21 Georgetown Fort Myers, FL 33919

McGregor NeighborhoodEstimated Value: $1,163,000 - $2,242,000

4

Beds

6

Baths

4,960

Sq Ft

$373/Sq Ft

Est. Value

About This Home

This home is located at 21 Georgetown, Fort Myers, FL 33919 and is currently estimated at $1,849,629, approximately $372 per square foot. 21 Georgetown is a home located in Lee County with nearby schools including Orangewood Elementary School, Allen Park Elementary School, and Edison Park Creative & Expressive Arts School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 26, 2022

Sold by

Kearns Daniel P and Kearns Family Trust

Bought by

Erickson Kenneth

Current Estimated Value

Purchase Details

Closed on

Aug 24, 2018

Sold by

Kearns Daniel P

Bought by

Kearns Daniel P and The Kearns Family Trust

Purchase Details

Closed on

Aug 2, 2018

Sold by

Gray Nicole E

Bought by

Kearns Daniel P

Purchase Details

Closed on

Feb 28, 2014

Sold by

Orr James W

Bought by

Kearns Daniel P and Gray Nicole E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,225,000

Interest Rate

3.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

May 14, 2007

Sold by

Orr James W and Orr Pamela F

Bought by

James W Orr Jr Revocable Trust

Purchase Details

Closed on

Dec 4, 1995

Sold by

Staerker Jean A

Bought by

Orr James W and Orr Pamela F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$660,000

Interest Rate

7.4%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Erickson Kenneth | $2,500,000 | None Listed On Document | |

| Kearns Daniel P | -- | Attorney | |

| Kearns Daniel P | $614,300 | Balofios Truxion Pa | |

| Kearns Daniel P | $1,500,000 | None Available | |

| James W Orr Jr Revocable Trust | -- | Attorney | |

| Orr James W | $425,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kearns Daniel P | $1,225,000 | |

| Previous Owner | Orr James W | $660,000 | |

| Closed | Kearns Daniel P | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,327 | $600,788 | -- | -- |

| 2024 | $11,327 | $546,171 | -- | -- |

| 2023 | $31,581 | $1,814,246 | $496,509 | $1,210,624 |

| 2022 | $13,378 | $759,246 | $0 | $0 |

| 2021 | $13,701 | $1,175,211 | $744,884 | $430,327 |

| 2020 | $13,921 | $726,955 | $0 | $0 |

| 2019 | $13,862 | $710,611 | $650,000 | $60,611 |

| 2018 | $22,664 | $1,134,179 | $650,000 | $484,179 |

| 2017 | $24,018 | $1,171,983 | $0 | $0 |

| 2016 | $23,880 | $1,147,878 | $683,625 | $464,253 |

| 2015 | $31,328 | $1,476,066 | $647,768 | $828,298 |

| 2014 | $20,593 | $1,064,202 | $583,244 | $480,958 |

| 2013 | -- | $988,613 | $557,211 | $431,402 |

Source: Public Records

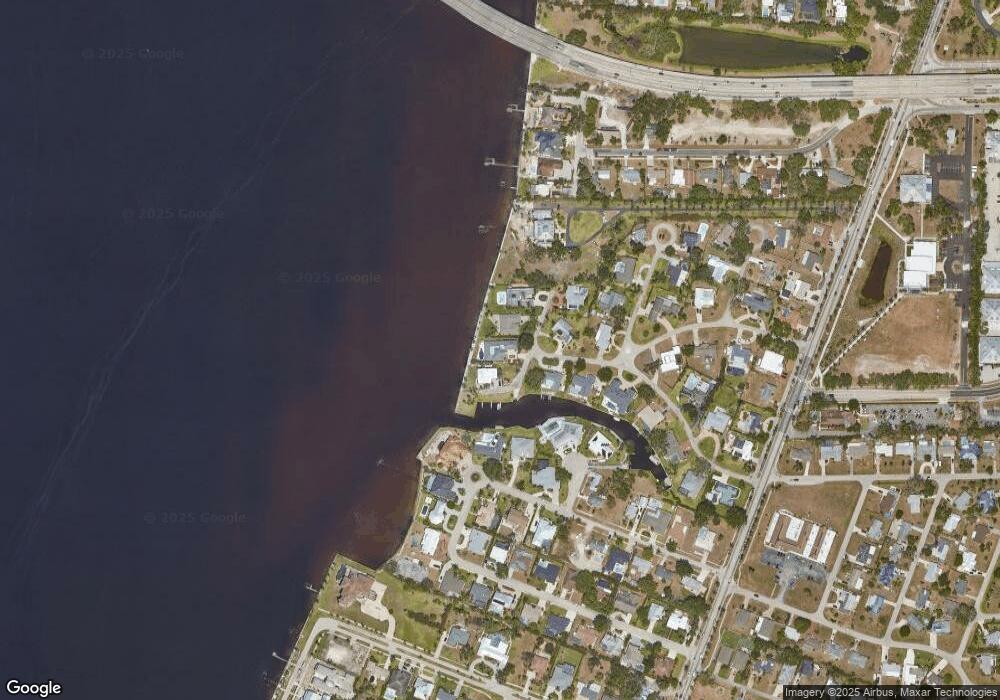

Map

Nearby Homes

- 8451 Casa Del Rio Ln

- 8327 Riviera Ave

- 8297 San Marcos

- 1212 Twin Palm Dr

- 1358 Hopedale Dr

- 1301 Rio Vista Ave

- 6005 W Riverside Dr

- 1331 Rio Vista Ave

- 6011 Fountain Way

- 1337 Bradford Rd

- 1427 Davis Dr

- 1325 Caloosa Vista Rd

- 1221 La Faunce Way

- 1211 Caloosa Point

- 1420 Mandel Rd

- 1200 Walden Dr

- 1442 Byron Rd

- 4747 Mcgregor Blvd

- 4701 Mcgregor Blvd

- 4400 Lazio Way Unit 201

- 22 Georgetown

- 20 Georgetown

- 19 George Town

- 19 Georgetown

- 24 Georgetown

- 17 Georgetown

- 28 George Town

- 18 Georgetown

- 28 Georgetown

- 8430 Riviera Ave

- 16 Georgetown

- 8384 Villaire Ct

- 8410 Riviera Ave

- 8450 Riviera Ave

- 15 Georgetown

- 10090 Mcgregor Blvd

- 29 Georgetown

- 8390 Riviera Ave

- 14 George Town

- 8471 Casa Del Rio Ln