209 Pine Willow Ct Friendswood, TX 77546

Estimated Value: $866,000 - $1,234,000

5

Beds

6

Baths

4,929

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 209 Pine Willow Ct, Friendswood, TX 77546 and is currently estimated at $1,009,975, approximately $204 per square foot. 209 Pine Willow Ct is a home located in Galveston County with nearby schools including Westwood Elementary School, Zue S. Bales Intermediate School, and Friendswood Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 2, 2024

Sold by

Tubbs Steven Wayne

Bought by

Tubbs Jean Eliason

Current Estimated Value

Purchase Details

Closed on

Feb 12, 2008

Sold by

Smith Noel

Bought by

Eliason Jean M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$372,000

Interest Rate

6.07%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 16, 1998

Sold by

Ricks John P and Ricks Patricia M

Bought by

Smith Noel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$364,500

Interest Rate

6.46%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tubbs Jean Eliason | -- | None Listed On Document | |

| Eliason Jean M | -- | Lawyers Title | |

| Smith Noel | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Eliason Jean M | $372,000 | |

| Previous Owner | Smith Noel | $364,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,535 | $791,982 | $134,350 | $657,632 |

| 2024 | $12,535 | $746,301 | $134,350 | $611,951 |

| 2023 | $12,535 | $741,948 | $0 | $0 |

| 2022 | $14,856 | $674,498 | $0 | $0 |

| 2021 | $14,322 | $765,870 | $134,350 | $631,520 |

| 2020 | $13,430 | $623,390 | $134,350 | $489,040 |

| 2019 | $12,868 | $506,760 | $134,350 | $372,410 |

| 2018 | $13,074 | $511,840 | $134,350 | $377,490 |

| 2017 | $13,424 | $516,890 | $134,350 | $382,540 |

| 2016 | $12,979 | $527,360 | $134,350 | $393,010 |

| 2015 | $4,128 | $454,320 | $134,350 | $319,970 |

| 2014 | $4,231 | $413,560 | $134,350 | $279,210 |

Source: Public Records

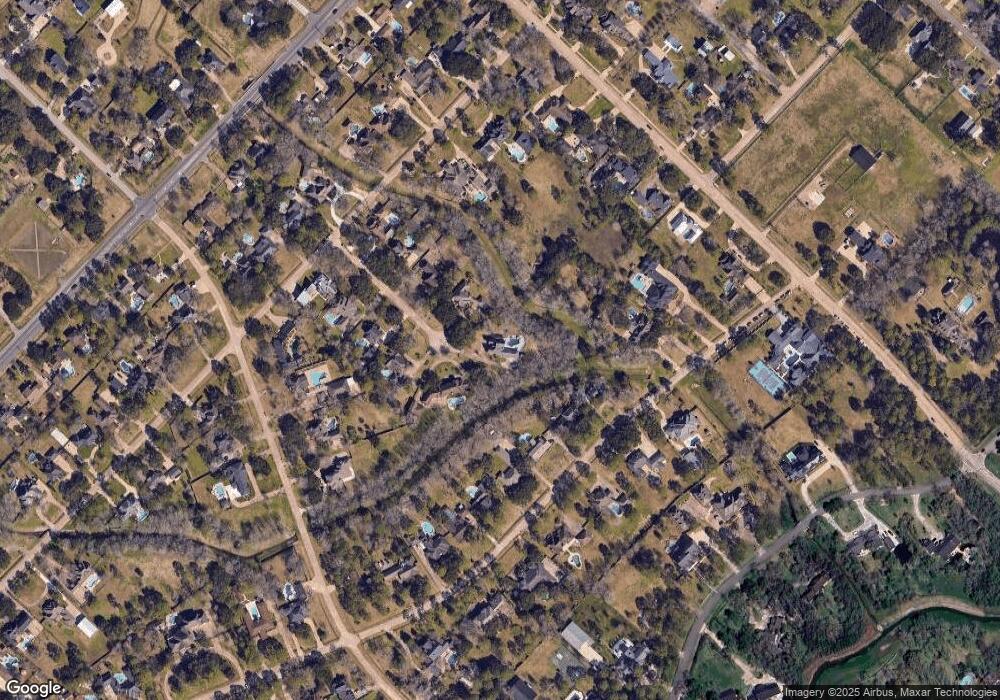

Map

Nearby Homes

- 702 Pine Hollow Dr

- 805 W Edgewood Dr

- 1004 Tall Pines Dr

- 0 W Fm 2351 A K A Edgewood Dr Unit 48227752

- 702 E Haven Ct

- 506 W Shadowbend Ave

- 1002 Cowards Creek Ct

- 204 Monte Bello Dr

- 300 W Edgewood Dr

- 912 Falling Leaf Dr

- 310 Rustic Ln

- 1204 Cowards Creek Dr

- 1208 Cowards Creek Dr

- 524 Fairdale St

- 307 Bellmar Ln

- 205 Del Monte Dr

- 607 Misty Ln

- 1003 Glenview Dr

- 807 Evergreen Dr

- 201 Live Oak Ln

- 207 Pine Willow Ct

- 802 Tall Pines Dr

- 210 Pine Willow Ct

- 804 Tall Pines Dr

- 708 Tall Pines Dr

- 806 Tall Pines Dr

- 208 Pine Willow Ct

- 205 Pine Willow Ct

- 706 Tall Pines Dr

- 808 Tall Pines Dr

- 206 Pine Willow Ct

- 203 Pine Willow Ct

- 704 Tall Pines Dr

- 204 Pine Willow Ct

- 902 Tall Pines Dr

- 707 Tall Pines Dr

- 707 Pine Hollow Dr

- 201 Pine Willow Ct

- 801 Tall Pines Dr

- 705 Tall Pines Dr