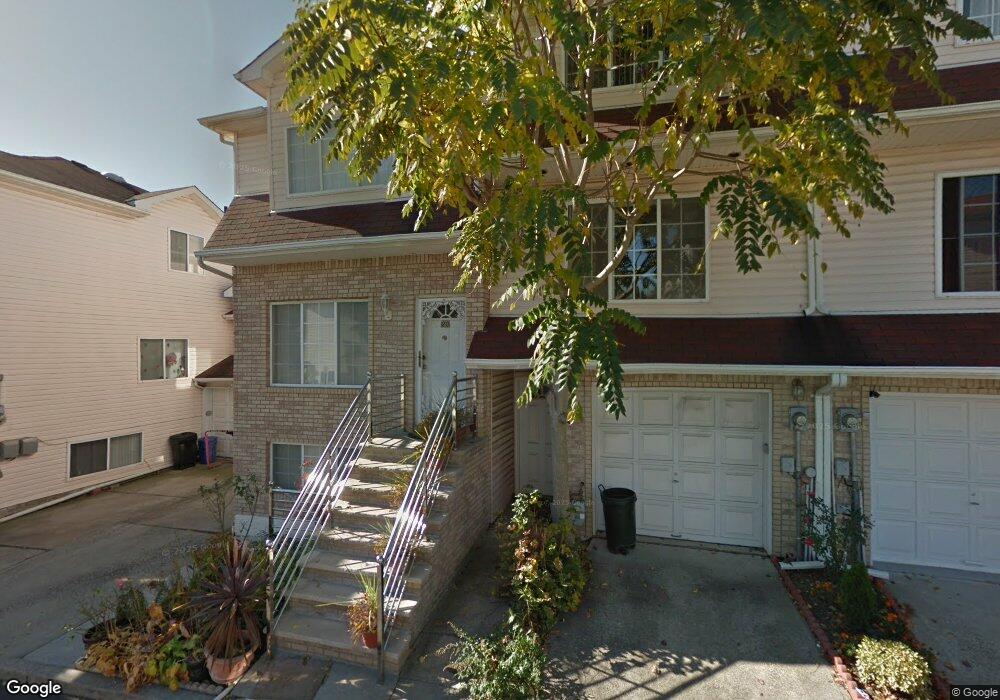

20H Meadow Ln Unit 20H Staten Island, NY 10306

Great Kills NeighborhoodEstimated Value: $414,000 - $460,000

--

Bed

--

Bath

996

Sq Ft

$445/Sq Ft

Est. Value

About This Home

This home is located at 20H Meadow Ln Unit 20H, Staten Island, NY 10306 and is currently estimated at $443,505, approximately $445 per square foot. 20H Meadow Ln Unit 20H is a home located in Richmond County with nearby schools including P.S. 53 The Barbara Esselborn School, Myra S. Barnes Intermediate School 24, and Susan E Wagner High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 13, 2016

Sold by

Quaglia Maria

Bought by

Crasto Anthony

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Outstanding Balance

$165,481

Interest Rate

3.97%

Mortgage Type

New Conventional

Estimated Equity

$278,024

Purchase Details

Closed on

Aug 24, 2010

Sold by

Nielsen Mary

Bought by

Crasto Anthony and Quaglia Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,000

Interest Rate

4.55%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 5, 2000

Sold by

Graf Joseph M and Graf Joseph J

Bought by

Nielsen Mary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,200

Interest Rate

8.1%

Purchase Details

Closed on

Feb 24, 1998

Sold by

Levin Bernice and Weinberger Harriet

Bought by

Graf Joseph J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Crasto Anthony | -- | First American Title Ins Co | |

| Crasto Anthony | $232,500 | None Available | |

| Nielsen Mary | $118,000 | -- | |

| Graf Joseph J | $108,000 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Crasto Anthony | $208,000 | |

| Previous Owner | Crasto Anthony | $186,000 | |

| Previous Owner | Nielsen Mary | $106,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,220 | $21,043 | $831 | $20,212 |

| 2024 | $3,220 | $20,148 | $834 | $19,314 |

| 2023 | $3,072 | $15,126 | $734 | $14,392 |

| 2022 | $2,943 | $19,211 | $1,048 | $18,163 |

| 2021 | $2,927 | $17,390 | $1,048 | $16,342 |

| 2020 | $2,943 | $16,454 | $1,048 | $15,406 |

| 2019 | $2,795 | $16,675 | $1,048 | $15,627 |

| 2018 | $2,570 | $12,605 | $953 | $11,652 |

| 2017 | $2,504 | $12,284 | $1,010 | $11,274 |

| 2016 | $2,317 | $11,589 | $1,047 | $10,542 |

| 2015 | -- | $11,564 | $1,048 | $10,516 |

| 2014 | -- | $11,756 | $1,047 | $10,709 |

Source: Public Records

Map

Nearby Homes

- 252 Timber Ridge Dr Unit 9252

- 46 Meadow Ln Unit B13

- 272 Timber Ridge Dr Unit 5272

- 264 Timber Ridge Dr Unit 5264

- 52 Timber Ridge Dr Unit 52

- 3721 Amboy Rd

- 3723 Amboy Rd

- 155 Woodcutters Ln

- 3745 Amboy Rd Unit 10B

- 18 Bay Terrace Unit 1c

- 42 Greaves Ave

- 181 Evergreen St

- 3747 Amboy Rd Unit 6b

- 28 Bay Terrace Unit 2H

- 40 Dewey Ave

- 132 Dewey Ave

- 3461 Amboy Rd Unit 1J

- 29 Ashwood Ct

- 157 Exeter St

- 106 Redwood Ave

- 20F Meadow Ln Unit 20F

- 20D Meadow Ln Unit 20D

- 20 Meadow Ln

- 20G Meadow Ln Unit 20G

- 20C Meadow Ln Unit 20C

- 20B Meadow Ln Unit 20B

- 20A Meadow Ln Unit 20A

- 22 Meadow Ln

- 16 Meadow Ln

- 24 Meadow Ln

- 14 Meadow Ln

- 26 Meadow Ln

- 30 Meadow Ln

- 66 Willow Ln

- 32 Meadow Ln

- 64 Willow Ln

- 377 Timber Ridge Dr

- 377 Timber Ridge Dr Unit 1F

- 377 Timber Ridge Dr Unit Main Unit

- 338 Timber Ridge Dr Unit 6338