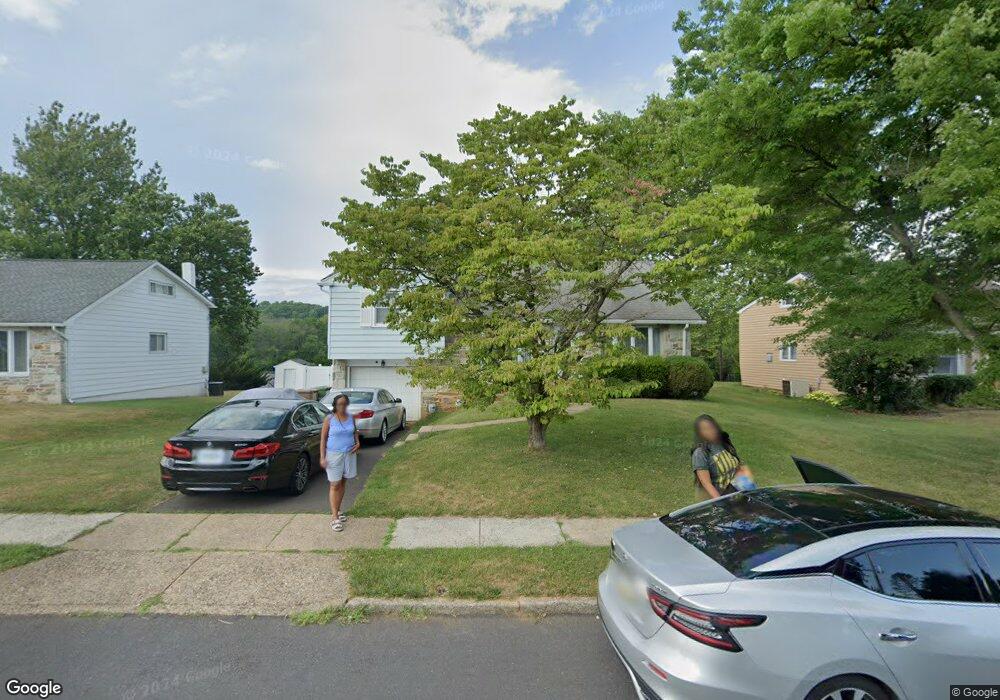

21 Eastview Dr Glenside, PA 19038

Estimated Value: $502,000 - $553,000

4

Beds

3

Baths

2,185

Sq Ft

$241/Sq Ft

Est. Value

About This Home

This home is located at 21 Eastview Dr, Glenside, PA 19038 and is currently estimated at $527,222, approximately $241 per square foot. 21 Eastview Dr is a home located in Montgomery County with nearby schools including Thomas Fitzwater Elementary School, Sandy Run Middle School, and Upper Dublin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 25, 2018

Sold by

Gibson Charles Theodore

Bought by

Gibson Charles Theodore

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$223,596

Interest Rate

4.44%

Mortgage Type

New Conventional

Estimated Equity

$303,626

Purchase Details

Closed on

May 16, 2005

Sold by

Soos Robert

Bought by

Gibson Charles T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$231,920

Interest Rate

5.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 29, 1999

Sold by

Ward Marie A

Bought by

Soos Robert

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gibson Charles Theodore | -- | Germontown Title | |

| Gibson Charles T | $289,900 | -- | |

| Soos Robert | $161,340 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gibson Charles Theodore | $260,000 | |

| Closed | Gibson Charles T | $231,920 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,866 | $140,800 | $55,980 | $84,820 |

| 2024 | $6,866 | $140,800 | $55,980 | $84,820 |

| 2023 | $6,706 | $140,800 | $55,980 | $84,820 |

| 2022 | $6,560 | $140,800 | $55,980 | $84,820 |

| 2021 | $6,396 | $140,800 | $55,980 | $84,820 |

| 2020 | $6,211 | $140,800 | $55,980 | $84,820 |

| 2019 | $6,108 | $140,800 | $55,980 | $84,820 |

| 2018 | $6,108 | $140,800 | $55,980 | $84,820 |

| 2017 | $5,885 | $140,800 | $55,980 | $84,820 |

| 2016 | $5,830 | $140,800 | $55,980 | $84,820 |

| 2015 | $5,507 | $140,800 | $55,980 | $84,820 |

| 2014 | $5,507 | $140,800 | $55,980 | $84,820 |

Source: Public Records

Map

Nearby Homes

- 3012 Lincoln Ave

- 2934 Jefferson Ave

- 550 Penn Ave

- 943 Tennis Ave

- 536 Cardinal Dr

- 814 Cricket Ave

- 501 Martin Ln

- 906 Maple Ave

- 2959 Madison Ave

- 2951 Madison Ave

- 324 Valley Rd

- 1151 Fitzwatertown Rd

- 332 Logan Ave

- 2933 Susquehanna Rd

- 2812 Meyer Ave

- 718 Harrison Ave

- 642 Monroe Ave

- 314 Girard Ave

- 441 Cricket Ave

- 0 Girard Ave