| Previous Owner | Gedeon Jean R | $56,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,100 | $191,000 | -- | -- |

| 2024 | $2,952 | $177,724 | -- | -- |

| 2023 | $2,952 | $161,568 | $0 | $0 |

| 2022 | $2,503 | $146,880 | $0 | $0 |

| 2021 | $2,394 | $136,000 | $0 | $0 |

| 2020 | $2,401 | $136,000 | $0 | $0 |

| 2019 | $2,323 | $135,000 | $0 | $0 |

| 2018 | $2,019 | $116,975 | $0 | $0 |

| 2017 | $2,375 | $133,201 | $0 | $0 |

| 2016 | $2,167 | $121,092 | $0 | $0 |

| 2015 | $1,842 | $100,910 | $0 | $0 |

| 2014 | -- | $58,094 | $0 | $0 |

Source: Public Records

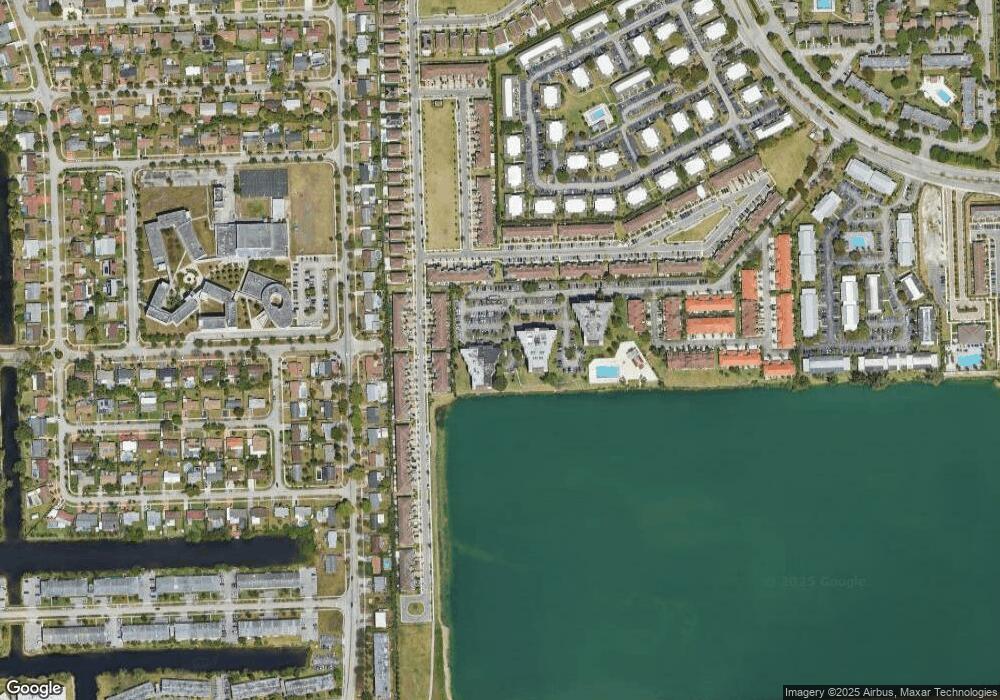

Map

Nearby Homes

- 20860 San Simeon Way Unit 4046

- 20661 NE 2nd Ct

- 20600 NE 2nd Ct Unit na

- 303 NE 208th Terrace

- 328 NE 208th Terrace

- 340 NE 208th Terrace Unit 340

- 333 NE 208th Terrace

- 20428 NE 2nd Ct

- 20820 San Simeon Way Unit 24G

- 20820 San Simeon Way Unit 26G

- 20840 San Simeon Way Unit 305

- 20840 San Simeon Way Unit 307

- 20840 San Simeon Way Unit 706

- 20840 San Simeon Way Unit 309

- 20850 San Simeon Way Unit 3095

- 391 NE 208th Terrace

- 400 NE 208th Terrace

- 71 NE 206th Terrace

- 121 NE 204th St Unit 6

- 121 NE 204th St Unit 9

- 20860 San Simeon Way Unit 201

- 20860 San Simeon Way Unit 105

- 20860 San Simeon Way Unit 107

- 20860 San Simeon Way Unit 405

- 20860 San Simeon Way Unit 102

- 20860 San Simeon Way Unit 407

- 20860 San Simeon Way

- 20860 San Simeon Way Unit 301

- 20860 San Simeon Way

- 20860 San Simeon Way Unit 3026

- 20860 San Simeon Way Unit 1086

- 20860 San Simeon Way Unit 2016

- 20860 San Simeon Way Unit 1026

- 20860 San Simeon Way Unit 4076

- 20860 San Simeon Way Unit 4026

- 20860 San Simeon Way Unit 4056

- 20860 San Simeon Way Unit 3046

- 20860 San Simeon Way Unit 3086

- 20860 San Simeon Way Unit 2086

- 20860 San Simeon Way Unit 4016