20916 NW 6th Ct Ridgefield, WA 98642

Estimated Value: $1,345,000 - $1,631,000

4

Beds

5

Baths

4,019

Sq Ft

$375/Sq Ft

Est. Value

About This Home

This home is located at 20916 NW 6th Ct, Ridgefield, WA 98642 and is currently estimated at $1,505,579, approximately $374 per square foot. 20916 NW 6th Ct is a home located in Clark County with nearby schools including Ridgefield High School, The Gardner School of Arts & Sciences, and Cedar Tree Classical Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 20, 2021

Sold by

Burgess Jason and Knochel Anna

Bought by

Burgess Jason P and Knochel Anna L

Current Estimated Value

Purchase Details

Closed on

Jan 11, 2021

Sold by

Rivers Mary E and Weber Adam J

Bought by

Burgess Jason and Knochel Anna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$409,600

Interest Rate

2.79%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 25, 2013

Sold by

Wilthew Robert and Wilthew Lois

Bought by

Rivers Mary E and Weber Adam J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$408,500

Interest Rate

3.41%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 2, 2005

Sold by

Waldron Gary A and Waldron Carolyn F

Bought by

Wilthew Robert and Wilthew Lois

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

5.7%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Burgess Jason P | -- | None Available | |

| Burgess Jason | -- | Wfg Clark County Resware | |

| Burgess Jason | $1,150,000 | Wfg Clark County Resware | |

| Rivers Mary E | $535,000 | Cascade Title | |

| Wilthew Robert | $725,000 | Chicago Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Burgess Jason | $409,600 | |

| Previous Owner | Burgess Jason | $510,400 | |

| Previous Owner | Rivers Mary E | $408,500 | |

| Previous Owner | Wilthew Robert | $125,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,490 | $1,401,504 | $466,529 | $934,975 |

| 2024 | $11,558 | $1,340,124 | $466,529 | $873,595 |

| 2023 | $10,272 | $1,277,071 | $449,440 | $827,631 |

| 2022 | $9,204 | $1,124,765 | $430,053 | $694,712 |

| 2021 | $9,264 | $940,069 | $368,564 | $571,505 |

| 2020 | $9,372 | $884,227 | $344,467 | $539,760 |

| 2019 | $9,305 | $881,236 | $332,954 | $548,282 |

| 2018 | $9,762 | $884,460 | $0 | $0 |

| 2017 | $7,821 | $802,984 | $0 | $0 |

| 2016 | $7,174 | $752,127 | $0 | $0 |

| 2015 | $7,061 | $659,134 | $0 | $0 |

| 2014 | -- | $619,815 | $0 | $0 |

| 2013 | -- | $543,839 | $0 | $0 |

Source: Public Records

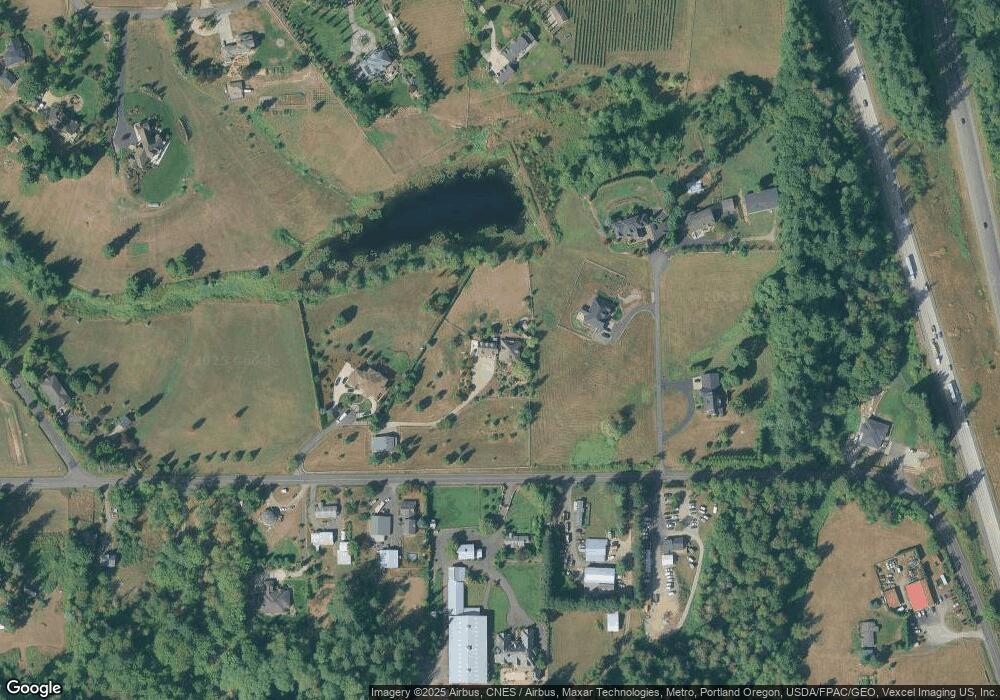

Map

Nearby Homes

- 21106 NW 3rd Ct

- 21121 NW 17th Ct

- 21900 NE 10th Ave

- 19818 NW 14th Ave

- 710 NE 221st St

- 1911 NW 206th St

- 0 NE 10th Ave Unit 308311465

- 0 NE 10th Ave Unit 781835902

- 0 NE 10th Ave Unit 24083068

- 19306 NW 11th Ave

- 2304 NW 209th St

- 904 NE 224th Cir

- 0 NE 209th St Unit 21290641

- 21617 NE 15th Ave

- 1207 NE Whispering Winds Cir

- 0 NW 184th St

- 701 NW 184th St

- 0 NW Carty Rd

- 3403 NW 209th St

- 702 NW 178th Way

- 21012 NW 3rd Ct

- 20913 NW 6th Ct

- 0 NW 5th Ave

- 613 NW 209th St

- 20900 NW 6th Ct

- 21001 NW 3rd Ct

- 313 NW 209th St

- 701 NW 209th St

- 21105 NW 3rd Ct

- 615 NW 214th Cir

- 501 NW 214th Cir

- 619 NW 209th St

- 108 NW 209th St

- 807 NW 214th Cir

- 419 NW 209th St

- 713 NW 214th Cir

- 737 NW 209th St

- 21501 NW 5th Ave

- 414 NW 214th Cir

- 1 NW 209th St