21 Tremore Way Holland, OH 43528

Estimated Value: $1,129,000 - $1,554,224

6

Beds

6

Baths

6,955

Sq Ft

$193/Sq Ft

Est. Value

About This Home

This home is located at 21 Tremore Way, Holland, OH 43528 and is currently estimated at $1,342,306, approximately $192 per square foot. 21 Tremore Way is a home located in Lucas County with nearby schools including Dorr Street Elementary School, Springfield Middle School, and Springfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2023

Sold by

Barbara K Oostra Trust

Bought by

Board Of Lucas County Commissioners

Current Estimated Value

Purchase Details

Closed on

Nov 20, 2020

Sold by

Oostra Barbara K and Tremore Holdings Trusts

Bought by

Oostra Barbara K and Barbara K Oostra Trust

Purchase Details

Closed on

Aug 19, 2013

Sold by

Oostra Randall D

Bought by

Oostra Barbara K and Tremore Holding Trust

Purchase Details

Closed on

Apr 28, 2005

Sold by

Oostra Randall D and Oostra Barbara K

Bought by

Oostra Barbara K and The Barbara K Oostra Trust

Purchase Details

Closed on

Oct 15, 1999

Sold by

Louisville Title Agency Fo R Nw Oh Tr

Bought by

Oostra Randall D and Oostra Barbara K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,500

Interest Rate

8.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Board Of Lucas County Commissioners | $3,905 | None Listed On Document | |

| Oostra Barbara K | -- | None Available | |

| Oostra Barbara K | -- | None Available | |

| Oostra Randall D | -- | None Available | |

| Oostra Barbara K | -- | -- | |

| Oostra Randall D | $130,000 | Louisville Title Agency For |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Oostra Randall D | $97,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,894 | $390,565 | $205,275 | $185,290 |

| 2023 | $20,809 | $298,340 | $87,500 | $210,840 |

| 2022 | $16,623 | $237,930 | $116,445 | $121,485 |

| 2021 | $15,636 | $237,930 | $116,445 | $121,485 |

| 2020 | $16,877 | $232,995 | $113,715 | $119,280 |

| 2019 | $16,489 | $232,995 | $113,715 | $119,280 |

| 2018 | $16,831 | $232,995 | $113,715 | $119,280 |

| 2017 | $17,280 | $227,675 | $111,125 | $116,550 |

| 2016 | $17,448 | $650,500 | $317,500 | $333,000 |

| 2015 | $17,417 | $650,500 | $317,500 | $333,000 |

| 2014 | $15,773 | $218,930 | $106,860 | $112,070 |

| 2013 | $15,773 | $218,930 | $106,860 | $112,070 |

Source: Public Records

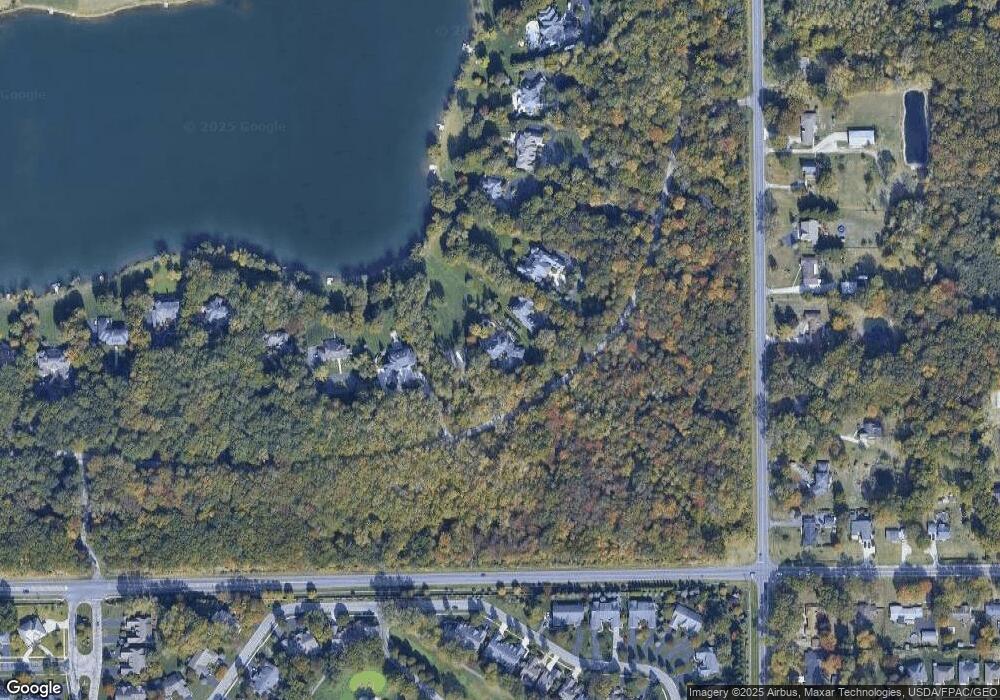

Map

Nearby Homes

- 44 Treetop Place

- 8670 Augusta Ln

- 7 Tremore Way

- 215 Stone Oak Ct

- 8553 Stone Oak Dr

- 8617 Ponte Vedra Ct

- 8760 Nebraska Ave

- 68 Hidden Meadow Dr

- 126 Hidden Meadow Dr

- 8046 Lea Ct

- 8435 Willow Glen Ct

- 540 S Centennial Rd

- 7944 Hill Ave

- 612 S Centennial Rd

- 7909 Hill Ave

- 8006 Cove Harbour Dr N

- 8945 Oak Valley Rd

- 9151 Rolling Hill Rd

- 8276 Dorr St

- 7920 N Shoreline Dr

- 20 Tremore Way

- 22 Tremore Way

- 19 Tremore Way

- 23 Tremore Way

- 18 Tremore Way

- 24 Tremore Way

- 17 Tremore Way

- 25 Tremore Way

- 16 Tremore Way

- 26 Tremore Way

- 8466 Augusta Ln

- 8462 Augusta Ln

- 8452 Augusta Ln

- 8507 Augusta Ln

- 8519 Augusta Ln

- 8448 Augusta Ln

- 8515 Augusta Ln

- 8509 Augusta Ln

- 8440 Augusta Ln

- 350 N Centennial Rd